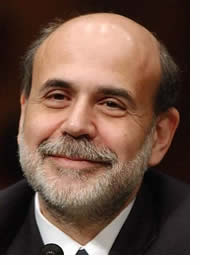

No Fed Policy Exit Strategy for Ben Bernanke

Economics / Quantitative Easing Jul 24, 2009 - 06:26 PM GMTBy: Peter_Schiff

In a Wall Street Journal op-ed on Monday, and in congressional testimony later in the week, Fed Chairman Ben Bernanke reassured all that thanks to his accurate foresight and deft use of the Fed's policy toolkit, he could maintain near zero percent interest rates for an extended period without creating inflation. With supernatural powers such as these, one wonders if Ben would be better employed by the Justice League rather than the Federal Reserve.

In a Wall Street Journal op-ed on Monday, and in congressional testimony later in the week, Fed Chairman Ben Bernanke reassured all that thanks to his accurate foresight and deft use of the Fed's policy toolkit, he could maintain near zero percent interest rates for an extended period without creating inflation. With supernatural powers such as these, one wonders if Ben would be better employed by the Justice League rather than the Federal Reserve.

Ben's game plan is apparently simple: once he determines that the economy is on solid ground, he will use the monetary equivalent of Superman's laser vision to strategically evaporate all the excess liquidity that he has recently created without endangering the recovery. Don't try this at home, kids.

Ben's game plan is apparently simple: once he determines that the economy is on solid ground, he will use the monetary equivalent of Superman's laser vision to strategically evaporate all the excess liquidity that he has recently created without endangering the recovery. Don't try this at home, kids.

In other words, as he did just a few years ago when the subprime fiasco began to emerge, Bernanke is assuring us that inflation is contained. He is just as wrong now as he was then.

The idea that the inflation genie can be painlessly rebottled has no historic precedent. Even mainstream economists, who've never met a fiscal stimulus they didn't like, agree that central banks must act preemptively with regard to inflation. Bernanke is making the case that the new set of liquidity tools, hastily developed in the panic of late 2008, will act just as well in reverse. But liquidity is a lot like liquid, it's a lot easier to spill than to un-spill. The Chairman believes that his new gadgetry will allow him to perform a feat of monetary magic no other central banker has managed to pull off. But given his history of getting it wrong, why should we assume that this time he will get it right?

The bottom line is that Bernanke has no exit strategy. He can talk about it all he likes, but when it comes time to actually pull the trigger, his nerves will buckle. The current communications campaign is simply an attempt to calm the markets. I doubt few citizens or members of Congress had any hope of understanding the exit strategy mechanisms that Bernanke described. Many likely place their faith in his seeming mastery of financial minutiae. Sadly, as with the mythical “strong dollar policy,” confident talk may be the sum total of the Chairman's strategy.

He senses that the villagers, in the form of currency traders and bond market vigilantes, are becoming a bit restless. To sooth their concerns, he must pretend that he has the situation under control. Like Jack Nicholson in A Few Good Men, he knows full well that markets simply “can't handle the truth.”

But make no mistake, in order to mop up all the excess liquidity, the Fed will need to raise interest rates substantially to attract buyers for all the bonds that the Treasury must sell. Fed officials know that our economy is completely dependent on cheap money and limitless government credit, and can't tolerate the loss of either. Of course, the longer the monetary spigot remains open, the more addicted to low rates we get, and the harder it will be to kick the habit. If the Fed could not remove the punch bowl during the years before the bust, how will they do so while the economy is far weaker? Even if they do start the process, the minute the “recovery” seems in jeopardy, look for the Fed to turn the showers back on.

Also, paring down the Fed's bloated balance sheet will require selling hundreds of billions of dollars of toxic assets, such as bonds backed by subprime mortgages, credit card debt, and auto and student loans, back into the market. Finding buyers for such sludge without crushing the market is a trick that Houdini himself would be reluctant to attempt. The Fed's assumption that the assets will no longer be toxic by the time it sells them is farcical. The economy at large has not yet suffered the full weight of the recession because these assets have been largely quarantined at the Fed. Reintroduce these toxins back into the economy and the reaction could be lethal.

Bernanke also mistakenly expressed optimism that a strengthening global economy would aid our recovery. Unfortunately, a global resurgence will force Bernanke's anti-inflation hand, and will thereby cause more pain to the U.S. economy.

Few appreciate how the global panic of 2008 actually benefited the U.S. by causing a flight into U.S. dollars and Treasury bonds. The resultant flows put a lid on consumer prices and kept interest rates low. As growth overseas resumes, and these flows reverse, both consumer prices and interest rates will rise.

Further, as current policy prevents the structural imbalances underlying our economy from being corrected, U.S. unemployment will continue to rise. Combined with higher interest rates and rising consumer prices and the Misery Index (inflation + interest rates + unemployment) will be a big issue in the 2010 mid-term elections, and an even bigger one in 2012.

For a more in depth analysis of our financial problems and the inherent dangers they pose for the U.S. economy and U.S. dollar denominated investments, read my new book “Crash Proof: How to Profit from the Coming Economic Collapse.” Click here to order a copy today.

For an updated look at his investment strategy order a copy of his just released book ‘The Little Book of Bull Moves in Bear Markets.” Click here to order your copy now .

By Peter Schiff

Euro Pacific Capital

http://www.europac.net/

More importantly make sure to protect your wealth and preserve your purchasing power before it's too late. Discover the best way to buy gold at www.goldyoucanfold.com , download my free research report on the powerful case for investing in foreign equities available at www.researchreportone.com , and subscribe to my free, on-line investment newsletter at http://www.europac.net/newsletter/newsletter.asp

Peter Schiff Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.