Aussie Dollar and Euro Under Pressure

ConsumerWatch / Forex Trading Jan 11, 2011 - 01:43 AM GMTBy: Bari_Baig

Rains might have only fallen in Australia but Aussie Dollar and Euro both are feeling the pressure: rains might have stopped but to put a finger on to the extent of damage these rains have done is far from within sight. Brisbane got few inches of rain even now and few areas were given evacuation warnings nevertheless, as a whole the worst seems to have past now. The Aussie Dollar which only on the last day of 2010 posted the highest high ever recorded has been hit as badly as the floods have hit Queensland. We wrote in our Jan 4th newsletter that

“We have backed the Aussie Dollar against Green back against Euro and the only time we weren’t sure of Aussie Dollar was last year when last Prime Minister Mr. Rudd introduced the mining tax however, this time it is different. The flooding which took place in Queensland and most of New South Wales Australia which is being referred to as biblical flooding is going to put a serious dent in the Australian economy” and we further went on to say “If the par is given away against US Dollar we’d be liquidating our long held position”.

Well, there are no surprises the pair broke below par and now the “bottom feeders” that earlier couldn’t see Aussie Dollar break parity and trade higher are convinced that this is perhaps the best time to get into the trade as [they] missed the last rally however, we do not share the same enthusiasm which is why we are out of Aussie Dollar. Until the extent of damage is not clear, until no one can determine how much of the wheat crop has been damaged, until no one can tell how much would the mining targets be affected we’d remain bearish of Aussie Dollar.

The big question to us is whether Aussie Dollar would once again break parity and the answer is most probably not. At best we see the pair trading as high as 0.997s after which it may not have a free fall as some of the “bears” amongst are of the view but perhaps a more pattern like fall with inclination towards a plausible Head and Shoulder after which the price may travel down to 0.960s territory but this is where it gets even more interesting. Looking at the daily chart with Aussie Dollar trading 0.96s relative to Green back it could potentially be on the verge of making a double top and next good supportive region on the daily chart would then be around 0.90-92s.

Keeping the floods in view and the serious effects they could have on the economy therefore it is not “that” difficult to imagine that RBA would now be more reluctant than ever to tighten the monetary policy which too was one of the reasons why we had anticipated Aussie Dollar to push past the parity. With no aid to Aussie dollar in a form of tighter policy that makes things that much more difficult for AUD to stand firmly or push back over thus we maintain our bearish view on Aussie Dollar as was stated on Jan 4th.

Euro knows too well how to play the bullish strings of the Euro Bulls: The week that just past has deeply wounded the biggest of the biggest Euro bulls as the price movement was such that even Euro bears lost track and many sided the bulls and eventually when the high majority seemed to be siding the upside, Euro turned over the proverbial coin and took to a hard, very hard downtrend losing as much as nearly 4 big figures and closed hard upon its lows. That to us is a typical sign when something is seriously wrong. Would it be wrong to state that whatever happened in the last week of December could very well be a potential “Bull trap”, we’d not disagree with that and speaking of bull trap we believe a very similar bull trap is now forming in Euro yet again as Euro bulls are once again busy finding a bottom below the Nov 29th lows. Seriously, who does that? What is the most one could make probably 100 pips to the top side? Nothing material we’d say.

This to us seems sad and had it not involved real money and people losing their hard earned money it would have been comical. Since start of Asian trading, Euro stayed in a very tight range and as the day progressed the swings became larger, the kind which give a breakout but the breakout didn’t take place even for most of European trading session and if we were asked for our opinion we’d say regardless of Euro making three highs it still has not given a “breakout” yet or not something which majority had hoped Euro would do.

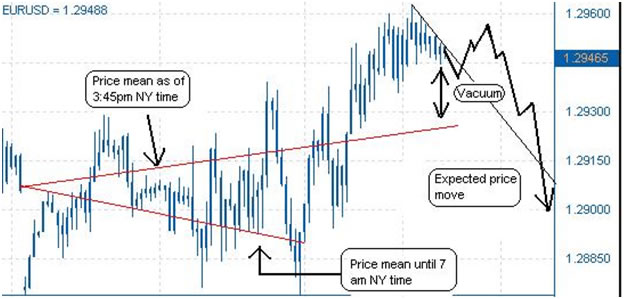

We held our view firmly in place since morning when we projected on www.marketprojection.net where we make real time projections that “to us price action has a downward slope and until this downward slope doesn’t become absolutely horizontal [Or comes at 0 degrees] or more likely have an upward inclination, we do not see the next leg downward taking place and the best strategy would be to trade the range”. It was a day for the scalpers than and we advised ones whom have not short sold yet should sell short as the price goes up or do incremental shorts with 29440s region being a prime short selling region. Euro/USD since breaking 2924s has held nicely over 2940s and the gradient of the slope after Friday has finally shifted sides from being negative to now being positive which we take as a clear sign that the shift in sentiment has taken place and the overly bearish have gone quiet and are now erring to the sides of a possible upward move!

The 15 minute chart above shows the average of price at different intervals and also more importantly we can see the gradient of the average price has slowly changed sides [But] the word of focus here being [but] the congestion at near highs is also very clearly visible which is why we stated above that breakout has not taken place just as yet or should we say a reversal.

We maintain our bearish stance of the single European currency and we feel it is best to sell it at strength. No change in our near term price target of just below 1.25 and medium term at 1.18s. Trade accordingly and more so trade patiently, it is times like these where the speculators get caught in the bulls and bears wars.

By Bari Baig

http://www.marketprojection.net

© 2011 Copyright Bari Baig - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.