Workers, Socialization of Banking Debts and Crisis in Mexico

Politics / Mexico Mar 12, 2010 - 02:01 AM GMTBy: Global_Research

Thomas Marois writes: A striking feature of the global financial crisis is the narrow and technical focus on banks and financial corporations without accounting for ordinary workers in these institutions and in society more broadly. Yet through the intensification of work, workers have also underwritten the profitability of finance. This has been generally ignored.

Thomas Marois writes: A striking feature of the global financial crisis is the narrow and technical focus on banks and financial corporations without accounting for ordinary workers in these institutions and in society more broadly. Yet through the intensification of work, workers have also underwritten the profitability of finance. This has been generally ignored.

In the nexus between workers, banking, and crisis, the case of Mexico is revealing due to the nature, evolution, and history of its emerging capitalist banking system. Examining the conditions of workers in Mexico is particularly important because it helps to explain not only the increase in bank profitability leading up to the global financial crisis but also the capacity of banks in Mexico to weather its worst consequences. This focus seeks to complement, not replace, analyses concerned with large interest differentials, rising commissions and fees, as well as usurious consumer and state debt servicing.

In the nexus between workers, banking, and crisis, the case of Mexico is revealing due to the nature, evolution, and history of its emerging capitalist banking system. Examining the conditions of workers in Mexico is particularly important because it helps to explain not only the increase in bank profitability leading up to the global financial crisis but also the capacity of banks in Mexico to weather its worst consequences. This focus seeks to complement, not replace, analyses concerned with large interest differentials, rising commissions and fees, as well as usurious consumer and state debt servicing.

The role of workers and the value they create should be examined at two levels: 1) the general society-wide relationship between labour and finance and 2) the specific employment relationship between bank workers and banks. Examining both levels is necessary for understanding how the banks have benefitted from neoliberal strategies of development in Mexico.

Historical Backdrop

Since 1982, Mexico has experienced three structural shifts in bank ownership (Marois 2008). The country’s severe 1982 debt crisis triggered the first shift. The administration of President López Portillo (1976 to 1982) nationalized virtually all the banks in order to save the financial system and resuscitate a strategy of state-led development. However, the incoming President de la Madrid (1982 to 1988) began, in contrast, to restructure the newly state-owned banks to operate as if they were private, market-oriented operations. This paved the way for the second structural shift under President Salinas (1988 to 1994), who rapidly sold, by presidential decree, the banks back to the Mexican private sector in 1991 and 1992.

The third structural shift, which increased the dominance of foreign ownership and control, began initially in the wake of Mexico’s 1994 peso and 1995 banking crisis, but it only accelerated in 2000 with the ascendancy of Fox’s presidency. By 2002, a massive inflow of foreign capital transformed the Mexican banking sector, which is now over 80% foreign controlled.

In Mexico, the banking institutions dominate the financial sector, holding 60% of all financial assets. Moreover, over three-quarters of all bank assets are held by the five largest banks in Mexico (the Spanish BBVA-Bancomer, U.S. Citibank-Banamex, Spanish Santander-Serfín, Mexican Banorte and UK HSBC). As another measure of concentration, over 96% of all commercial banks operate within large financial groups.

Impact of the Current Crisis

Given this concentrated structure, how did the Mexican banking sector perform during the global financial crisis of 2007-2009? When Lehman Brothers collapsed in mid September 2008 and the global financial system teetered on the edge of the precipice in October 2008, there was an unavoidable impact on the Mexican economy and knock-on effects on its financial sector.

International flows of capital into Mexico evaporated, trade with the U.S. (which represented 80-85% of Mexico's total) fell dramatically, domestic industrial output plummeted, and remittances into Mexico abruptly slowed. According to the IMF, GDP growth slowed to 1.3% in 2008 and nose-dived to -6.8% in 2009.

During the height of the crisis, the central bank, Banco de México, resorted to selling, in less than 72 hours, a record 11% of its reserves (worth well over $6-billion (U.S.)) and increasing the interest rate on the public debt in order to defend the value of the peso.

However, the banks in Mexico appear to have avoided the financial disaster that struck many advanced capitalist societies like the U.S. and UK. To be sure, profits, measured as the Return on Assets (ROA), fell from a high level of 2.75% in 2007 to only 1% in 2009. But the banks have not been losing money. Moreover, they remain well capitalized, with reserves floating around the 15% mark.

Socialization of Banking Debts

Why have the banks in Mexico escaped the worst of the global financial crisis? The common explanation is that they have become better regulated since the 1995 crisis and now prudently hold more cash in reserve. Such a conventional interpretation is only partially true since it does not relate the so-called better regulations to the competitive imperatives of neoliberalism. Furthermore, such surface-level interpretations fail to capture an underlying transformation in the relationship of power between labour and finance (see Marois, forthcoming).

This transformation has enabled governments to socialize private financial risk in times of crisis in Mexico. And such socialization has enabled the Mexican banking sector to successfully weather the recent global financial crisis.

When the 1995 banking crisis broke, the Ernesto Zedillo government (1994 to 2000) socialized vast amounts of private bank debt that had gone sour. The Banco de México coordinated a huge bank bailout through Mexico’s banking insurance fund, Fobaproa. This involved the injection of U.S. dollar liquidity, the temporary and permanent recapitalization of banks, and individual debt restructuring programs. This rescue was necessary if and only if the Zedillo administration wanted to remain committed to implementing neoliberal strategies of development.

By early 1998, the cost of the bailout had grown to $60-billion (U.S.). Amidst great public outcry and dissent, Zedillo still managed to transfer the original Fobaproa debts to IPAB, a newly created banking insurance fund, and to re-affirm the state’s responsibility to service the growing debt. Today the total accrued cost of this debt has grown to about $100-billion (U.S.), or about 20% of Mexican GDP. The Zedillo administration saved the banking system and its neoliberal orientation, but at mammoth cost to Mexican society.

The costs of providing public guarantees for private financial risk that had gone sour became the perpetual collective responsibility of present and future generations of Mexican workers – the ones responsible for creating the income needed to service the debt. The Mexican process of the socialization of bank debts typifies all recent state-initiated neoliberal bank rescues.

Increased Exploitation of Bank Workers

The post-1980s transformation of employment relationships between bank workers and the banks in Mexico is another factor that helps explain the attenuated impact of the global financial crisis on the Mexican banking system.

Beginning with the de la Madrid presidency, under the aegis of state ownership from 1982 to 1991-92, and despite being unionized since 1982, Mexican bank workers suffered 10 years of real wage reductions in order to help banks improve productivity measures. When President Salinas rapidly privatized the banks in 1991-92 – and 18 state-owned banks became 18 private domestic banks – the pressure to drive up bank worker productivity only intensified.

Intense inter-bank competition ensued as the new private owners sought a rapid return on their investment. One prominent strategy involved expanding bank branches in order to capture additional domestic savings that could be used in the lucrative business of supplying public credit and consumer credit. But the expansion of branches occurred without increasing the numbers of bank employees.

From the first sell-offs of the state banks in 1991 until the peso crisis in 1995, the number of bank branches in Mexico exploded by nearly 35%. The number of bank workers, by contrast, declined by 13%. This pattern continued after the state-initiated rescue of the banks in 1995. Between 1996 and 2000, the number of bank branches grew by an additional 12% while employee numbers fell by over 16% (by more than 20,000 jobs).

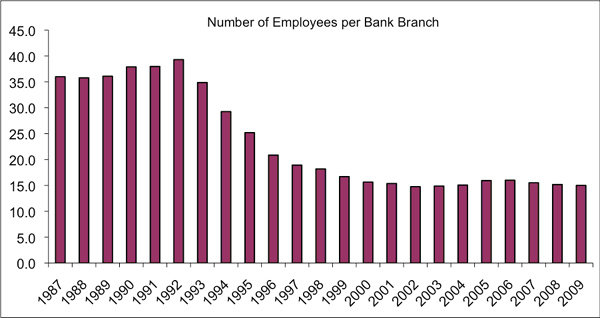

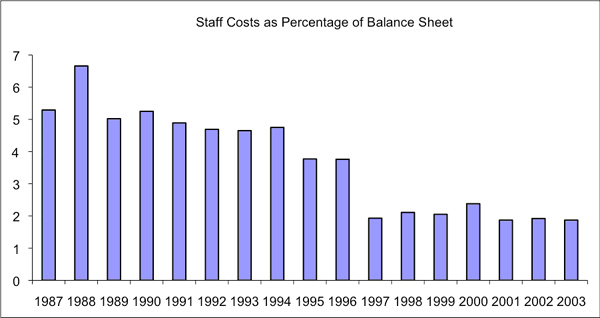

It was at this point that foreign bank capital began to flood into Mexico, and for good reason. In less than a decade, the average number of workers per branch more than halved, from around 38 to just over 15, thus driving up labour productivity (see Figure 1). More importantly, the average cost of labour on a bank’s balance in Mexico sheet plummeted from 5.25% in 1990 to 2.4% in 2000 (see Figure 2).

Since 2002 and under the predominant control of foreign bank capital, the rapid expansion of branch networks has continued. By the end of 2009, nearly 4000 new branches had opened – representing an expansion of over 50%. However, during this period the number of bank employees grew by a similar percentage. This suggests some leveling off of levels of labour productivity demands, relative to branch expansion, as banks in Mexico focused on lucrative operating strategies like servicing state debt and consumer credit.

The dramatic increase in labour productivity, in conjunction with the socialization of bank debt, contributed to the banks’ relatively high levels of profitability by 2007, when the U.S. sub-prime crisis began to unfold. As noted earlier, the Return on Assets of banks in Mexico hit an internationally high level of 2.75% in 2007. This level was triple their ROA of 0.94% in 2000.

Finance and Union Struggles

To be sure, the fattening of bank profits has had much to do with favorable institutional reforms, higher fees and commissions, and lucrative state debt and consumer credit operations. Still, these important factors do not take account of what has been largely ignored in the literature but affirmed by no less than the Deputy Governor of the Bank of Mexico, José Sidaoui (see Sidaoui 2006): the expansion of banks’ profits has been closely tied to a contraction in operating expenses, which has been due mostly to reductions in the number of bank employees per branch.

At the same time, one must underscore the central point that the apparent resilience of Mexico’s banking sector today is unimaginable without the state-organized financial bailouts and guarantees backed, in effect, by the income-earning and tax-paying capacity of the country’s workforce.

Since the 1990s, neoliberalism has entered a new phase in which the continuous enrichment of the financial sector has been built on the basis of shifting the burden of financial risk onto labour, both directly and through society-wide measures. These practices are not limited to Mexico, but are also evident in the recent G20 response to global financial crisis. It is ironic indeed that widespread support for a pro-active role of the state in socializing the debts of private banks is so far removed from the liberal idealization of free-market competition.

Strategies to overcome the shifting of private financial risk onto the working class must be multi-layered. Where there are bank unions, as in Mexico, the leadership needs to be severed from its historic corporatist and conservative roots, and then democratized. Second, where there are no bank unions, bank unionization of employees needs to be part of the agenda (such as the international UNI Global Union and SEIU are pursuing). Third, the state and collective ownership of large banks must be put back on the table (as witnessed today in Venezuela). These banks must be fundamentally different from state banks of the past, which have existed largely to service private capital formation. Rather, the banks must have an open and collective decision making process that seeks to allocate workers’ savings along democratic, stable, socially-oriented, and sustainable lines.

Thomas Marois teaches Development Studies at the School of Oriental and African Studies in London, UK.

Global Research Articles by Thomas Marois

© Copyright Thomas Marois , Global Research, 2010

Disclaimer: The views expressed in this article are the sole responsibility of the author and do not necessarily reflect those of the Centre for Research on Globalization. The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible or liable for any inaccurate or incorrect statements contained in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.