Stocks Tread Water as Non Farm Payrolls Beckon

Stock-Markets / Stock Markets 2010 Aug 05, 2010 - 07:12 AM GMTBy: PaddyPowerTrader

U.S. equities rallied and fixed income sold off upon hump day on the back of a surprisingly solid July non-manufacturing ISM release quelling some of the concerns that the economy is slowing and some good earnings from Time Warner and Polo , this all despite a Bloomberg News reported that China told lenders to conduct a new round of more stringent stress tests to gauge the effects of a deeper real-estate slump.

U.S. equities rallied and fixed income sold off upon hump day on the back of a surprisingly solid July non-manufacturing ISM release quelling some of the concerns that the economy is slowing and some good earnings from Time Warner and Polo , this all despite a Bloomberg News reported that China told lenders to conduct a new round of more stringent stress tests to gauge the effects of a deeper real-estate slump.

Earnings highlights were : Time Warner Inc 2Q EPS $0.50 vs $0.46 estimate; Polo Ralph Lauren Corp 2Q EPS $1.21 vs $0.90 estimate; El Paso Corp 2Q EPS $0.15 vs 0.21 estimate; AOL 2Q EPS -$1.36 vs $0.50 estimate. Elsewhere Priceline.com. jumped 22% after forecasting earnings that exceeded estimates. Barnes & Noble soared 19% as the biggest U.S. bookstore chain said it will consider selling the company

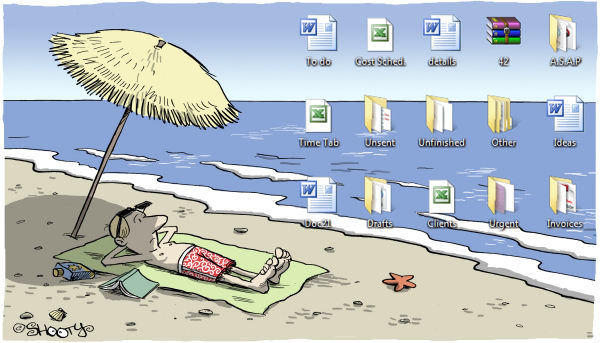

The ADP employment release surprised to the upside Weds with a 42k print (30k consensus), but given the ADP’s poor performance in predicting private payrolls, the July non-manufacturing ISM set the tone for the US session. JPY was the immediate casualty following the 54.3 (53 consensus) ISM print driven by encouraging new orders and employment components.

In the U.S., a weekly report today will show initial claims for unemployment insurance were little changed in the latest period at 455,000, a survey showed. The U.S. probably lost 65,000 jobs last month, according to the median forecast in a Bloomberg News survey of economists.

Today’s Market Moving Stories

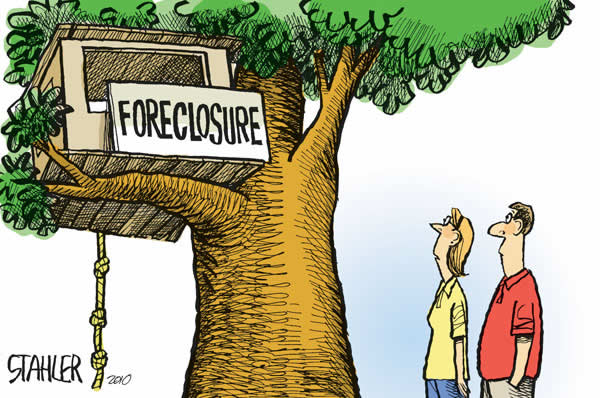

•China: According to sources, the China Banking Regulatory Commission has ordered lenders to test the impact of a fall in house prices of up to 50% in key cities where prices have risen sharply. The CBRC also instructed banks to stop extending mortgages to people buying their third homes in four of the cities – Beijing, Shanghai, Shenzhen and Hangzhou. PBOC advisor Xia Bin said China must contain bank lending, keep the CNY exchange rate flexible and provide “guidance” for the property market to help ensure “smoother functioning” of the economy.

A report in Der Spiegel states that China’s real estate bubble is at risk of bursting due to massive state stimulus programs, which it says has unpredictable risks for the global economy.

•UK: The Times reports that a number of business leaders are warning of a building inflation threat. The paper cites fashion China Next which has warned that prices would rise by up to 8% because of high cotton prices and rising manufacturing and shipping costs in the Far East, whilst Premier Foods has said that soaring wheat prices could add as much as 10p to a loaf of bread.

•The Royal Institution of Chartered Surveyors warns that more distressed property sales are expected in the next 12 months as changes to international regulations will likely raise the capital cost of holding commercial property on banks’ balance sheets. Central banks last week agreed on a raft of changes to the planned Basel III banking regulations that will make banks hold more capital and liquidity to withstand shocks without taxpayer aid.

•But today it is all about BoE and ECB. BoE is not as interesting as rates will be on hold with no news about QE2 – no press conf and no minutes – so we can’t see if more voters wants to do an Andrew Sentance and EXIT now. ECB a bit more interesting on this meeting at a time of the year where ECB normally is on vacation (Aug meetings have been cancelled before). This time ECB will say that rates are appropriate – that they are happy with the outcome of the EU bank stress test – comfortable with rise in short end rates (more on this later) and that ECB will sit back and hope that the German led EURO recovery will keep gaining momentum.

•German service PMI was a touch weaker but still strong – and Germany have done all the right things – low wage growth – high private saving – but still suffers from very weak domestic spending – it is all about exports mainly to Middle East – Russia – Asia and not least USA (did I forget the rest of Europe ?) The export growth in Germany might create further jobs in Germany and in neighbouring countries – but not enough to counter the austerity in all EU countries – and ECB knows that – that is why they are in no hurry to EXIT any time soon.

Company / Equity News

•Ladbrokes’ H1 results show group net revenues down 2.4% which compares to a 6% decline after the first four months of 2010. Group EBIT increased 5.1% to £103.6m, an improvement on the +3% for the January to April period. As previously flagged Ladbrokes has resumed dividend payments with a 3.85p interim distribution declared. In UK retail, OTC amounts staked declined 7.1% (-10% after 4 months) reflecting a challenging consumer environment despite the benefit of the World Cup. As with William Hill, the group has seen the positive impact from the World Cup being offset by poor horse racing results, including a loss making Royal Ascot. Retail in Ireland remains challenging with OTC amount staked down 7.8% in constant currency (-9% after 4 months). The decline in the Irish OTC gross win margin was limited to 20bps as a strong football margin largely offset weaker horse racing.

Online was the strongest performing division with net revenue increasing 1.2% and reversing the 2% decline seen after the first four months. Online EBIT increased 40% which is inline with the 41% advance earlier reported in the period up to the end of April. Online active customers increased 5.7%, while new sign-ups rose 6.8%. As before, sportsbook and bingo led the online performance. Sportsbook net revenue grew 9.8% (4% after 4 months) with the World Cup boosting player numbers and revenues. Active customers grew 13%. In an update on current trading, net revenue for July increased 8.0% which Ladbrokes states is broadly inline with its expectations. Excluding the World Cup effect net revenue for July would be down 2.2%. Ladbrokes H1 results are largely as expected following William Hill’s trading update (20 July) with the benefits of the World Cup being largely offset by a run of poor horse racing results.

•easyJet and Air Berlin July data show single digit volume growth in passenger volume. easyJet grew 7.7% to 5.02m pax while Air Berlin was up 6.4% to 3.7m. Slowing capacity expansion across the system is key to why yields are rising during 2010. Ryanair’s passenger volume rose 13% in July to 7.6m. Its 2010 profile has growth front loaded into H1 with capacity rising more modestly during the winter quarters.

•Barclays results headlines look ok but the results are a bit of a mixed bag as it benefits from a few one-off gains. H1 pretax profit was GBP3.9bn up 44% yoy. Underlying pretax which strips out an own debt gain of GBP851m and a few other acquisition gains and debt buybacks, was GBP3bn which is up 22% yoy. Revenues for the half yr are GBP7.9bn, excluding the gain on own debt was GBP7.1bn. Q1 propped up the half yr numbers as Q2 is notably down. Adjusted profit before tax for Q2 is 37% lower than Q1. Barcap continues to be the key profit generator although its quarter very much relied on the own debt gain. Pre-tax profit excluding own debt gain was GBP978m which is 38% down on Q1. Top line revenues (excl own debt gain) for Q2 was GBP3.3bn, down 15% on Q1. Falls in FICC business of 16% and Investment Banking businesses of 17%, more than offset a 14% increase in the contribution from Equities and Prime Services. Other businesses did not do so well. Retail was ok as was ABSA, but the Corporate and Europe business posted losses. Europe was hit by a weak Spain result due to impairments from property and construction exposure. Capital is fine, stable Tier 1 of 10.0%, adjusted gross leverage unchanged at 20x. Liquidity profile looks good, up by GBP33bn during the half to GBP160bn. These are not overly impressive to say the least and the outlook from management is quite reserved. The outlook states that business has picked up in the second half of July such that the bank is running at Q2 run rate- hardly bullish.

•Mining giant Rio Tinto has reported an 85% increase in H1 EBITDA to USD11.3bn, ahead of the USD10.9bn consensus, essentially reflecting higher commodity prices during the period (copper up 78%, aluminium up 50%, gold up 26%). Net debt fell by USD6.9bn to USD12bn at the end of June due to lower H1 capex of USD1.8bn, and USD3.6bn of disposals, although FY capex will increase to USD6bn, with USD9bn targeted for 2011. Much like it peers, Rio is expecting “volatile” economic conditions in the short term, although it still sees long term commodity demand growth coming from the urbanisation of India and China. These are good results, although the comparatives will get more challenging as we move into H2.

•BP has been given approval by the National Incident Commander to start pumping cement in to the Macondo well from today, which if successful will finish off the “static kill” process. The tone from the US Government is also finally turning more positive, as the National Oceanic and Atmospheric Administration revealed yesterday that they think 74% of the 4.9m barrels of spilt oil has gone from the Gulf; with 33% captured or eradicated, 25% evaporated or dissolved, and 16% naturally dispersed. This could potentially reduce BP’s clean up and other costs, and with the operational issues now seemingly under control, the attention will now move to the courts as BP attempts to get Anadarko and Mitsui to pay for their share of the costs

Unilever Q2 results came in broadly in line with expectations with underlying operating profit rising 5% to EUR1,724m on revenue up 3.4%. Underlying sales growth was 3.6%, driven by stronger than expected volume growth of 5.7%, offset by 2% price attrition, as Unilever made more price/promotional investment. Western Europe, unsurprisingly, was the laggard in regional terms (down 2.2%), with Asia, Africa and Central & Eastern Europe reporting a typically strong 8.2% advance. In product terms, Personal Care (up 7.9%) and Ice Cream & Beverages (up 5.1%) were the outperformers in underlying sales terms. Operating margin was only up 0.1% in Q2, reflecting a 140bp increase in advertising and promotional spend, which no doubt reflects an increase in rates as well as volume. The Company indicated that spending in this area would be flat. Little else notable.

•This morning Germany’s Commerzbank shares are ahead after it posted its second quarterly profit since mid-2008 and has indicated it will have a FY profit for 2010. The net income of €352m for 2Q10 largely beat expectations and was mainly due to a sharp fall in loan loss provisions. We find it interesting that Commerzbank has stated that the increase in net interest revenue in the first half of the year (+6.1% v. 1H09), has been helped by the non-servicing of coupons on hybrid bonds and profit participation certificates.

•And Belguim’s largest banking group KBC reported net income for the second quarter of €149m, in line with expectations, but representing a 66% decrease versus the prior quarter, mainly due to lower FV gains on financial instruments (€147m versus €320m). Loan loss provisions decreased by 22% compared to the previous quarter and net interest margins held up very well (1.87% versus 1.82% in 1Q10). The Tier 1 ratio was strong at 11.4%. Despite the fact that KBC is allowed to pay coupons on its Tier 1 securities, after the EC did seek to block them, we prefer to stay clear of hybrid structures when it comes to KBC. We do see value in the senior market e.g. KBC4.5 2014 at a Z spread of 163bp or KBC3.875 2015 at Z spread of 176bp.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.