Gold and Silver Short-term Correction Expected

Commodities / Gold & Silver Jul 23, 2007 - 11:13 PM GMTBy: Roland_Watson

It's interesting times for gold and silver as the dollar bears and bulls fight it out over the 80 level of the US Dollar Index. As expected, gold and silver have risen in opposition to the dollar but the $1.15 move over the month for silver and $40 for gold may be getting long in the tooth. First we look at silver and then check out our gold sentiment indicator, which uses google hits on key gold phrases.

It's interesting times for gold and silver as the dollar bears and bulls fight it out over the 80 level of the US Dollar Index. As expected, gold and silver have risen in opposition to the dollar but the $1.15 move over the month for silver and $40 for gold may be getting long in the tooth. First we look at silver and then check out our gold sentiment indicator, which uses google hits on key gold phrases.

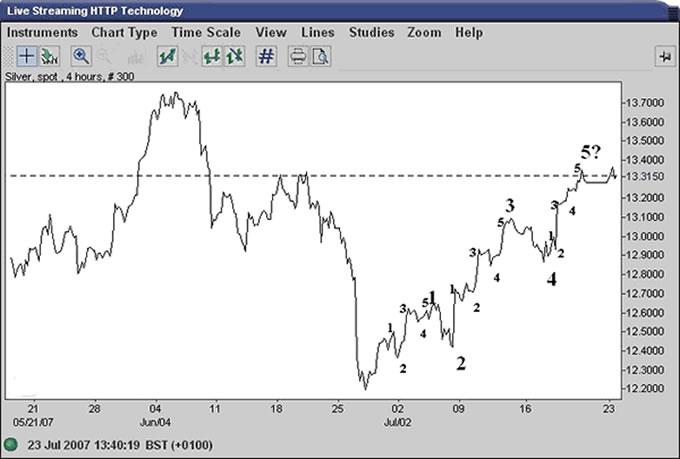

For silver, I just want to look at one indicator and that is Elliott Wave analysis. Sometimes it misses and sometimes it hits but at this point in time we have a clear wave formation suggesting a correction ahead. Take a look at the intraday chart courtesy of Netdania.

A clear impulse wave is in the process of completing and has been labeled 1 to 5. We also label the smaller sub-waves to show readers how well formed this wave is. The message is clear from an Elliott point of view; this is not the best time to buy silver. As to price targets from this point onwards, I'll pass those onto subscribers.

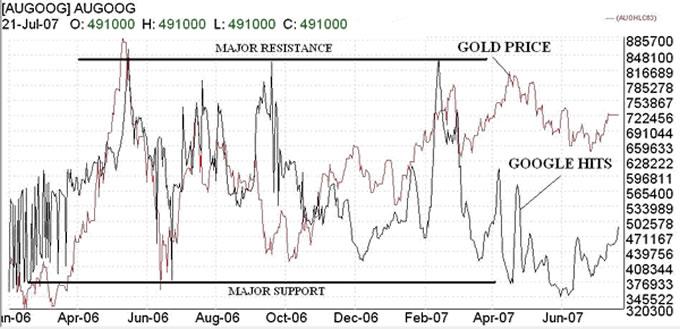

Meanwhile, gold treads a similar path to silver and sentiment has been rock bottom for the king of metals. For the last year and a half I have been collecting the number of google hits on certain key phrases that are indicative of a gold bull market. The gold-google sentiment chart is updated below.

You will note that three times in the last 18 months, gold sentiment hit a high of around 850,000 google hits. That is now an area of major resistance and the next surge in the gold bull will be confirmed when this level is breached.

Meanwhile, bearish sentiment on gold has tended to hit bottom around the 400,000 level to form a support level (though it is not as clear cut as our resistance level). However, sentiment hit rock bottom at the end of May as it slipped just below this to about 350,000. Now we are nearly at 500,000 hits and when the sentiment indicator has come off such low levels the medium term trend tends to be up. But as we have noted from our brief silver analysis, the shorter-term trends will be lower.

I offer one final comment. I note that some laboratory has claimed to be able to turn base metals into gold in commercial viable quantities. I have some news for them. Governments throughout the ages have claimed to turn base metals into wealth for centuries. The process is as follows.

- Take a block of iron, lead or similar base metal.

- Carve out a "$" or "£" or similar into it.

- Further carve the desired number of zeroes and ones after the symbol.

- Cover the metal in ink.

- Press it onto paper.

- Hey presto! Instant wealth!

You get the picture.

Further comments can be had by going to my silver blog at http://silveranalyst.blogspot.com where readers can obtain a free issue of The Silver Analyst and learn about subscription details. Comments and questions are also invited via email to silveranalysis@yahoo.co.uk

By Roland Watson

http://silveranalyst.blogspot.com

Further analysis of the SLI indicator and more can be obtained by going to our silver blog at http://silveranalyst.blogspot.com where readers can obtain the first issue of The Silver Analyst free and learn about subscription details. Comments and questions are also invited via email to silveranalysis@yahoo.co.uk .

Roland Watson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.