Checking on Apple from Japan to Hawaii

Companies / Tech Stocks Jul 31, 2007 - 10:18 AM GMTTony Sagami writes: Although the Dow posted its second-biggest one-day loss of the year last Thursday, one U.S. company's stock rose more than 6% by the end of trading.

I'm talking about Apple — a stock that my Elite Stock Trader subscribers have owned for some time, and a company that I've told you about before right here in Money & Markets.

Why did the shares jump so much on such a lousy day in the markets? Because Apple announced spectacular June-quarter results. Profits jumped 73% to $0.92 a share on $5.41 billion in sales. Wall Street had been expecting $0.72 on $5.29 billion in sales.

Better yet, sales of Macintosh computers soared 33% and sales of iPods jumped 21%. Sales of the company's brand-new iPhone weren't too shabby, either. The company sold 270,000 of them in just two days and expects to sell a million by the end of the September quarter. By the end of 2008, it plans on selling 10 million! The company will start selling iPhones in Europe during the fourth quarter of the year.

In my opinion, Apple continues to be one of the best managed companies in the world. After all, it was able to expand its gross profit margins from 30.3% a year ago to 36.9% today. That's impressive!

Plus …

From What I Saw in Japan and Hawaii, There's More Success Ahead of Apple

If you've read my last few columns, you know that I just took my two oldest sons, Ryan and Kenji, to Japan with me. We had a ball! I just had to carefully balance my research activities with things that would interest the boys, ages 23 and 14.

See, I may have loved things like my question-and-answer session with the president of one of Japan's top universities, but my sons wanted no part of anything remotely related to school.

"It's summer, Dad. We don't want to talk to teachers," said Kenji.

That's why I scheduled trips to boy-friendly places like Joypolis, a super high-tech video arcade, and Akihibara, the consumer electronics capital of Japan.

I also arranged an extended layover in Honolulu on the way home, figuring my boys would enjoy a few days on Waikiki's beaches, mingling with the bikini-clad natives.

Of course, in both Tokyo and Honolulu, there were places that we all wanted to visit — Apple's stores.

Ryan and Kenji wanted to check out the company's latest gizmos. And I wanted to see how well the company's newest products were being received.

Let's start with what I saw in Japan …

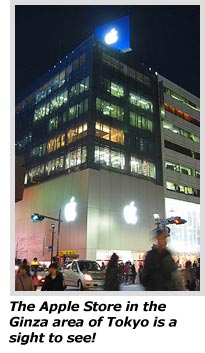

Apple Shines above the Bright Lights of the Ginza

The Ginza area of Tokyo is a boulevard filled with the most exclusive and expensive shops in the world — Cartier, Prada, Louis Vuitton, Hermes, Gucci, and chi-chi department stores like Takeshimaya and Wako.

Smack in the middle of all that opulence is an Apple store. Let me tell you, it was filled with a very steady stream of yen-toting consumers who were buying iPods and Mac computers like there was no tomorrow.

That didn't surprise me as much as the fact that customer after customer was asking about the iPhone.

Now, Japanese consumers are among the most knowledgeable on the planet, and they know darn well that the iPhone isn't available in Japan yet!

So, I can draw only one conclusion from all their questions — they have major ants in their pants about the device. When it finally does arrive on Japan's shores, I think consumers are going to go absolutely crazy for it.

Meanwhile …

Apple's Hawaiian Store Wasn't Hanging Loose … It Was Bustling with Activity!

Unlike the Ginza store, the Honolulu Apple store in the Ala Moana Mall already had about a dozen iPhones out for the public to play with.

And play with them they did! People — including my sons — were waiting two and three deep for a turn to test them out.

My boys were so absolutely blown away by the iPhone's functionality and ease of use that I spent the rest of the day turning down their persistent pleas to buy them one. And that's even after they found out that the iPhone doesn't work in Montana yet!

My boys, however, weren't the only people going nuts over the iPhone. I hung back in the shadows and listened to some of the other comments. Here are a few of the things I heard:

"I can text message twice as fast with this keyboard,"

"The internet connection is wicked fast!" (I'm pretty sure this guy was from New England!)

"This is the coolest thing I've ever seen in my life!"

"I have GOT to get one of these!"

The conversation with one of the Apple clerks was even more encouraging. He told me that the Honolulu store was getting new shipments of iPhones just about as fast as they were selling them. That tells me that Apple has solved its supply and manufacturing problems, and is now ready to blast through what I've said all along are much-too-conservative sales projections.

Bottom line: I don't know how else to say it — Apple is kicking some major butt right now. If your town has an Apple store, you really need to drop by and see and hear the enthusiasm for yourself. No amount of reading can equal what you'll learn by doing your own field research!

Best wishes,

By Tony Sagami

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.