Stock Market Technically Troubling Tuesday

Stock-Markets / Stock Markets 2010 Aug 24, 2010 - 11:56 AM GMTBy: PhilStockWorld

We finally blew our levels!

We finally blew our levels!

Sadly, it’s time to flip bearish until we can retake our watch levels at Dow 10,200, S&P 1,070, Nas 2,200, NYSE 6,800, and Russell 635. If we can’t retake at least 2 of them today, we may be seeing 2.5% drops back to Dow 9,945, S&P 1,043, Nas 2,145, NYSE 6,630 and Russell 619. Since the Russell already blew 619 we have to consider the possibility of even a test of our 5% lines at Dow 9,690, S&P 1,016, Nas 2,090, NYSE 6,460, and Russell 603.

Fundamentals are great but once panic sets in the market is all about technicals and we just need to strap in and go along for the ride. We have been playing for a bounce off our 10,200, 1,070 lines but, now that we lost it – it’s time to flip bearish – I was wrong and that’s that, time to move on and make some downside money. Of course it will take more than a single day to give us a trend but the same way we don’t get very bearish until we loser 3 of 5 of our center levels, we don’t get bullish again until we break back over. Yesterday I sent out an Alert to Members as we broke down, saying: “We could very easily drop 250 from here on the Dow (2.5%).“

Fundamentals are great but once panic sets in the market is all about technicals and we just need to strap in and go along for the ride. We have been playing for a bounce off our 10,200, 1,070 lines but, now that we lost it – it’s time to flip bearish – I was wrong and that’s that, time to move on and make some downside money. Of course it will take more than a single day to give us a trend but the same way we don’t get very bearish until we loser 3 of 5 of our center levels, we don’t get bullish again until we break back over. Yesterday I sent out an Alert to Members as we broke down, saying: “We could very easily drop 250 from here on the Dow (2.5%).“We added a fresh DXD hedge but we already had a proper hedge from Friday when the morning trade idea was:

A better way to hedge at the moment is the DXD Sept $27s for $1.70. They have a delta of .62 but can be transferred into a vertical if the Dow goes up by selling the $25 puts (now .20) for .50 and covering with the $29s (now $1) for at least .70, leaving you in a $2 spread for .50. That would be the ESCAPE, at the moment I like the plain DXD $27s at $1.70 until we get a real move back up.

That was an addition to the Morning Alert Trade, which was the DIA Sept $99 puts at $1.50. Neither the DXD or the DIA plays have been paying off so far but they did provide cover for our speculative bullish plays as we tried to play the line. Of course we take our major disaster hedges when the market is high (it’s cheaper then), like on August 9th, when I wrote “Monday Market Momentum (or Lack Thereof)” and our longer-term protection was:

That was an addition to the Morning Alert Trade, which was the DIA Sept $99 puts at $1.50. Neither the DXD or the DIA plays have been paying off so far but they did provide cover for our speculative bullish plays as we tried to play the line. Of course we take our major disaster hedges when the market is high (it’s cheaper then), like on August 9th, when I wrote “Monday Market Momentum (or Lack Thereof)” and our longer-term protection was:

SDS – Sure, now you can do the Jan $31/35 bull call spread for $1.50 and sell 1/2 March $27 puts for $2.60 which is net .20 on the $5 spreads that are .20 in the money to start. You can sell 5 of the March $27 puts for $1,300 and about $5.5K in margin and buy 10 of the spreads that pay $5,000 if the S&P drops about 5% (to below 1,070). The $27 puts are almost 15% below so about a 7.5% gain in the S&P to over 1,200 by March for this to be put to you. Anything less than that is VERY cheap insurance.

We’ll see how that logic pans out but that’s what we call a “disaster hedge” and this market drop is exactly the kind of disaster we are guarding against. That same day we had a shorter-term hedge on QID (which I even posted for free readers on that Tuesday) which was:

QID Aug $16/17 bull call spread is .42 and is .42 in the money and you can sell $16 puts for .29 to drop the net to .13, which is a nice way to play the Nas down and we can kill the trade if we get green on the Russell (666) and the Dow (10,700) for a small loss vs. a potential .87 gain (669% upside).

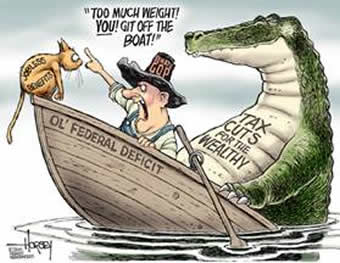

QID expired on Friday at $18.15 so a full 669% payoff on that one too! So forgive us if we are simply amused by this drop but it’s all part of the trading range we’ve been tracking all year. I had been hoping we would turn the middle of our range into a new floor after earnings but we didn’t get the stimulus we need and it looks like we aren’t going to get any help at all from our grid-locked government. In fact, this morning, House Minority leader, John Boehner demands that Obama “fire Timothy Geithner and Larry Summers” (and, of course, extend the Bush tax cuts for the wealthy), so I’m not really expecting the boys in DC to be sitting at a table and fixing anything any time soon!

QID expired on Friday at $18.15 so a full 669% payoff on that one too! So forgive us if we are simply amused by this drop but it’s all part of the trading range we’ve been tracking all year. I had been hoping we would turn the middle of our range into a new floor after earnings but we didn’t get the stimulus we need and it looks like we aren’t going to get any help at all from our grid-locked government. In fact, this morning, House Minority leader, John Boehner demands that Obama “fire Timothy Geithner and Larry Summers” (and, of course, extend the Bush tax cuts for the wealthy), so I’m not really expecting the boys in DC to be sitting at a table and fixing anything any time soon!

The 8 a.m. speech is being billed by some as the beginning of a major rollout of the Republican party’s economic agenda — and also a preview of how Boehner would run the House if he becomes Speaker. Although the speech contains some fresh ideas — Boehner calls for a 20 percent tax cut for small businesses — he also uses some familiar rhetoric, using the phrase “job killing” 13 times to describe Obama economic policies, according to the prepared text of his speech.

Money is flying out of Europe as Joe Stigliz warned that the EU is “stupidly creating a double-dip recession” by doing what John Boehner wants to do to America:

Stiglitz said the European economy is at risk of sliding back into a recession as governments cut spending to reduce their budget deficits. “Cutting back willy-nilly on high-return investments just to make the picture of the deficit look better is really foolish,” Stiglitz told Dublin-based RTE Radio in an interview broadcast today. Euro-area governments stepped up efforts to cut their deficits to below the European Union limit of 3 percent of gross domestic product after the Greek crisis earlier this year eroded investor confidence in the 16-member currency union. He went on to point out the absurdity and arbitrariness of the 3% number, and the obsession with the debt side of the balance sheet only.

Our own Fed turns out to have been much more divided than originally reported on their decision to provide more quantitative easing and THAT, more than anything else, is spooking the markets as a possible end to EZ Money from the Fed is not what the Banksters want to hear. According to the WSJ, at least 7 of the 17 Fed officials at the Aug 10th meeting were against the decision to keep the Fed’s $2.05 trillion stock of mortgage debt and U.S. Treasury holdings from shrinking – apparently so much so that they went to the press with their objections.

Our own Fed turns out to have been much more divided than originally reported on their decision to provide more quantitative easing and THAT, more than anything else, is spooking the markets as a possible end to EZ Money from the Fed is not what the Banksters want to hear. According to the WSJ, at least 7 of the 17 Fed officials at the Aug 10th meeting were against the decision to keep the Fed’s $2.05 trillion stock of mortgage debt and U.S. Treasury holdings from shrinking – apparently so much so that they went to the press with their objections.

I urge you to read the whole article as it’s a complex issue and, on the whole, the headlines are blowing it out of proportion as really the main objection of the seven dissenters is that the economy is strong enough to stand on it’s own and the Fed is sending the wrong signal by buying back Treasuries but, as I mentioned regarding last week’s visit to Treasury, it seems that our government couldn’t be more pleased to see rates kept artificially low for as long as possible, despite the malinvestment it’s causing.

I also urge you to spend 10 minutes watching this Daily Show video, which does a very nice job of pointing out that it’s Rupert Murdoch’s business partner at Fox News, Alwaleed bin Talal, who is the “money man” funding the installation of the mosque at ground zero – the same one that Fox News has been using as the focal point for their attacks on, well everything, for the past month (actually a pretty cheap price to pay for all those hours of programming).

Video here – Jon Stewart’s The Parent Company’s Trap.

So is Fox News evil or are they just ”staggeringly, achingly, almost inspiringly stupid“? We report, you decide…

This is the kind of nonsense that is driving US sentiment as Murdoch & bin Talal’s Journal and Murdoch & bin Talal’s News Network donate $1M (see yesterday’s post) to Boehner’s Republican party in exchange for sound bytes and chaos and, of course, huge tax breaks – what a country!

I am still not fundamentally bearish. Things just don’t seem that bad but we will continue to hold a more bearish stance until we take back our levels. If we have a low-volume sell-off, we may even get a bounce back today, in which case, it’s a lot of worry over nothing but it’s nice to be hedged – just in case…

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.