Gold and Why Gold Now?

Commodities / Gold & Silver 2009 Aug 17, 2009 - 01:40 AM GMTBy: Darryl_R_Schoon

Understanding these times is its own reward. If, however, you understand the role of gold in these times, a reward of another magnitude awaits you.

Understanding these times is its own reward. If, however, you understand the role of gold in these times, a reward of another magnitude awaits you.

Economic cycles of expansion and contraction are the inevitable result of central bank credit flows. So, too, are deflationary depressions and hyperinflations. Though far less frequent, the destruction caused by deflationary depressions and hyperinflations more than make up for their infrequency; and, today, after perhaps the longest absence of each in recent history, we are now about to experience both—perhaps this time in tandem.

This will not be just a deflationary depression, it will be deflationary depression accompanied by a monetary crisis of epic proportions.

The sudden on-set and virulence of the current economic crisis caught economists and central bankers by surprise. Having successfully dismissed those who disagreed with the spread of central banking and its illegitimate off-spring, fiat money, central bankers and economists were stunned when their world of paper money suddenly collapsed in 2007.

Were it not for the unprecedented flood of government aid in 2008, private bankers would have been swept away just as they were in the 1930s. But, instead, private bankers were rescued with public funds, funds which allowed them to quickly return to their avocation of profiting from the indebting of others.

DON’T FEED THE PIGEONS

words of advice from The Banker’s Handbook

Modern banking is essentially a Ponzi-scheme on a global scale. Bernard Madoff’s Ponzi-scheme was but a smaller, private version of the public model used in the world today. What people do not understand is that bankers loan money which doesn’t exist and then receive compounding interest and repayment of previously non-existent funds in return.

While this might be considered an abomination and nightmare, it is a wet-dream for bankers and those who profit from such a system. Charging interest on the loaning of gold and silver was believed to be a sin during the Middle Ages, but, today, the charging of interest on the loaning of money that didn’t previously exist and the receiving of the previously non-existent principal back plus interest is considered nothing less than a miracle—at least by the bankers who profit thereby.

The very birth of paper money was conceived in sin. In its genesis, central banking’s paper money was always a fraud. Believed to be backed by equal amounts of gold or silver, in actuality it was never so, no more than were the demand deposits of savers available upon demand in banks.

WHERE’S THE MONEY?

THE SHELF LIFE OF A SHELL GAME

Modern banking is akin to a shell game. As long as the public doesn’t catch on or the unexpected never happens (as in a banking crisis) the fraud can and does continue. The banking crisis during Great Depression, however, almost brought the banker’s shell game to an end by exposing it for what it was—a shell game.

When US depositors rushed to the banks between 1930 and 1933 to withdraw their savings, they found the banks didn’t actually have their money and thousands of banks were forced to close.

This is what happened to Bernie Madoff’s clients when they requested their money en masse in 2008. This was Bernie Madoff’s nightmare. It is also the nightmare of all bankers because—just as with Bernie Madoff—the depositors’ money isn’t really there.

When the Great Depression alerted savers to the fact that the banks didn’t actually have their money, bankers and government decided something had to be done to prevent bank runs from occurring in the future.

So, they created the FDIC, the Federal Deposit Insurance Corporation, which would maintain a fund composed of bank insurance premiums that would protect depositors against any losses up to a certain proscribed amount.

But while Americans now believe their savings are backed by premiums paid into the FDIC fund, no such fund exists; and, although the FDIC regularly reports how much money is in the FDIC fund, the fund itself, like modern economics, is a fraud.

The following is an excerpt from an article, The Mythical FDIC Fund, by William M. Isaac, former Chairman of the FDIC. It should be titled:

WHAT BILL FOUND OUT WHEN HE WENT TO WASHINGTON DC

8/27/08

THE MYTHICAL FDIC FUND

By William M. Isaac

William Isaac, former Chairman of the Federal Deposit Insurance Corporation, (FDIC)

…When I became Chairman of the FDIC in 1981, the FDIC's financial statement showed a balance at the U.S. Treasury of some $11 billion. I decided it would be a real treat to see all of that money, so I placed a call to Treasury Secretary Don Regan:

Isaac: Don, I'd like to come over to look at the money.

Regan: What money?

Isaac: You know . . . the $11 billion the FDIC has in the vault at Treasury.

Regan: Uh, well you see Bill, ah, that's a bit of a problem.

Isaac: I know you're busy. I don't need to do it right away.

Regan: Well . . . it's not a question of timing . . . I don't know quite how to put this, but we don't have the money.

Isaac: Right . . . ha ha.

Regan: No, really. The banks have been paying money to the FDIC, the FDIC has been turning the money over to the Treasury, and the Treasury has been spending it on missiles, school lunches, water projects, and the like. The money's gone.

Isaac: But it says right here on this financial statement that we have over $11 billion at the Treasury.

Regan: In a sense, you do. You see, we owe that money to the FDIC, and we pay interest on it.

Isaac: I know this might sound pretty far-fetched, but what would happen if we should need a few billion to handle a bank failure?

Regan: That's easy - we'd go right out and borrow it. You'd have the money in no time . . . same day service most days.

Isaac: Let me see if I've got this straight. The money the banks thought they were storing up for the past half century - sort of saving it for a rainy day - is gone.

If a storm begins brewing and we need the money, Treasury will have to borrow it. Is that about it?

Regan: Yep.

Isaac: Just one more thing, while I've got you. Why do we bother pretending there's a fund?

Regan: I'm sorry, Bill, but the President's on the other line. I'll have to get back to you on that.

I don’t know whether Treasury Secretary Don Regan ever answered Isaac’s question, Why do we bother pretending there's a fund? But the answer is obvious. Modern economics, i.e. central banking, is a shell game, a shell game where bankers with the aid of governments have foisted a highly lucrative fraud on society; and, while the fraud of the FDIC fund is egregious, it is no more egregious than the fraud of the Fed or of the economy itself.

In economies based on the fraudulent issuance of money as debt, there are only predators and victims. Bankers are the predators, society is the victim (businessmen are victims who often believe they’re predators) and governments are the well-paid-off referees in the rigged game being played out in today’s capital markets.

ALL GOOD THINGS COME TO AN END

AND BAD THINGS DO TOO

This is our salvation. The debasement of our money and our enslavement by bankers into perpetual debt is finally coming to and end; but not because those oppressed realize their plight and are finally revolting. Their slavery is ending because those so enslaved are now so indebted they are unable to pay what they owe and the prison of debt itself is now bankrupt.

Banker’s credit creates constantly compounding debt and; today, so much debt has been created the economy can no longer expand fast enough to service it or pay it back. Homeowners, workers, farmers, business people, corporations and governments are all indebted beyond their means to repay and. when debtors can’t pay what they owe, the shell game of debt-based capitalism collapses—game over.

The Federal Reserve System which substituted debt-based paper money for the gold and silver based money issued previously from the US Treasury is now 96 years old; and, if the US economy continues to decline because of the compounding levels of debt created by the Federal Reserve, the Federal Reserve System itself may be called into question before it reaches its 100 year anniversary.

The end of the Federal Reserve System should be the collective goal of all Americans; for all Americans—black, white and brown, men and women, rich and poor, tea-baggers and tree-huggers, the already born and yet-to-be born—have all been enslaved by the Fed’s substitution of its debt-based money for the gold and silver currency previously issued by the US Treasury.

Today, all Americans collectively owe more than can ever be repaid. America has been delivered into perpetual bondage by the Federal Reserve. It’s about time that changed. The descent into perpetual debt happened on our watch. It is our responsibility to now do something about it. If we owe anything to anyone, we owe this to ourselves and to our children.

US DOLLARS AND US DEBT

The enslavement of Americans into perpetual debt could not have been accomplished had US dollars remained based on gold and silver as put forth in the US Constitution. But the substitution of credit-based paper money brought with it the levels of debt that have now indebted Americans into perpetuity.

The debasement of the US dollar is accelerating as trillions more are being printed, i.e. “borrowed” (from whom?) and spent hoping to reverse the greatest deflation since the Great Depression. It is this process of accelerated debasement that will eventually destroy the remaining value of the US dollar.

In our derivative reality, value is a function of scarcity and when so many dollars have been printed, the value of all printed money begins to rapidly decline; and, eventually crosses the line from inflation into hyperinflation, an invisible line which is never seen until it is too late.

Today, the US, the UK and Japan are all debasing of their currencies through monetization, a process akin to monetary self-immolation. By “self-borrowing” and the resultant issuance of even more credit, it is hoped that monetizing their debt will allow them to borrow and spend their way out of the deflationary sinkhole into which they are now being drawn. It won’t.

THE ROLE OF GOLD IN THESE TUMULTUOUS TIMES

It is this accelerating debasement of currencies that will eventually force a powerful upward move in the price of gold and silver. When the value of paper money plummets, the value of real money—silver and gold—will explode upwards as a consequence.

We are now approaching the end game that will resolve the monetary sins of the past.

As the end game nears, I suggest a greater concentration of assets be allocated to investments in physical gold and physical silver.

A UNIQUE GOLD FUND

I first met Sandeep Jaitly through an article he had presented for my comment. I quickly realized Mr. Jaitly’s article deserved far more than just a cursory read. Whether I agreed or not with his conclusions, Mr. Jaitly clearly possessed an extraordinary mind and a unique ability to express his thoughts.

I later met Mr. Jaitly in person at Professor Fekete’s gold seminar in Hungary in March. There, he delivered a presentation of the Professor’s work on the basis as it related to the price of gold. Mr. Jaitly clearly understood Professor Fekete’s thinking and also possessed the ability to apply Professor Fekete’s ideas in the marketplace.

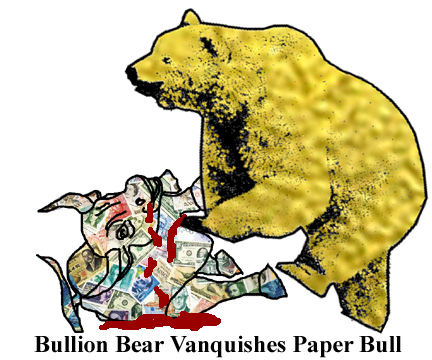

Last month, Martha and I met with Professor Fekete and Mr. Jaitly in San Francisco where Martha filmed my interview with the two regarding a new off-shore gold fund that will be managed by Mr. Jailtly, see http://www.youtube.com/watch?v=WBgjCoxEJq4. Based on Professor Fekete’s paper, A Bull In Bear’s Clothing, Mr. Jaitly is in the process of bringing to market a unique gold bullion fund that will pay dividends in gold.

Also in San Francisco was Mr. Philip Barton of the Gold Standard Institute which will be featuring Professor Fekete at its inaugural meeting in Canberra, Australia this November.

I will be speaking at the event as will others, including Sandeep Jaitly. For information, contact feketeaustralia@gmail.com.

Those who enroll by the end of August will receive a complementary six month subscription to my members-only area, Moving Through The Maelstrom With Darryl Robert Schoon at www.drschoon.com.

WHY NOW?

History is a process in which we are both participant and observer. According to Professor David Hackett Fisher, author of The Great Wave, we are nearing the end of a “great wave” that will bring to an end the shift from the era of Victorian stability to what comes next.

Great waves last between 80 and 120 years and mark both the end and beginning of epochs. The current wave began in 1896 which means we have but seven years at most before it culminates in the beginning of yet another era.

Great waves are marked by strife and disaster. Wars, plagues, and famines have all occurred during previous waves, waves that each ended with the complete economic destruction of the preceding era.

Since this wave began in 1896, there have been two World Wars, several lesser wars, the dropping of nuclear bombs, a Great Depression, a flu pandemic, the over-heating of the atmosphere, and for the first time in history a global economy based entirely on fiat money. The collapse of the paper-based global economy may well be the trigger-event for the finale—a complete economic destruction which marks the end of all Great Waves.

Buy gold, buy silver, have faith

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.