BP Gulf Oil Well Cap, Pressure At The Wellhead And What It Really Means

Politics / Environmental Issues Jul 18, 2010 - 09:55 AM GMTBy: Dr_Tom_Termotto

BP and the Coast Guard are watching the pressure at the wellhead very, very closely because of what it will mean for the future prospects of this well. Pressure readings under a critical threshold usually mean that there may be leaking elsewhere in the system. If there is a single leak, it will be more easily diagnosed and remedied depending on where it is. If there is more than one leak present, a whole set of different challenges emerges. Most importantly, keeping the system under pressure, when leaks exist anywhere, will inevitably increase the potential for those leaks to worsen.

BP and the Coast Guard are watching the pressure at the wellhead very, very closely because of what it will mean for the future prospects of this well. Pressure readings under a critical threshold usually mean that there may be leaking elsewhere in the system. If there is a single leak, it will be more easily diagnosed and remedied depending on where it is. If there is more than one leak present, a whole set of different challenges emerges. Most importantly, keeping the system under pressure, when leaks exist anywhere, will inevitably increase the potential for those leaks to worsen.

“One mysterious development was that the pressure readings were not rising as high as expected, said retired Coast Guard Adm. Thad Allen, the government’s point man on the crisis.” (Per AP Article of 7/17/10: “BP, scientists try to make sense of well puzzle”)

At this juncture of monitoring, everything points to the distinct possibility of leakage further down in the well system. BP will, therefore, be forced to open the valves to release oil in order to relieve some of the pressure. If the system is kept under pressure for any length of time, the likelihood of exacerbating any leaks increases rapidly, which will then create serious problems, as if BP doesn’t already have them.

“Admiral Allen added that the possibility remained that the well had been breached and that oil and gas were escaping into the surrounding rock and perhaps even into the Gulf.” (Per NYT on 7/17/10)

How did we get here? To a place where leaks have quite possibly opened up deeper in the well system. As follows:

In a high compression well such as this one, the effluent is moving up the pipe at a very high speed due to the extraordinary pressures pushing up from below. The methane gas component of the upsurging hydrocarbon brew changes its state at this speed and affects the characteristics of the entire effluent coming up the pipe in the following way. As methane ascends, the bubbles expand causing a discernible acceleration in velocity. The interaction between effluent speed, geological debris and any additional bump from acceleration can give rise to catastrophic ejections, explosive potential, stretch and inline cavitations. All one has to do is examine an oil pipe which has sustained a similar flow rate to find evidence of this phenomena.

The critical result of this “methane gas effect” is that a more intensified kind of friction begins to occur within the pipe between the rising effluent and the inside metal surface. The longer this situation is allowed to persist, the more the piping will become eroded from the inside out. As the surface becomes increasingly attenuated, cavitations begin to develop on this inside surface of the pipe thereby creating weak points. Given the relentless pressure in the system, and depending on the grade of the pipe steel, the weak points at the joints and seams can become compromised, as the subtle bends and leanings will receive a greater amount of frictional activity and impact. There is also the possibility of breaches deeper in the system, which could be practically impossible to remedy in any meaningful way.

“Benton F. Baugh, president of Radoil Inc. in Houston and a National Academy of Engineering member who specializes in underwater oil operations, warned that the pressure readings could mean that an underground blowout could occur. He said the oil coming up the well may be leaking out underground and entering a geological pocket that might not be able to hold it.” (Per AP Article of 7/17/10: “BP, scientists try to make sense of well puzzle”)

Another phenomenon occurs with methane that must also be considered in the sinking of the $350,000,000 Deepwater Horizon.

Per Wikipedia:

“When drilling in oil- and gas-bearing formations submerged in deep water, the reservoir gas may flow into the well bore and form gas hydrates due to the low temperatures and high pressures found during deep water drilling. The gas hydrates may then flow upward with drilling mud or other discharged fluids. As they rise, the pressure in the drill string decreases and the hydrates dissociate into gas and water. The rapid gas expansion ejects fluid from the well, reducing the pressure further, which leads to more hydrate dissociation and further fluid ejection. The resulting violent expulsion of fluid from the drill string is one potential cause or contributor to what is referred to as a ‘kick’.”

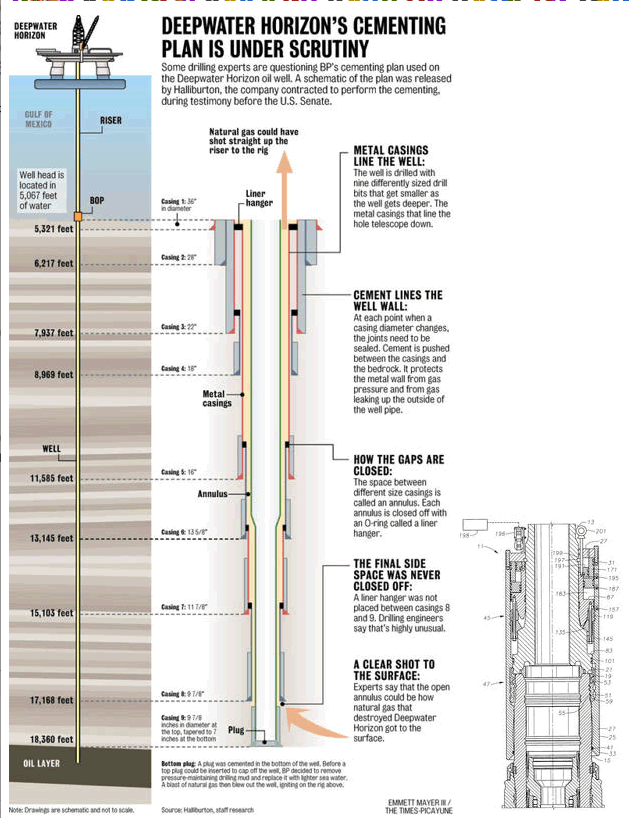

Then there is the matter of how BP’s cementing plan may have provided another very weak link in this whole chain of events. A careful study of the diagram below will reveal some serious issues that have come into play, both before the blowout and after. Clearly, if there are significant breaches in the system, the points of deficiency outlined in this chart should serve as a guide as to where the trouble-shooters ought to look. The real challenge here will be how to solve any of these potential problems given an active well status under tremendous pressure.

The confluence of circumstances which are of greatest concern are delineated by the following points of fact:

(1) This gusher flowed with great velocity for 86 days and therefore produced a lot of wear and tear in the system.

(2) The gravel, mud, stones, sand, oil and gas mix rushing through the pipe at excessive speed has undermined the integrity of the well system to a degree not known.

(3) Over the course of the aforementioned period different quick fixes were attempted, which were not always in the best interest of maintaining the integrity of the entire well system.

(4) BP has drilled in an area that was known to be a very high risk prospect for a variety of reasons, the most significant being pressure.

(5) Because this is a high compression well, the pressures involved exceed the capability of much of the technology and equipment that has been utilized. (i.e. BP is in over their head both literally and figuratively.)

(6) BP made many missteps over a three-month period that have unequivocally caused unintended consequences to the system, as well as collateral damage to the area, the repercussions of which may not manifest until a later date.

(7) We know the formation structure around the wellhead has changed. The relationship of the wellbore to the casing, in the wake of a subsea explosion that occurred during the events that sunk the Deepwater Horizon, has most probably been impacted. The BOP and riser were substantially affected by this trauma, and therefore the pipe and wellhead may very likely have shifted a few degrees. Furthermore, the cement that holds the well casing in place is undoubtedly under assault by oil, gas and debris under high pressure. As the cement holds the casing and production line in place, a breaching of this architecture is quite possible if it has been sufficiently compromised.

(8) The convergence of these various factors may have caused breaches in the system that are below the relief wells, and therefore will be extremely difficult to address with any degree of finality.

As of this date, we do not know with certainty if there are leaks in the system. However, in light of BP’s track record for grossly misrepresenting the truth, as well as the US Federal Government’s passivity and lack of response in the face of this extraordinary pattern of misrepresentation, we can only conclude that it is extremely unlikely that we will receive an accurate status regarding the integrity of the current capping application. From this point forward, now that the gusher has been capped, it is likely that the true state of affairs will be concealed by BP and its agents spread across the media and Oil & Gas Industry. In an effort to spin it positive – at all costs – and perform the damage control necessary to return things back to where they were, this company and industry will proceed with a well organized and focused program of information control. It’s what the Oil & Gas Industry has done quite well for over a hundred years.

After all, BP’s very existence is at stake, and therefore it will assume the posture of a cornered raccoon! The flow of accurate information regarding the actual condition of the capping system, the changes in the seafloor, and the emergence of additional leaks will be determined by BP spinmeisters. Therefore our sleuthing becomes proportionately more penetrating and prosecutorial in both tack and tone. Simply put, we won’t believe a word they say, even with doctored video backing them up!

HOUSTON, WE HAVE A PROBLEM! A HUGE PROBLEM ! ! !

Houston is the current location of BP’s US National Headquarters. Per Wikipedia, “BP America’s headquarters is in the One Westlake Park in the Houston Energy Corridor, Texas.” Houston is also home to many other oil and gas companies, as well as their affiliates that operate throughout the 48 contiguous states. Perhaps we should begin to look there to find a deeper source of the problems that have ceaselessly appeared throughout this catastrophe. We speak of the standard operating procedures that have evolved throughout the entire industry, as well as a status quo which has produced the most conducive environment for this kind of disaster to take place around the world.

Without any doubt, these calamitous events will continue to take place in the future with even greater consequence. Due to the organic changes that the planet is experiencing, and especially the quite profound and fundamental nature of these geological, oceanic and atmospheric transformations, the most dangerous practices of our civilization will produce quicker and more dramatic feedback from Mother Earth. The Gulf Oil Spill is but a foretaste of things to come, if we do not change our ways both individually and collectively.

Step # 1 is to begin transitioning the world away from the hydrocarbon fuel paradigm. She – Mother Earth – can no longer maintain a clean enough environment for nearly 7 billion humans to live a quality life while utilizing oil and gas resources. It now represents an energy platform that is as obsolete, as it is destructive, to almost every living thing (There are certain types of bacteria and other microbes that just love the stuff!).

Dr. Tom Termotto

National Coordinator

Gulf Oil Spill Remediation Conference (International Citizens’ Initiative)

Tallahassee, FL

OilSpillSolution@comcast.net

http://oilspillsolutionsnow.org/

© 2010 Copyright Dr. Tom Termotto - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.