Silver Price Long-term Trend Analysis

Commodities / Gold and Silver 2010 Feb 23, 2010 - 07:25 AM GMTBy: Jordan_Roy_Byrne

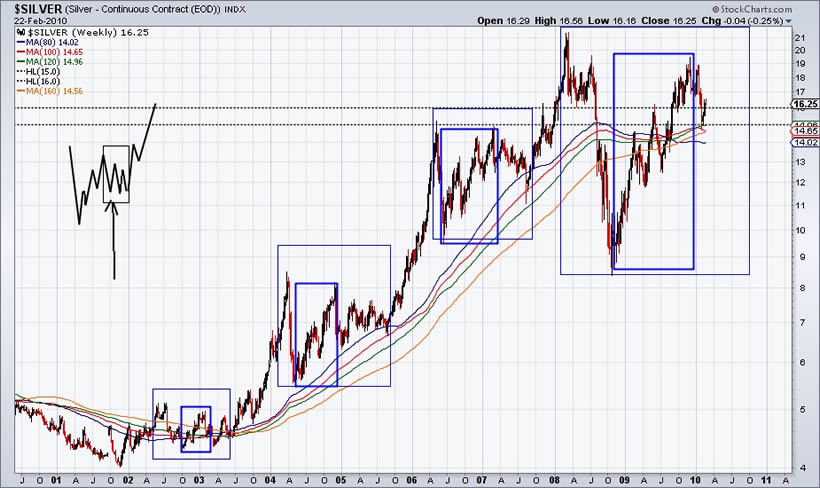

Throughout this bull market, Silver has formed the same corrective pattern over and over again. Currently, Silver is repeating the same pattern but on a much larger scale. Note that Silver’s decline in 2008 and ensuing recovery are a larger fractal of preceding corrections. See the chart below.

So what now? The pattern implies that Silver will grind lower over the next four to six months, before beginning another impulsive advance. Judging from past corrections, Silver could decline to as low as $12 or $13. Note the strong lateral support at $15, as well as the long-term MA’s clustering from $14 to $15.

Take a look at a 45-year chart and you’ll notice that the upcoming bottom could be a major opportunity.

There is a problem with the recent data feed as it obfuscates the end of the chart but it doesn’t affect our analysis. Other than major resistance at about $20 and a bit of resistance at $25, it is clear skies ahead for Silver. We should also note the beautiful long-term cup and handle formation. The handle would be market action over the past two years.

Refer to our first chart and you’ll notice that since March 2008, Silver has thrice failed at $19. Needless to say, a close above that $19-$20 resistance could be very significant and would trigger a tremendous advance close to the spike high in 1980.

The technical outlook for Silver is part of the reason we are super-bullish on the junior silver companies. We believe these companies will be the real stars of the next several years. If you are interested to know our recommended silver juniors, then consider joining our newsletter at http://www.thedailygold.com/newsletter.

We are set to add two more companies in the coming weeks.

Jordan Roy-Byrne, CMT

http://www.trendsman.com

http://www.thedailygold.com

trendsmanresearch@gmail.com

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.