U.S. Economy Slows as States Lose Federal Stimulus Funds

Economics / US Economy Jun 14, 2010 - 03:05 PM GMTBy: Mike_Shedlock

For only the second time in 50 years, state budget cuts will act as a fiscal drag on GDP as noted by Bloomberg in Economy in U.S. Slows as States Lose Federal Stimulus Funds.

For only the second time in 50 years, state budget cuts will act as a fiscal drag on GDP as noted by Bloomberg in Economy in U.S. Slows as States Lose Federal Stimulus Funds.

Spending cuts by state and local governments from New York to California may act as a drag on the economy into 2011, only the second time in more than a half century that such reductions have restricted growth for three consecutive years.

States face a cumulative budget gap of $127.4 billion as 46 prepare for the start of their fiscal year on July 1, according to a report this month by the National Governors Association and the National Association of State Budget Officers. They will have to fill that hole largely on their own, as aid from the federal government under programs including President Barack Obama’s $787 billion stimulus package starts to wind down.

State and local cutbacks may trim growth by about a quarter percentage point in 2010 and 2011 after shaving it by 0.02 point in 2010, said Mark Zandi, chief economist at Moody’s Analytics Inc. He also sees the governments lopping payrolls by 200,000 during the next year after reducing them by 190,000 in the 12 months through May.

“The budget cutting that is dead ahead will be a significant impediment to economic growth later this year into 2011,” he said in an interview.

Warren Buffett, whose Berkshire Hathaway Inc. has been paring its municipal-bond portfolio, predicted a “terrible problem” for state and local government debt in June 2 testimony to the U.S. Financial Crisis Inquiry Commission in New York. The Omaha, Nebraska-based company cut its municipal holdings to less than $3.9 billion as of March 31 from more than $4.7 billion at the end of 2008, according to the company’s first-quarter report.

Credit default swaps of five states -- California, Illinois, Michigan, New Jersey and New York -- have risen an average of 91.5 basis points since May 3, according to data compiled by Bloomberg, as bondholders seek protection. Credit swaps pay the buyer face value if a borrower fails to meet its obligations, less the value of the defaulted debt. A basis point equals $1,000 annually on a contract protecting $10 million of debt.

State and local governments will have to dismiss 162,000 workers if Congress fails to extend about $24 billion of Medicaid payments, Lawrence Mishel, president of the Economic Policy Institute in Washington, said during the governors’ call. Payrolls have already registered 11 straight months of year- over-year declines, the longest stretch of continuous drops since 1983, based on Labor Department data.

Spending cuts by state and local governments chopped 0.49 percentage point off GDP in the first quarter, the most since 1981, as the economy expanded 3 percent. The impact of the budget squeeze probably was larger than that, as the GDP data don’t break out the effects of tax increases on growth, Zandi said.

California, with a $1.8 trillion economy that’s bigger than Russia’s, faces a $19 billion deficit. Republican Governor Arnold Schwarzenegger wants deeper spending cuts, including elimination of the main welfare program for the poor, while Democratic lawmakers have backed tax increases.

New York, the third-most populous U.S. state, has been operating under weekly spending bills because lawmakers haven’t agreed on a comprehensive budget to close a projected $8.5 billion gap for the fiscal year that began April 1.

Illinois, with a deficit equal to half its $25.9 billion budget, saw its debt rating cut after it failed to “enact significant recurring measures” to reduce the shortfall, Moody’s Investors Service said in a June 4 press release. The New York-based agency reduced the rating on $29 billion of general-obligation debt by one level to A1, putting Illinois on par with California as the lowest-rated U.S. state.

Obama's Solution is to Spend more Taxpayer Money

President Obama does not want a slowdown heading into the election. In fact, no politician ever wants a slowdown no matter how badly one is needed. Thus it should not be surprising that Obama Once Again Wants to Buy Union Votes with Your Tax Dollars.

The simple fact of the matter is states have too many public workers making too much money with benefits tremendously out of line with the private sector. Indeed the situation is so bad that Seven State Pension Plans will be Out of Money by 2020.

Although the problem is too much government spending and too many promises, Obama is begging for money while hypocritically calling for deficit reduction. Ironically, his own budget deficit commission has run out of money and seeks a budget increase.

It is time to send a message and the way to do it is to vote against any incumbent from either party who just cannot say no to this fiscal madness.

What You Can Do

Please call your legislative representative and tell them the problem is too much government spending, unions are wrecking the country, and if they vote for more taxpayer sponsored bailouts of public union workers or more state aid, then you will vote them out of office.

Tell your representatives you are against spending $50 billion more on states and that it is long overdue for government workers share the pain and that it's time for states to fix their budget messes without more Federal handouts and taxpayer dollars.

Here is a directory sorted by state of all the Senators of the 111th Congress.

You can also look up the phone numbers in the Online Directory For The 111th Congress

MacroAdvisers Says Chances of a "Double-Dip" are Essentially Nil

In spite of the coming slowdown in state spending (there will be some slowdown even if Congress throws more money at the problem), MacroAdvisers says Chances of a "Double-Dip" are Essentially Nil.

Early in the recovery many forecasters, concerned that the nascent expansion was fueled only by temporary inventory dynamics and short-lived fiscal stimulus, fretted over the possibility of a double-dip recession. Now, with the emergence of the sovereign debt crisis in Europe, that concern has re-surfaced. Certainly we recognize that the debt crisis imparts some downside risk to our baseline forecast for GDP growth. However, based on current, high-frequency data — most of which is financial in nature and so is not subject to revision — we believe the chance of a double-dip recession is small.

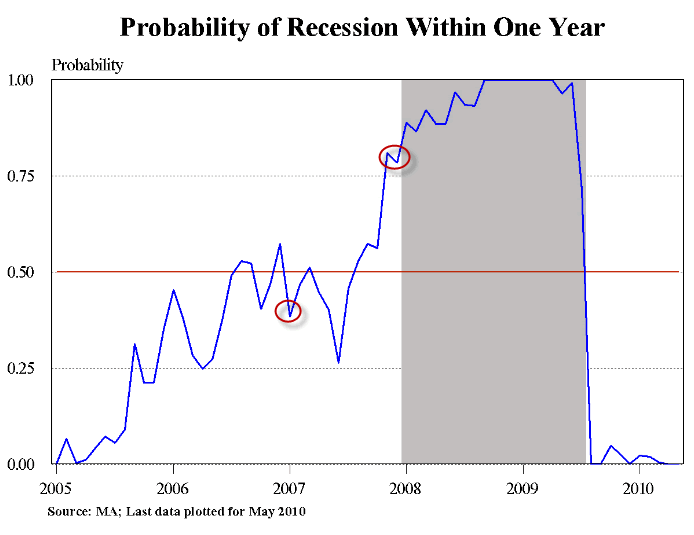

One way we assess these odds is with a simple but empirically useful “recession probability model” in which the probability of experiencing a recession month within the coming year is a weighted sum of the probability that the economy already is in recession and the probability that a recession will begin within a year. The former probability is estimated as a function of the term slope of interest rates, stock prices, payroll employment, personal income, and industrial production. The latter is estimated as a function of the term slope, stock prices, credit spreads, bank lending conditions, oil prices, and the unemployment rate. Currently this model, updated through May’s data, estimates that the probability of another recession month occurring within the coming year is zero. (See Chart).

While ex post this model has a perfect record of predicting recessions, ex ante its predictions are only one factor we weigh when considering whether to introduce a double-dip recession into our baseline forecast.Perfect Track Record?

A year before the 2007 Recession started MacroAdvisers had the odds substantially under 50% yet we had a recession anyway. To be fair the chart also shows the odds were substantially above zero at the time.

Assessing the Odds

I believe everyone has far too much faith in the yield curve and not enough consideration to understanding the dynamics of debt deflation coupled with attitude changes of consumers and lenders.

Banks are not lending because there are too few credit worthy borrowers, and simultaneously credit worthy corporations see no need to expand in a very hostile business environment of rising taxes, rampant overcapacity, global wage arbitrage, and shrinking consumer demand.

Consumers attitudes have changed. Boomers are heading into retirement with insufficient funds, now in full awareness that their house is not an ATM. As a result consumers of all ages are buying what they need, not loading up on more toys.

The jobs picture is also grim. Students fresh out of college are hundreds of thousands of dollars in debt with no way to pay it back.

China is overheating and must slow.

The macro picture is in my estimation grim. Thus the odds of a double-dip (assuming of course the 2007 recession is over), are clearly not zero. If there is no double-dip, the odds of stagnation with flat to 2% GDP growth is enormously high.

Meanwhile even though Obama is spending like crazy, Bernanke has promised not to monetize the debt. The only conceivable way that can happen is if interest rates rise substantially. If you are seeking odds on something that is close to zero, that would be it.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.