UK Firms Resiliant To Credit Crunch Market Turmoil

Companies / Credit Crunch Oct 24, 2007 - 02:02 AM GMTBy: Lloyds_TSB

Business Barometer for September shows:

Business Barometer for September shows:

• Majority of firms expect activity to increase over the next year

• Industrial sector drives confidence

• Confidence in wider economy drops sharply

Despite worries that the US sub-prime credit crisis will lead to weaker economic growth on this side of the Atlantic, UK firm’s confidence in their own business activity is increasingly robust, according to September’s Lloyds TSB Corporate Markets Business Barometer.

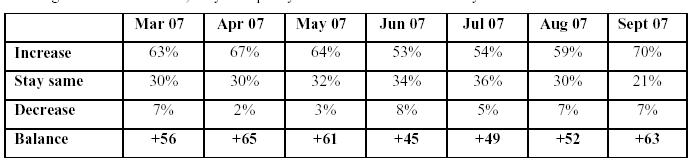

Confidence amongst UK firms rocketed in September, with 70 per cent expecting their business activity to increase over the next 12 months. This is an increase of 11 per cent from August’s survey. Just 7 per cent of UK firms predicted that their activity will decrease over the same period.

Confidence was driven by the industrial sector, with the balance of firms expecting higher rather than lower business activity rising sharply to 83 per cent, compared with just 38 per cent in August. Encouragingly, service sector confidence was also high, with the balance standing at 81 per cent, up from August’s balance of 68 per cent. Such strong survey results suggest that profits will continue to grow this year for the majority of UK companies, a view underpinned by official data showing that companies’ profitability reached record levels in the second quarter of this year.

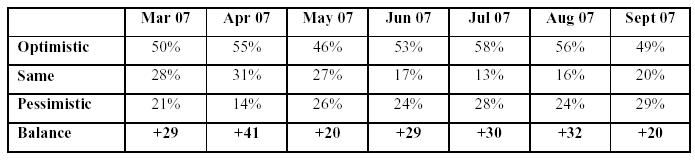

However, the credit crisis has hit firms’ confidence in the wider economy. This was demonstrated by the balance of firms feeling more, rather than less, optimistic about the economy dropping 12 per cent, to 20 per cent in September.

Trevor Williams, chief economist at Lloyds TSB Corporate Markets, said: “While UK firms are clearly concerned about the possible wider implications of the credit market

turmoil, such bullish results suggest there is no evidence of any impact on their day to

day business activities. In fact, business confidence has increased in each of the last

three months, at a time when the inter-bank liquidity squeeze and fears over the US

sub-prime crisis spreading to the global economy have been most intense.

“Since the US Fed cut interest rates, investor confidence in the prospects for the corporate sector has soared, as reflected in stock market rallies. In the UK, official data suggest that the majority of the corporate sector will perform strongly this year in terms of output growth and profit.”

Barometer Questions

Are you presently more optimistic about the economy than you were three months ago?

During the next 12 months, do you expect your level of business activity to increase?

Notes t:

• The survey started in January 2002.

• Research carried out monthly on behalf of Lloyds TSB Corporate Markets by Continental

Research. Data represents over 200 companies with turnover above £1million. This month the

research was conducted between 10-14 September.

• The Business Barometer complements the Consumer Barometer which is also released

monthly by Lloyds TSB Corporate Markets.

• http://www.lloydstsbcorporatemarkets.com/economicresearch.asp

For more information:

| Kirsty Clay Lloyds TSB Press Office Tel 020 7356 1714 |

Trevor Williams Chief Economist Tel: 020 7696 4597 |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.