Weekly Financial Markets Analysis - US Employment Situation Unchanged?

Stock-Markets / Financial Markets Sep 07, 2007 - 02:55 PM GMT “Nonfarm payroll employment was essentially unchanged (-4,000) in August, and the unemployment rate remained at 4.6 percent, the Bureau of Labor statistics of the U.S. Department of Labor reported today.”

“Nonfarm payroll employment was essentially unchanged (-4,000) in August, and the unemployment rate remained at 4.6 percent, the Bureau of Labor statistics of the U.S. Department of Labor reported today.”

Unchanged??? If you look more closely at the numbers, the Department of Labor (DOL) had to decrease the civilian workforce by 340,000 in order to achieve that feat. The other trick they pulled out of their hat this month is to add 120,000 fictitious jobs through the CES Birth/Death Model. Neat trick, eh? Could it be that the USA just lost 464,000 jobs last month? We'll never know for sure, but the statistics are underwhelming. The two largest blocks of new hires is health care (35,000) and food service employees (24,000). Meanwhile, manufacturing jobs were down another 46,000 and construction was down 22,000.

Check this out. “The number of persons employed part time for economic reasons, at 4.5 million in August, was 359,000 higher than a year earlier. This category includes persons who indicated that they would like to work full time but were working part time because their hours had been cut back or because they were unable to find full- time jobs. (See table A-5.)”

The Fed keeps “pumping.”

The Federal Reserve has been busy at the pumps all week trying to keep our nation's banks afloat. The facility through which this is done is called the “ Discount Window .” The press is making light of this by suggesting that this is a minor thing. Note the headline in MarketWatch, “ THE FED - Little new discount window borrowing . ” This is disingenuous. The reason is that the original loans were for only a few days. But they have recently been “rolled over” at longer maturities, because the banks still have not resolved their liquidity problems. The latest loans have been extended for 14 days. Today, as the market declines, the Fed is at it again , lending (not pumping) another $31.25 billion into the banking system. This bears repeating…the Fed is only offering temporary loans while the banks work out their liquidity problems. They are not buying the subprime debt that caused the crisis to begin with. At some point, either the banks unload their “toxic waste” or begin selling other assets. This morning's stock market is giving us a clue of what is transpiring.

The Japanese market fell on Friday.

Fears of overvalued properties dragged down the Japanese equities market this morning. “ Japanese property shares have declined since early this year on fears of overvaluation. But the decline became a rout at the beginning of this week after Monday's official numbers showed a particularly sharp fall in investment spending among real estate companies as part of a broad general decline in capital spending. Fears about property shares worsened on Wednesday, after Takeo Higuchi, the head of Japan 's second biggest house builder, warned real estate prices were a bubble set to burst.”

Party like there's no tomorrow.

In an article entitled, “Why the party won't stop for Chinese stocks”, the author mentions that inflations is rising at 6%. Bank deposits are paying less than that. The author asks, “ Why on earth, in that situation, would an ordinary Chinese investor not put their savings into a stock market, which by law can't be shorted? No wonder the Shanghai Composite has more than doubled year-to-date.”

In an article entitled, “Why the party won't stop for Chinese stocks”, the author mentions that inflations is rising at 6%. Bank deposits are paying less than that. The author asks, “ Why on earth, in that situation, would an ordinary Chinese investor not put their savings into a stock market, which by law can't be shorted? No wonder the Shanghai Composite has more than doubled year-to-date.”

Just because a market cannot be shorted doesn't mean that it won't go down. Meanwhile the party continues until the punchbowl runs out of rice wine.

Starting the next leg down.

Today's payroll numbers were a bit of a surprise to the markets, when most were expecting the “Goldilocks economy” to continue.

" It's a major shock to the market," said Peter Cardillo, chief market strategist at chief market economist at Avalon Partners. "This employment report is shocking to most Wall Street observers but not to the thousands that have been thrown out of work in the housing and mortgage industries," Eliot Spar, market strategist at Stifel Nicolaus & Co., wrote in an early comment.

Bernanke now has the cover to cut rates…

… so the thinking goes on Wall Street. The credit market deterioration and the job cuts in August all point to a slowing economy. This is increasing investor expectations that the Fed will cut rates again…very soon. In the meantime, overseas central banks were net buyers of U.S. treasuries , while they sold agency debt, such as Freddy Mac and Fanny Mae issues.

… so the thinking goes on Wall Street. The credit market deterioration and the job cuts in August all point to a slowing economy. This is increasing investor expectations that the Fed will cut rates again…very soon. In the meantime, overseas central banks were net buyers of U.S. treasuries , while they sold agency debt, such as Freddy Mac and Fanny Mae issues.

Tough week for home builders.

Before the opening bell , Beazer Homes USA Inc. (BZH) said it has received purported default notices from U.S. Bank National Association, the trustee under the indentures governing several outstanding senior notes.

Another large home builder, Hovnian saw a loss this quarter as well. "Credit tightening in the mortgage market has reduced the number of qualified home buyers, existing home inventory levels remain persistently high in many of our markets and buyer psychology has been negatively impacted by a steady stream of news related to falling housing prices, foreclosure rates and mortgage availability," said Chief Executive Ara Hovnanian in the earnings release.

The U.S. Dollar is taking an unexpected beating.

Sept. 7 (Bloomberg) -- The dollar fell to the lowest in a month against the euro and weakened versus the yen after a government report showed the U.S. economy unexpectedly lost jobs last month for the first time in four years.

Sept. 7 (Bloomberg) -- The dollar fell to the lowest in a month against the euro and weakened versus the yen after a government report showed the U.S. economy unexpectedly lost jobs last month for the first time in four years.

``It added significantly to the dollar-negative sentiment,'' said Alan Ruskin, head of international currency strategy in North America at RBS Greenwich Capital Markets Inc. in Greenwich, Connecticut. “The Fed rate cut at this month's meeting is a lock. The question is whether the central bank will cut by 25 basis points or 50 basis points.''

Speculators are chasing performance.

The latest headline for gold in MarketWatch is, “ Gold shoots higher after weak payroll reading .” "Long-term investors are piling into gold, gold producers are buying back their hedges and the funds are going with the flow," said Julian Phillips, an analyst at GoldForecaster.com. "It looks like the see-saw has tipped in gold's favor."

The latest headline for gold in MarketWatch is, “ Gold shoots higher after weak payroll reading .” "Long-term investors are piling into gold, gold producers are buying back their hedges and the funds are going with the flow," said Julian Phillips, an analyst at GoldForecaster.com. "It looks like the see-saw has tipped in gold's favor."

Could it be that the speculators are just redeploying hot money into a favored commodity?

“Demand destruction” may be appearing.

The EIA's report on Wednesday suggested that, “…for the 10th month in a row, total oil demand was lower than suggested by the weekly data for the same period. Gasoline demand was also lower than suggested by the weekly data for the same period for the sixth time in a row.” All those reports about increasing demand may be based on old information, while new data was being ignored. But the charts told us something was happening four months ago.

The EIA's report on Wednesday suggested that, “…for the 10th month in a row, total oil demand was lower than suggested by the weekly data for the same period. Gasoline demand was also lower than suggested by the weekly data for the same period for the sixth time in a row.” All those reports about increasing demand may be based on old information, while new data was being ignored. But the charts told us something was happening four months ago.

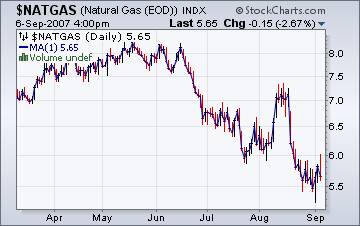

Supply: Large, Demand: Small.

Lower prices have encourages some natural gas producers to take some production offline, says the Energy Information Agency . In the meantime, one natural gas transporter is expanding capacity to deliver natural gas to the Northeast. Natural gas prices still have room to go lower in the long term.

Lower prices have encourages some natural gas producers to take some production offline, says the Energy Information Agency . In the meantime, one natural gas transporter is expanding capacity to deliver natural gas to the Northeast. Natural gas prices still have room to go lower in the long term.

Waddayaknow, Greenspan sees turmoil ahead.

Mr Greenspan said : "The behaviour in what we are observing in the last seven weeks is identical in many respects to what we saw in 1998, what we saw in the stock-market crash of 1987, I suspect what we saw in the land-boom collapse of 1837 and certainly [the bank panic of] 1907.”

Mr. Bernanke probably wishes that Alan Greenspan would tone down his remarks. After all, the Wizard behind the Curtain doesn't want us looking into things too deeply. We might lose confidence in his job performance. Of course, Alan doesn't have to worry about the consequences of his words. After all, he's only a highly paid consultant.

Back on the air again.

Tim Wood of www.cyclesman.com , John Grant and I have had a running commentary on the markets again this week. You may listen to our comments by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: It is not possible to invest directly into any index. The use of web-linked articles is meant to be informational in nature. It is not intended as an endorsement of their content and does not necessarily reflect the opinion of Anthony M. Cherniawski or The Practical Investor, LLC.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.