Baltic Dry Index Peaking Impact on Stock Market

Stock-Markets / Stock Markets 2010 Apr 19, 2010 - 03:14 PM GMTBy: Ashraf_Laidi

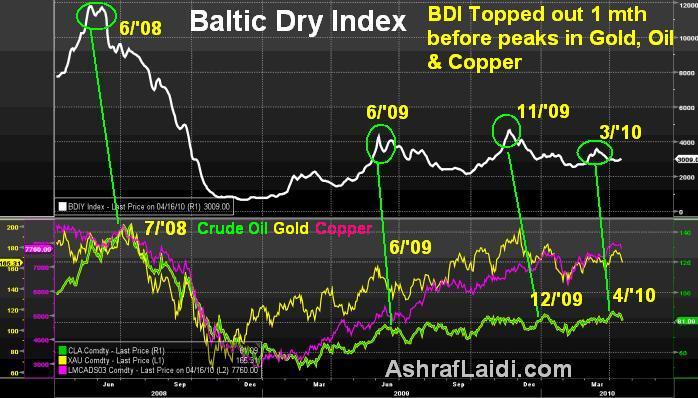

The 1-month lag between the Baltic Dry Index and selected commodities strikes again. The BDI, a daily index of shipping costs of dry bulk, is often seen as a leading indicator for raw material demand, hence a precursor for global production dynamics.

The 1-month lag between the Baltic Dry Index and selected commodities strikes again. The BDI, a daily index of shipping costs of dry bulk, is often seen as a leading indicator for raw material demand, hence a precursor for global production dynamics.

On March 15, the BDI hit a 3-month high at $3,574. 4 weeks later, US crude oil hit an 18-month high of $87.09/barrel, copper reached a 17-month high of $8,000/tonne and gold hit a 4-month high of $1,169 /oz. Both copper and oil peaked out on the same day (April 6th), while gold topped out 3 days later.

This was not the first time that BDI peaks preceded dry and liquid commodities by 4 weeks. The chart below shows the same pattern occurred in November 2009 and July 2008. There was no identifiable time lag in the BDI peak of June 2009.

The economic rationale for such time lag could be explained by the notion that production-targeted demand for commodities starts to turn prior to a retreat in the speculative element of these commodities. Thus, global factory demand starts to ease, so will shipping capacity for hauling raw materials and eventually their price in organized exchanges. I recognize that such analysis may be a little too simplistic in that it ignores the supply factors of these cargos, yet the general rational remains valid.

Integrating the China factor into the BDI equation, we recall that the April peak in copper coincided with reports that Chinas surging demand may have reflected stockpiling than actual integration into the building cycle. Looming measures of policy tightening from Beijing (curbing property prices, higher reserve requirements, upcoming rate hikes and loan restrictions) as well as the dampening effect of the anticipated currency revaluation on the economy will further dampen infrastructure spending and industrial capacity. And since Chinas March record imports were instrumental in producing the first monthly trade deficit since 2004, the pressure is on to cool down.

The 1-month lag has started to take effect after the recent sell-off in oil (-5%) and gold (-3%). If more commodities selling is on the way, then equities could surely follow.

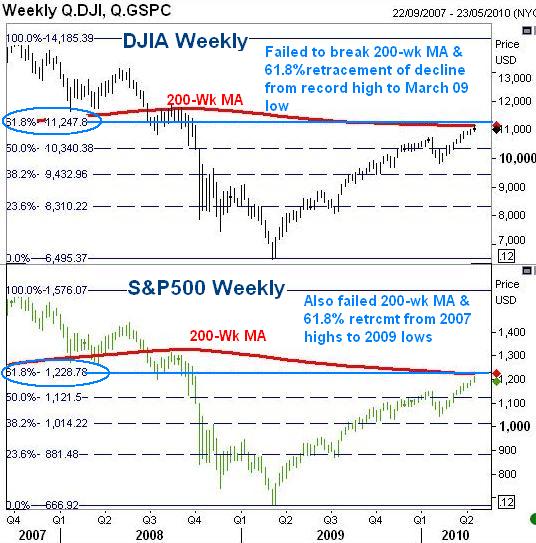

S&P500 and Dows Failures.. So far

The charts below illustrate both the DJIA and S&P500 have failed to cross above their 200-week moving average as well as the 61.8% retracement of the decline from their 2007 record highs to their March 2009 lows. The importance of these two technical levels is underlined by their proximity; hence their confluence, which is an essential element in technical analysis.

The case of the S&P500: Last week, the index peaked at 1,121, which lies below 1,229, representing the 61.8% retracement (rebound) of the decline from the October 2007 high to the March 2009 low. The peak also failed to take out 1,224, which represents the 200-week MA, a popular measure of long term trend.

In the case of the Dow: Last week, the index peaked out at 11,154, failing to take out the 11,232, which represents the 61.8% retracement of the decline from its October 2007 high to its March 2009 low. It also failed to take out 11,133, which is the 200-week MA.

Considering that unusual development that some emerging market indices (Brazils Bovespa and Indias Sensex) have fallen by as much as 4% before the high in the aforementioned US indices, these are due for a correction of 3-5%, which could drag the S&P500 and the Dow towards 1,150 and 10,550 respectively.

The economic impact of the volcanic ash disruption on European airlines is estimated to cost $250 million per day. The European Airlines Association stated the disruption could be unsustainable for some airlines, but no airline has yet applied for any compensation for lost revenues. Setting aside the risk of an EU bailout for airlines, currency markets remain pre-occupied with the medium term (6-9 month horizon) visibility for Greeces ability to meet this years debt obligations and the likelihood of further austerity measures that required to be passed as a condition for any ultimate IMF aid. With $1.3280 having been printed less than 2 weeks ago, the obstacles facing renewed declines towards $1.33 are negligible.

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi is the Chief FX Analyst at CMC Markets NA. This publication is intended to be used for information purposes only and does not constitute investment advice. CMC Markets (US) LLC is registered as a Futures Commission Merchant with the Commodity Futures Trading Commission and is a member of the National Futures Association.

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.