Global Financial System in Jeopardy!

Stock-Markets / Financial Crash Aug 13, 2007 - 03:16 PM GMTMartin Weiss writes : For the first time since 9-11, central banks around the world are pouring massive amounts of fresh new cash into their markets.

On Thursday alone, Japan pumped in $8.4 billion … Australia injected $4.2 billion … the U.S. pumped in $24 billion … and the European Central Bank flooded its banking system with an unprecedented $130 billion! And on Friday, they did it again , opening the money floodgates in similar quantities.

Why?

Is the global economy suddenly contracting? No.

Are the world's largest banks suddenly going broke? No.

So what has prompted these governments to pour out so much money so soon?

The answer:

They're afraid the mortgage meltdown in the United States could trigger massive failures in the international financial system.

Back in 1998, that's almost what happened: Russia defaulted on its debts. A major hedge fund, Long Term Capital Management, collapsed. Banks recoiled in horror. Stock and bond markets nosedived. And the world's financial system was perilously close to the brink.

That was nine years ago.

Nine months ago, in our November 2006 Safe Money Report, we laid out a scenario of how this was likely to happen again and in a bigger way.

We explained how a mortgage market collapse would lead to a credit crunch, and how a credit crunch could threaten the financial system.

Plus, we pledged to monitor the situation and to alert you when we felt it was becoming an immediate danger.

Now, that time has come.

Just 48 hours ago, in its lead Saturday article, The Wall Street Journal's headline declared …

"Tumult Is Testing New Machinery of World Finance."

And just a few hours before, bankers all over the world also rang alarm bells — not just about turmoil in the mortgage markets, but also about …

- Turmoil in the market for commercial paper — short-term corporate IOUs that large companies depend upon for their immediate cash-flow financing.

- Turmoil in the market for credit-default swaps — investments that institutions rely upon to protect themselves against defaults by weak borrowers, and …

- Turmoil in the market for countless new investments that most people have never heard of.

I don't care how remote or esoteric this may sound. I fear it could have an immediate impact on your money. And I feel you must have a good understanding of what it's all about.

That's why I am dedicating this morning's message to the heart of the matter, namely …

The Gigantic, Poorly-Known, Highly Inflammable Market For DERIVATIVES …

What are derivatives? Think of them as bets and debts by the super-rich and the world's largest companies.

What's the market for derivatives like? Think of it as a giant international casino:

- In the main hall, they bet on the interest-rate roulette.

- In the side rooms, they bet on foreign-currency blackjack, commodity craps or stock-market poker.

- And in virtually every sector, the bets are financed with generous amounts of borrowed money.

But unlike ordinary markets that you and I are familiar with, this giant casino is not just about betting on a price that goes up or down. It's about betting on virtually every quirk and intricacy of nearly every investment under the sun.

Some of the bets are high risk; some are not.

Some are for hedging against losses; some, for outright speculation.

But everywhere, the dangers are undeniable:

Danger #1

The Sheer Enormity of the Derivatives Market

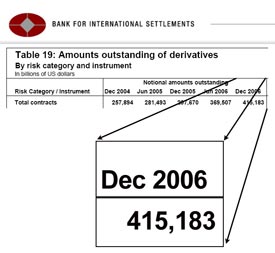

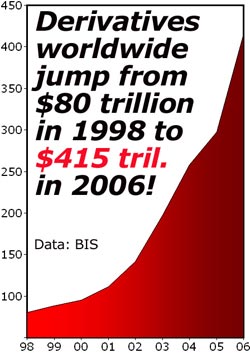

In its latest survey, the Bank of International Settlements (BIS) calculates that the total "notional" value of all derivatives outstanding in the world is a mind-boggling $415 trillion .

That's over eight times the GDP of the entire world economy … twenty times the total value of all U.S. stocks … and fifty times all the Treasury debts of the United States Government.

The fear: That any unexpected disruption in this $415-trillion market could throw the world's financial markets into turmoil … bankrupt hundreds of hedge funds … wipe out the profits of big-name financial institutions … sabotage the investments of pension funds … and scramble the portfolios of millions of average investors.

Danger #2

The Unbridled Growth

In 1998, the last time the derivatives market nearly blew up, there were "only" $80 trillion in derivatives outstanding worldwide, according to the BIS.

That was already huge.

But as I explained a moment ago, now the total derivatives outstanding has jumped to $415 trillion, or over FIVE times more!

And just from 2005 to 2006, it surged by a whopping 39.5%, about TEN times faster than the growth in the global economy.

Danger #3

Enormous Risks

If the risks were spread among thousands of institutions, each with plenty of capital to back up its bets, this derivatives balloon might not be such a threat.

But the U.S. Government's Office of the Comptroller of the Currency (OCC) reports that, in the United States …

Just FIVE banks control 97.1% of the derivatives in the entire U.S. banking system.

Worse, among these five banks, none — not ONE — has the capital to cover its net credit risk, the primary measure the OCC uses to evaluate the risks these banks are taking in their derivatives trading.

Back in 1998, at the time of the last debacle, JPMorgan Chase, the world's largest player in the derivatives market, had $3.80 in credit risk for each dollar of capital.

That was already over the top, in my view.

And now, the OCC reports that JPMorgan Chase has a whopping $7.99 in credit risk per dollar of capital, or more than double its 1998 risk level!

HSBC, which was barely a player in the derivatives market back in 1998, now has $5.65 in credit risk per dollar of capital!

Citibank: $2.03 per dollar of capital in 1998; $4.60 today.

Bank of America: 90 cents on the dollar in 1998; $2.88 today.

Wachovia: Just 18 cents on the dollar in 1998; $1.56 today.

This means that …

- Even though Wachovia has the least exposure to derivatives among the top five, it is still extremely vulnerable — with more at stake than its entire capital.

- America's largest bank — Bank of America — is also embroiled up to its eyeballs, risking over FOUR times its capital.

- And the single largest player in the derivatives market - JPMorgan Chase - is taking the most risk of all: EIGHT times its entire capital, according to the OCC's data.

Danger #4

Scant Oversight or Control

Based on data compiled — but no longer published — by the OCC, less than 9% of the derivatives held by U.S. banks are traded on regulated exchanges.

The remaining 91% are strictly one-on-one contracts, handled over the counter, outside the domain of regulated exchanges.

This mean that each party is ultimately responsible for monitoring the credit and trustworthiness of each counterparty. They're on their own … leading me to the conclusion that …

Even Some of the Biggest Winners Could Wind Up Among the Losers

Right now, everyone is worried about the big losers:

- Hedge funds that poured too much money into bad mortgages …

- Banks that financed the hedge funds, and …

- Investors that own the bank shares.

And there's no question that many of these are in grave danger as a result of the mortgage meltdown.

But what most people don't seem to realize is that, in the tightly interconnected world of derivatives, even some of the biggest winners could wind up among the losers.

Let's say, for example, that you're running a mortgage company.

You've got a big stake in the subprime mortgage market. And you're getting hammered with one massive loss after another. So one morning, you wake up in a cold sweat and say:

"I can't take this any more! If this continues, it's going to wipe me out! I've got to buy some protection. I've got to place some bets on the opposite side!"

Like thousands of others in recent weeks, you rush to buy "credit default swaps" — in your case, special bets that are designed to go UP in value when your borrowers default. You figure it's good insurance.

Plus, as is the usual practice, in order to avoid putting up a lot of capital, you finance most of your new bets with short-term loans.

Finally, you figure you can sleep nights. If the mortgage market calms down, you anticipate that your regular operations will stabilize. Conversely, if the mortgage meltdown worsens, the profits likely on your new bets should help offset your losses. Either way, you're covered … or so you think.

Now … here comes the hidden nightmare: Long before you start cashing in your chips, you're shocked to learn that the other guy — the one on the losing side of the bet — has run out of capital! He's broke. And he won't pay you a single penny.

Bottom line: Even though you're on the winning side of the trade, you still lose. You lose on your regular mortgage operations. AND you lose on the new trade.

You run out of capital just like the others caught in the mortgage meltdown. And, just like the others, you default on your bank loans.

The crux of the problem: If you were trading on an established exchange, the other guy's default would be primarily the exchange's problem — not yours. It would be their responsibility to make sure the market participants have enough capital to back up their bets. It would be their job to go after anyone who doesn't meet his obligations.

But unfortunately, the exchange has very little to do with your transaction! Remember: As I stressed above, 91% of U.S. derivatives are strictly one-on-one contracts, handled over the counter, outside the domain of regulated exchanges.

In other words, it's between you and the other guy: If he pays up, fine. But if he stiffs you, tough luck!

Now do you see why there's so much concern in high places about the credit risk America's five biggest banks are taking?

Now do you see why central banks all over the world are dishing out such huge amounts of cash all of a sudden?

Their great fears:

- A chain reaction of defaults that no government or exchange authority could control.

- Huge losses at major international banks.

- Massive convulsions in the world economy.

How to Protect Yourself

First, if you haven't done so already, get rid of your most vulnerable assets — investment real estate, mortgages, mortgage-backed securities, mortgage company stocks, bank stocks, brokerage firm stocks, and insurance company stocks.

But if you did not act on our earlier warnings, don't look back. Just focus on what you have to do now: SELL on rallies!

Second, take profits and raise cash, even on some of your best stocks.

This crisis is no longer limited to the investments we don't like. It's also bound to have an effect on areas we like, including some of our favorite foreign markets.

The global economic growth we've been telling you about is still strong. The fundamental forces pushing them forward are no less powerful. But that alone does not preclude sharp intermediate downturns.

So no matter what other investments you own — low-rated or high-rated, domestic or international — consider taking a chunk of your profits off the table.

Then stash most of the proceeds in short-term U.S. Treasury bills. Even if interest rates are low, even if the dollar is declining, short-term T-bills are still the ultimate place for safety and liquidity.

The most convenient vehicles: Treasury-only money market funds like American Century's Capital Preservation Fund , U.S. Global's U.S. Treasury Securities Cash Fund , or our affiliate's Weiss Treasury Only Money Market Fund .

Third, consider a stake in the strongest foreign currencies. Remember: The epicenter of the mortgage meltdown is in the United States. So the biggest negative impact is going to be on the dollar and dollar-denominated investments, as foreign currencies rise.

Fourth, for vulnerable investments that you may still be holding, buy hedges that can help protect you against losses. Just make sure they're traded on major exchanges — as are the specialized ETFs designed to go UP when the markets go DOWN.

For example, look at the long menu of inverse ETFs offered by ProFunds . Then pick the ones that most closely match the assets you want to protect.

Fifth, consult with a registered professional advisor. They're the only ones who can help you tailor your strategies to your individual needs, goals and tolerance for risk.

Sixth, attend my Thursday teleconference which I've called specifically to help in this emergency situation.

My topic is "The Spreading Credit Crunch: Protect Yourself and Profit."

And it's free.

But to participate, you must register by midnight on Wednesday!

Good luck and God bless!

Martin

By Martin Weiss

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.