Desperate Measures For US Fed As Treasury Yields Scream for a Interest Rate Cut

Interest-Rates / US Interest Rates Aug 23, 2007 - 09:12 AM GMTBy: Jim_Willie_CB

The US financial system is experiencing a combination of a heart attack (fibrillation from absent trade recycled surpluses), a massive hairball (subprime debt securities) working through the bank arteries, and a realization (like Wiley Coyote in cartoons) that no terra firma lies beneath the economic feet as the depths below are vividly apparent. Massive money printing constitutes a heart attack, now a crescendo since the Constitutional violation on gold backed currency. The mortgage bonds simply cannot work through the banking system, with hairballs leading to constipation and unspeakable intra-bank distrust. For ten years the USEconomy has relied upon rising stocks or rising home properties to sustain an entire economy, from a structural foundation of inflating assets. For any central bankers or leading economists working as policy maker counselors, this is a purely heretical strategy.

The US financial system is experiencing a combination of a heart attack (fibrillation from absent trade recycled surpluses), a massive hairball (subprime debt securities) working through the bank arteries, and a realization (like Wiley Coyote in cartoons) that no terra firma lies beneath the economic feet as the depths below are vividly apparent. Massive money printing constitutes a heart attack, now a crescendo since the Constitutional violation on gold backed currency. The mortgage bonds simply cannot work through the banking system, with hairballs leading to constipation and unspeakable intra-bank distrust. For ten years the USEconomy has relied upon rising stocks or rising home properties to sustain an entire economy, from a structural foundation of inflating assets. For any central bankers or leading economists working as policy maker counselors, this is a purely heretical strategy.

The US financial system is teetering. Its US Dollar currency is losing global support, with some outright revolts in crucial territories. The chief private sector export from the US financial sector has been fraud-ridden asset-backed bonds and their toxic credit derivatives. What should anyone expect? For years an institutional dishonesty within all things financial in the United States has been engrained, spreading, and become integrated with high levels of the USGovt. The Wall Street hucksters exported fraud. The backlash might be more severe than the soft soap gurus anticipate. Look for an international boycott. The shock waves in the US financial markets are preliminary symptoms of bigger events soon to come. Stability identified is nothing but quiet between tremors.

The layers of denial are being stripped, with big names losing credibility. The icon institutions are being irreparably tarnished. Wall Street firms in all likelihood has negative book value here and now! My forecast of under-water US banking system is slowly coming to realization. The recent nonsensical sell-side mantra is that the tangible economy with consumers will lead the way, despite financial sector shock waves. No way! Last autumn the same goombas told us that US corporations would invest in capital expenditures to lead the way. No way! This here analyst does not accept a single thing they say. The US financial sector has been the tail wagging the dog for numerous years, and it will continue to do so. The credit distress (what an under-statement euphemism!) will lead to interruptions in credit flow and an absolutely certain USEconomic recession, even AFTER fraudulent official statistics.

My expectation is for an eventual global boycott of US$-based bonds, gradually gathering like a storm, widening eventually to include even the USTreasurys. The USTBond complex continues to act like a safe haven, but it is the broad fire next to the frying pan. In time, the onliest buyers of USTBonds will be the corrupted compromised and desperate central bankers, who must sustain the system. The biggest red herring story in the banking system these days is not so much official US Federal Reserve action, as the cratering of money market funds supposedly safe as rain and apple pie. The French AXA infection is one of several stories to litter the landscape in that regard. The funds bought subprime mortgage bonds for the added juice of higher yield, only to find the juice has laden with hydro-chloric acid. Or was it more deadly sulfuric acid? Imagine a poison being peddled at the store front for banks, where the public walks up to their windows. The bank run process is at the doorstep. Savers will pull their money from banks if they hear that a 30% haircut is coming, just from a money market account!!! Depositors should not feel safe with their money in banks, especially in a nation which defrauds as a policy in almost every level in the hierarchy.

US FED RATE CUT COMING NEXT

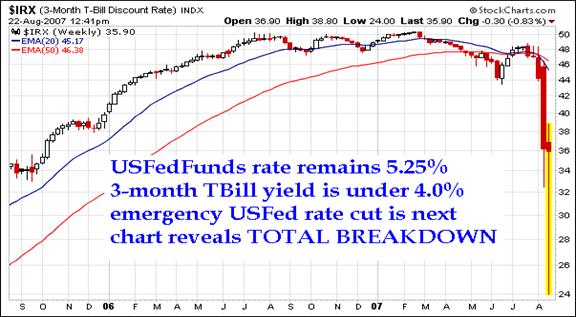

Forget for now the futures market and its indicator of the likelihood of upcoming official rate cuts. Turn to a more powerful market, which is more important than an indicator. The USFed is behind the curve by about a mile and a half. The FedFunds rate target is firm at 5.25% but they did cut the discount rate last week to best bank customers by 50 basis points. This followed emergency Fed Repo actions taken two weeks ago, amounting to around $40 billion in mortgage bond repurchases. What was not explained was two things. First, were only subprime mortgages repo'ed, or some prime mortgage bonds also? Second, were only Wall Street offerings of bonds accepted for repo, in a veiled Wall Street scummy bailout?

The 2-year Treasury Bill yield is below 4.2%, more than 100 basis points lower than the knucklehead desperados at the USFed have their target. Worse, the 3-month TBill yield has fallen well below 4.0% and during an intraweek situation, fell below the 3.0% mark. If one checks the behavior of the USFed over the course of the last twenty years, a discovery will come. They have been very obedient to the short-term bond market. The highly liquid, ultra-short-term 3-month Treasury market indicates 150 basis points in USFed rate cuts are coming, JUST FOR STARTERS!!!

So far the clown alchemists who lash themselves to the mast and helm have chosen to paint themselves into a corner. They insist they will cut the USFed official interest rate ONLY IF the USEconomy is on the verge of recession. These guys will be the last ones to notice. They hit the left guard rail then the right guard rail, then the left guard rail again. Apparently, they must hit the guard rail and feel the friction, the heat, and the lost limbs before they act. Even Treasury Secy Paulson has stated publicly his expectation of a SPILLOVER into the USEconomy. The financial sector will lead the way. Interrupted, hindered, and uncertain credit flow to the tangible economy dictates an obvious forecast of a slowdown of more than minor proportions. When the USFed reluctantly cuts rates this autumn, the gold & silver prices will rise and the related mining stocks will rise. The crude oil & natural gas prices will see much more volatility. They will fall under lower demand forecasts. They will rise with the faltering USDollar. On an increasing basis, analysts and fund managers are realizing that Asia depends upon the US markets less than in recent years. China , Russia , Brazil , and India will continue to grow by themselves. Trade within Asia is growing markedly. The arrogance of US-based analysis and forecast will be humbled here too.

The USFed finds itself witnessing the early stages of global boycott, and perhaps domestic avoidance. Here is a quote from my friend and colleague Rob Kirby, a super sleuth financial investigator of high order. “The Treasury's $32 billion four-week bill auction was the largest since at least July 2001 . The bills were sold at a high discount rate of 4.75 percent. The yields on one-month bills fell as low as 1.272 percent yesterday, and were trading at about 2.6 percent prior to the auction. In a sign of weak demand, the government received bids for the bills equal to 1.11 times the amount sold, the lowest since at least July 2001 . I have NEVER, EVER seen a bid to cover ratio this low, especially in the T-Bill Market. The fact that demand for 4 WEEK BILLS was this weak raises SERIOUS QUESTIONS as to how they are EVER going to be able to issue 2 year, 5 year, 10 year, or 30 year bonds! The air is thick with scent of future monetizations.” My impression is that, folks, this is desperation slowly sinking in. US$-based toxicity is being recognized!!! The last resort will be USFed and Dept Treasury money printing and rampant purchase of US$-based securities, not just USTreasurys.

THE GRAND INFLATION BIND

The USFed has no acceptable attractive policy choices. They incessantly harp about their concern over price inflation. They are victims of the dog they have fed, bred , and misled. If truth be known, the USDollar money supply is rampaging upward, skyrocketing by an annual growth rate of nearly 14%. So they chatter like noisy gongs about inflation when they oversee monstrous monetary inflation. They cannot DEFINE inflation, let alone measure it. Their spoken concern about price inflation is a disguised dreaded fear and desperation over the unleash of higher prices from a declining USDollar. They talk of inflation, but focus upon the currency risk. They cannot openly direct policy and discuss the US $ currency, by charter.

The nearest evidence of imminent outbreak of price inflation can be found in the Treasury Yield Spreads. What was once inverted for over a year in 2005 and 2006 has now reverted to the normal upward tilting spread. Worse, the spread between the 2-year TBill yield and the 10-year TNote yileld is a ripe 50 basis points. The stochastix are not even overbought yet, which means a wider spread is coming very soon. The spread between the long-dated Treasury and the shortest short-term Treasury is huge! The signals are two-fold, screaming of that ugly STAGFLATION, since both recession and price inflation are the strong messages growing louder with each passing week. This is the worst of worlds for any central banker, and the bitter fruit of the unequaled King of Inflation, who left town, knighted and revered, despite his actual role as serial inflation engineer. This is Greenspan's nightmare delivered to Bernanke's office desk.

The huge gap in the Treasury Yield Curve screams of necessary action to be taken on official interest rates. The trapped US Federal Reserve can wait until late September, or take emergency action. The last time a huge gap showed up was in January 2001, when the Greenspan Fed did what they were forced to do, cut rates radically, quickly, and repeatedly. The USFed is damned if they do take action, and damned if they do nothing. If the USFed takes no action on interest rates, the staggering monetary inflation will eventually continue to work its way through the pipeline and deliver galloping price inflation. If (WHEN) they lower interest rates, they will set off a global US$ selloff, and trigger the very threat they publicly acknowledge, price inflation. Bond market signals are orders of magnitude more reliable than USFed spoken words. The prices across the entire system would rise from a falling USDollar. The Europeans are not finished hiking interest rates. The bond yield differential which has supported the USDollar is soon to do a total vanishing act.

TRAPPED IN A POLICY CORNER

My conclusion has been all along, that the next USFed action will unleash huge volatile downdrafts in the US $ exchange rates. If they hike rates, the resulting USEconomic downturn will be a nightmare, again with dire USDollar consequences also. Credit would be restricted, as housing would be pushed downhill at a greater pace, only to result in a sequence of emergency rate cuts later on, amidst huge embarrassment and grand discredit of the heretical house that has become the USFed. The US $ exchange rate would first careen downward from bad prospects within the economy, and worse prospects in all investment classes except USTreasury Bonds.

If they cut rates, the resulting USDollar selloff would be potentially a major shock. The USEconomy desperately needs a rate cut, as does the bond market. The imbalance of bond demand and supply is totally out of synch, with the biggest piece out of place being the USFed Funds rate. Their cut in the discount rate addressed the commercial credit market imbalance. Next comes the action to address the bond market imbalance. In fact, the lockup in the bond market is soon to become a rather ugly spectacle. The US $ is teetering at the edge of an historic edge of a chasm. This alternative is mandatory yet treacherous, and likely to set off a chain reaction of dire consequences. GOLD WILL LOVE IT. Tragically, gold is soon to benefit from a national disaster. The US financial system is broken, yet its guiding maestros remain cocky and boastful. The cancer of inflation has been joined by a major release of subprime toxin. It is unclear whether anything can fix this fraud-ridden inflation-infested system. My deep seated concern is that a political transformation is just over the horizon, since remedy is impossible.

TRADE WAR SPICE

Trade war renders another inflation risk. For two decades, the US Economy has benefited from inflation export to Asia . Also, a benefit has been seen from its export to the Persian Gulf . Both Asia and the Gulf are important sites nowadays. At a time when Asia has stopped incremental purchases of USTBonds, the nitwits in the USGovt chambers push for trade sanctions. Talk about stupidity! So the avenues of inflation export are likely to be restricted, then curtailed further, and possibly shut down significantly. Heck, US voters, perhaps dumber than our leaders, want to take action against those who robbed their jobs. Well, take action against US corporate leaders, who sold out the US worker class altogether in the biggest betrayal in modern labor history in the United States .

The moronic economic mindset that has directed policy is close to a total breakdown from bad decisions run into an accumulation of dead ends, disasters, and dominos which cannot be even remotely rectified. My sources tell me now that China has hit the $1 trillion mark on US$-based debt security storehouse, they next will put the screws to the United States in almost every conceivable way. They want to become the world bankers. They want to reduce the USMilitary dominance. They want Taiwan in a more formal gesture like with a shepherd hook. They want to take what they regard as their rightful place as world leaders. The corrupted US wonks will continue to play into their hands, with basic profit motive from a skein of major initial stock offerings an ongoing motive. The US Defense industry and Wall Street bankers have accomplished a mudslide destruction of the US financial and economic system, one more devastating than any enemy could have designed with deep insight and careful planning.

The Persian Gulf continues to search for the guts to reject the US $ peg. First was Kuwait , shedding the US $ peg. Next has been the United Arab Emirates , soliciting wider action by all Gulf Cooperative Council members. The UAE is attempting to pull the pin on the hand grenade on the Petro-Dollar. The entire group of nations is at its own crossroads. They must decide on security pacts with the United States . They must react to the price inflation whirlwinds released by keeping the USDollar peg doorway open. Should the clueless USGovt leaders declare a trade war on the Persian Gulf also? No, not necessary, since the Military Protection Racket is working really well. The Saudis just completed a multi-billion$ arms deal with the US Defense industry, sure to be expanded in time. The US export data should be reinforced in a healthy manner. War would be good business if it did not destroy economies, at their end and our end.

THE US FED WALKS A NARROW PATH, ONE GROWING NARROWER WITH EACH WEEK. THE PATH HAS BECOME A RAZOR BLADE. NO ACTION MEANS DEEP BLOOD LOSS FROM NASTY CUTS. THEY ARE LOSING THEIR INTEGRITY. ON EACH SIDE OF THE PATHWAY LIES A STEP DOWN ON THE USDOLLAR EXCHANGE RATE. THE ONLY CHOICE LEFT IS ANOTHER PRESS OF THE MONEY SUPPLY ACCELERATOR. THE PEDAL ITSELF HAS A BRAND NAME OF WEIMAR . THE PUFFS BEHIND THE USFED LIFT GOLDEN SAILS. IT IS HARD TO MIX ENTHUSIASM AMIDST TRAGEDY, BUT WE MUST FIND STRENGTH.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

“My subscription is worth double what I pay. Once for the economic analysis, and once for the education in wordsmithing! I am coming to value the second one the most, as your alliteration and parable-esque style keeps me smiling even as you write about the walls crashing down!” (MichaelH in Georgia )

“I want to congratulate you and thank you for your quick and frankly stated revision on bonds [the 4.0% forecast]. That was my thinking all along, but I must say that your writing was and continues to be a most valuable input to my thinking in the first place. That type of integrity makes me value your opinion all the more and is likely to keep me as a loyal subscriber for years to come.” (ScottD in Pennsylvania )

“I am staggered by the depth and breadth of the information I now have access to in your newsletter. Just one problem, I cannot put my computer down. Reading your current reports and catching up on earlier editions you make available in your ‘library' is dominating my mornings, afternoons and evenings!” (DavidR in England )

“I believe your wit and disgust at the state of affairs stand untouched.” - (Charlie P in Virginia )

“I am currently subscribed to over 60 paid newsletters. Your analysis is by far the most accurate every time. The most impressive characteristic of your thought processes is your ability to think in multi-factorial terms. You are one of the few remaining intellectuals with such capacity intact.” -(Gabriel R in Mexico )

By Jim Willie CB

Editor of the “HAT TRICK LETTER”

www.GoldenJackass.com

www.GoldenJackass.com/subscribe.html

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise like a cantilever during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by heretical central bankers and charlatan economic advisors, whose interference has irreversibly altered and damaged the world financial system. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. A tad of relevant geopolitics is covered as well. Articles in this series are promotional, an unabashed gesture to induce readers to subscribe.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 24 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.