The ECB Takes Another Step Toward Reining In Global Liquidity

Interest-Rates / ECB Interest Rates Jun 06, 2007 - 11:11 PM GMTBy: Paul_L_Kasriel

Today the European Central Bank (ECB) raised its policy interest rate 25 basis points to a level of 4.0%. Today's rate hike brings the cumulative increase to an even 200 basis points since the ECB started hiking its policy rate in December 2005. Comments by ECB President Trichet suggest that the ECB is not yet finished raising its policy interest rate.

Today the European Central Bank (ECB) raised its policy interest rate 25 basis points to a level of 4.0%. Today's rate hike brings the cumulative increase to an even 200 basis points since the ECB started hiking its policy rate in December 2005. Comments by ECB President Trichet suggest that the ECB is not yet finished raising its policy interest rate.

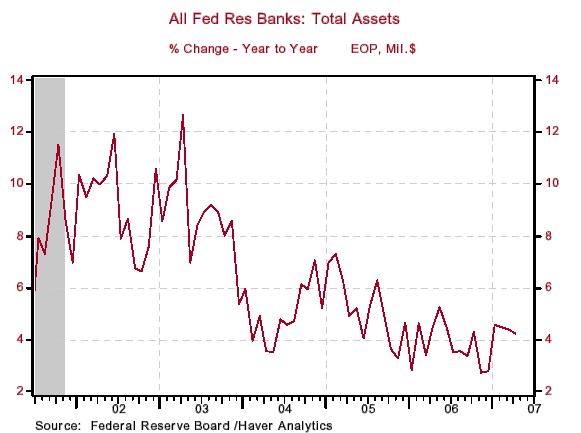

Of late, there has been much ink dedicated to the notion of "global liquidity." When it comes to central banks' contribution to global liquidity, the place to look is at the growth in their respective and collective balance sheets. On a year-over-year basis, after growing at about 10-1/2% at the end of December 2002, growth in the Fed's balance sheet has moderated to about 4-1/4% at the end of May 2007 (see Chart 1). Although this is still a rapid rate of growth relative to U.S. population growth, at least it has slowed significantly. There is a lot of talk about Japan being a major source of global liquidity growth. Well, the central bank of Japan is not the source of that liquidity growth. On a year-over-year basis, the Japanese monetary base contracted 5.7% as of May.

Chart 1

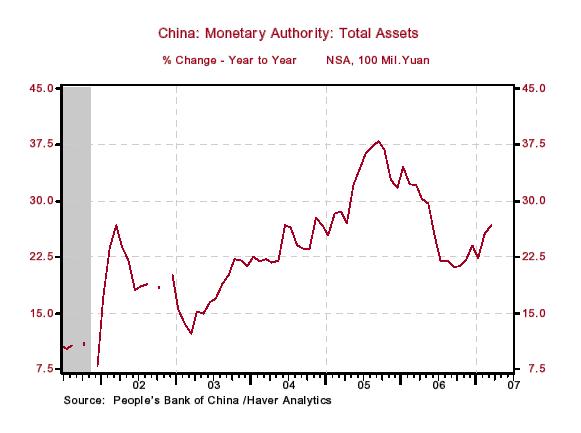

If you want to know which central banks are flooding the world with liquidity, look to the People's Bank of China (PBOC) and the ECB. Chart 2 shows that year-over-year growth in the balance sheet of the PBOC, although having slowed from almost 38% in September 2005, was still growing at a hefty 26-3/4% as of March of this year.

Chart 2

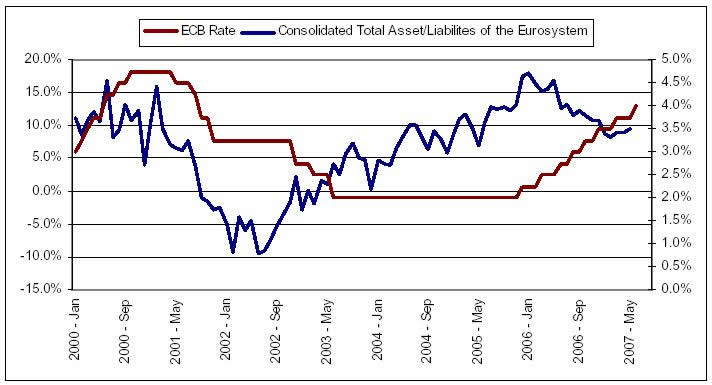

Although no match in terms of growth rates for the PBOC, the ECB has also been a major supplier of global liquidity, as shown in Chart 3. On a year-over-year basis, growth in the ECB's balance sheet at the end of May was a relatively-high 9.5%. But, at least that's down from 17.9% growth in January 2006. Notice that as the ECB has started raising its policy interest rate, growth in the ECB's balance sheet has moderated, with a lag. If the ECB continues to raise its policy rate, as widely expected, at least this source of global liquidity will be less plentiful.

Chart 3

Lastly, recent and prospective ECB interest rate increases will begin to impede growth in Eurozone domestic demand. At about that time, the slower growth in U.S. consumer spending will impede the growth of Eurozone export growth. In other words, current "hot" Eurozone economic growth is going to meet a "cold front" toward the end of this year.

By Paul L. Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2007 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.