Rich Investor, Poor Investor

Housing-Market / US Housing Jul 30, 2007 - 05:32 PM GMTBy: David_Morgan

One of the most widely read books on money and investing has to be Robert Kiyosaki's Rich Dad, Poor Dad, which is a unique economic perspective developed by Kiyosaki's exposure to two “dads,” his own highly educated father, and the multimillionaire eighth-grade dropout father of his closest friend.

One of the most widely read books on money and investing has to be Robert Kiyosaki's Rich Dad, Poor Dad, which is a unique economic perspective developed by Kiyosaki's exposure to two “dads,” his own highly educated father, and the multimillionaire eighth-grade dropout father of his closest friend.

Kiyosaki has made a fortune in real estate and was able to retire at 47. Rich Dad, Poor Dad lays out the philosophy behind Kiyosaki's relationship with money. Most reviews of the book stress that the book advocates “financial literacy,” which has never been taught in schools. The main principle is to acquire income-generating assets, always providing better results than even the best of traditional jobs. One of the main points is that assets must be acquired so that the jobs can eventually be shed.

What most investors hear time and time again is that “timing is everything.” This is an important factor for any investor and especially those who aspire to become truly financially independent. If investors knew that real estate had peaked in most places in the United States , would those investors be willing to use that timing to their advantage? It is something that is certainly worth considering very strongly, as Mr. Kiyosaki himself states quite simply: the real estate market is due to come down. It must be pointed out that this statement was made when real estate was peaking in most areas of the United States .

Mr. Kiyosaki, like all successful investors, knows there is a time to sow and a time to reap. Mr. Kiyosaki sowed when real estate was not the preferred investment class and has cautioned real estate investors against risky strategies such as “flipping,” or relying solely on the appreciation of the property, and properties with low, or no “cash flow.”

What does Mr. Kiyosaki like now? He is looking at the commodity markets, specifically oil and—sit down for this one—the precious metals. That is correct—yet gold and silver are investments that are still out of favor with most of the investing public.

Lately, at his live appearances, Mr. Kiyosaki has been inviting an increasing number of advisors and other guests on stage to speak on a wide variety of investment topics, including the precious metals industries. One of these guests is Mike Maloney of GoldSilver.com .

Mr. Maloney's mission has been to introduce real estate investors to an extremely undervalued asset sector, the precious metals. It is Mr. Maloney's belief that all things run in cycles and everything repeats. He believes that the bear market in precious metals, which ended in 2001, took gold and silver into such undervalued extremes, that even at today's prices, gold and silver are still an incredible bargain.

He also claims that the new bull market in the metals has just barely begun and that this new bull will take the precious metals to price levels considered unimaginable by most. Mr. Maloney estimated a price target of $6,000.00 for both gold AND silver . . . and he follows that statement up with “and that's only IF the dollar survives, and history gives that a very low probability.” When you consider the amount of paper currency that the governments of the world have printed since the last precious metals bull ended in 1980, could Mike Maloney possibly be right?

The point of this essay, however, is how well a real estate investor might do if a little proper timing is used during the investment process. Let us look back into history and see just what took place the last time we had a real estate boom, followed by an era of high inflation.

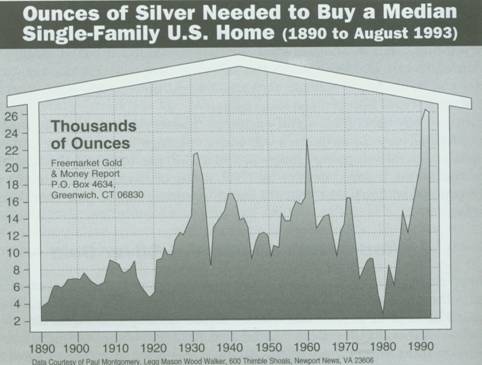

Look at the charts below:

Chart 1 – Average House Price 1890 to 1990

Data from Paul Montgomery, Legg Mason, published in Silver Bonanza , 1993.

What we see in this chart is a real estate investor who would have been well served to move some of those profits (diversify) in the precious metals. Since the chart depicts silver, and real estate peaked prior to the metals (many investors were using real estate as a hedge against inflation in the 1970s), an astute real estate investor might have sold some real estate holdings and moved into the precious metals in, perhaps, 1978 for example. At that time, the median single-family home in the United States might have cost 9,000 troy ounces of silver.

Move forward to the peak in silver prices in early 1980, and that same median home would cost one-third as much in terms of silver. Quite a move in just a few years, don't you think? This of course will bring many questions to mind, because most real estate investors are

partial to the investment class that they understand and have experienced for some time. Real estate opportunities still exist, but the overall trend has shifted. In plain words, it will be far easier to make money in the precious metals over the next several years than in real estate.

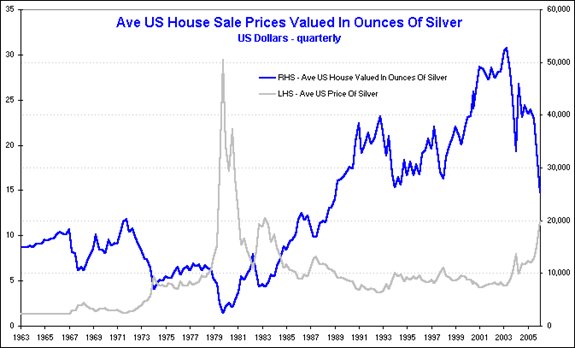

Chart 2 - Average House Price 1963 to 2005

Chart 2 will give a real estate investor something to ponder. At the top of the precious metals market last time (January 1980), it took a mere three thousand ounces of silver valued at $150,000 to purchase a median-priced single-family home. Today, three thousand ounces of silver is valued at about $40,000. Who wouldn't be willing to pick up the median-priced house for $40,000? We are not talking the foreclosure market here; we are valuing houses in terms of silver bullion.

The ability of most investors to profit from differing sectors is key to really becoming a seasoned investor. However, it is human nature to stick with the winners, and most real estate investors, once successful, seldom look to other investment opportunities. This is not to say that a very astute real estate investor cannot do well as the housing market declines, but why swim against the tide?

If the same principals that made you a successful real estate investor were applied to the precious metals markets, you could reap huge rewards by selling silver when it was dear and buying back into the real estate market when it again is fairly valued.

In conclusion, most of life's biggest lessons are learned by experience. History does repeat, but it never repeats exactly. The last time inflation really took off in a big way, the real estate sector was vibrant as a “tangible asset” but eventually became overvalued; as this was occurring, the precious metals were in the mid stages of being accepted by many individual investors, not only as a method of preserving wealth, but as a potential means of making large capital gains.

Today the world has changed significantly from the 1980s. We have instant communications from almost anywhere, stocks can be traded by the click of a mouse, the Internet is providing society with information overload, and the world economy is showing signs of large changes ahead. The future will favor those who can see ahead and take the appropriate action now. With the real estate market having a surplus in some of the major boom areas, and aboveground silver supplies dwindling dangerously low, having lost approximately 1.5 billion ounces of the 2-billion-ounce inventory since 1980, don't you think chance favors taking profits on some of the more marginal real estate holdings and moving some of your assets into the precious metals sector?

By David Morgan,

Silver-Investor.com

Correction to my last public domain article , “The Silver Millionaire”: The correct amount of paper millionaires in the U.S. is about nine million. A silver millionaire requires 715,000 troy ounces of silver.

Mr. Morgan has been published in The Herald Tribune , Futures magazine, The Gold Newsletter , Resource Consultants , Resource World , Investment Rarities , The Idaho Observer , Barron's , and The Wall Street Journal . Mr. Morgan does weekly Money, Metals and Mining Review for Kitco. He is hosted monthly on Financial Sense with Jim Puplava. Mr. Morgan was published in the Global Investor regarding Ten Rules of Silver Investing , which you can receive for free. His book Get the Skinny on Silver Investing is available on Amazon or the link provided. His private Internet-only newsletter, The Morgan Report , is $129.99 annually.

Contact information: silverguru22@hotmail.com , http://silver-investor.com

Disclaimer: The opinions expressed above are not intended to be taken as investment advice. It is to be taken as opinion only and I encourage you to complete your own due diligence when making an investment decision.

David Morgan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.