Stock Market Possibilities for 2011

Stock-Markets / Stock Markets 2011 Jan 13, 2011 - 02:08 PM GMTBy: Clif_Droke

Wall Street seems particularly giddy entering the New Year, and for good reason: the stock market has had its best two-year performance since 1932. Retail investors are also beginning to shed their bear suits and slowly embrace a bullish posture. For the month of December 2010, a total of $14.9 billion moved out of bond funds while stock funds saw a $5.5 billion net inflow.

Wall Street seems particularly giddy entering the New Year, and for good reason: the stock market has had its best two-year performance since 1932. Retail investors are also beginning to shed their bear suits and slowly embrace a bullish posture. For the month of December 2010, a total of $14.9 billion moved out of bond funds while stock funds saw a $5.5 billion net inflow.

Bullish predictions galore have been made from all corners of Wall Street, with many analysts predicting anywhere from a 9% to a 17% gain for stocks in 2011. That’s quite the about face from the previous two years when analysts and investors alike were gun shy from the credit crisis with many of them preferring bond funds over stocks.

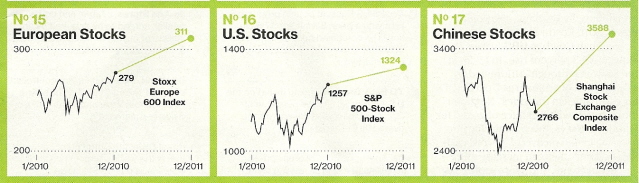

A Bloomberg survey of economists and investors found that expectations of an increase in prices for European, U.S. and Chinese shares abounded, as the following graph from the Jan. 3 issue of Businessweek shows.

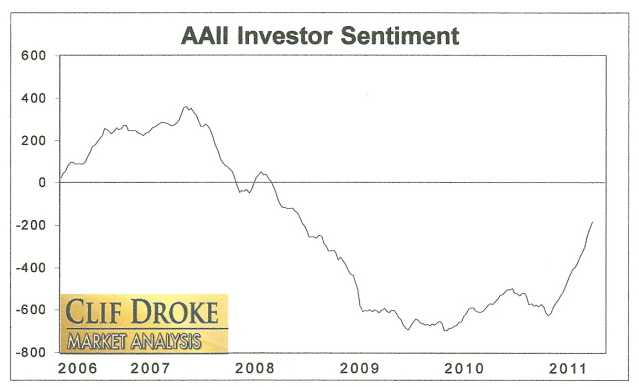

It’s debatable just how much the recent increase in bullish sentiment might be used to fuel a continuation of the recovery rally. It’s indisputable, however, that there has been a sizable increase in the percentage of bullish investors in just the last few weeks. Following is a chart showing the change in cumulative investor sentiment according to the poll conducted each week by the American Association of Individual Investors (AAII). As you can see, the AAII investor poll has shown a rather dramatic increase in bullish expectations since the latter part of 2010 after reflecting a net bearish outlook for much of the last three years.

A market contrarian might be tempted to conclude that this extended run in bullish sentiment bodes ill for the stock market outlook in the months immediately ahead. It would do well to remember, though, that a similar increase in bullish sentiment was seen during the extended run-ups of the late 1990s and in the year or so preceding the 2007 stock market top. When the stock market gathers a head of steam as it has since bottoming in early 2009, a steady increase in buying from the retail sector can actually help sustain the market’s uptrend, at least so long as inflows remain strong and the key cycles are still up.

It’s only after everyone has become convinced that the bull market is here to stay and the early birds into the market – namely hedge funds and institutional buyers – have decided to cash out that you have to worry about a major reversal of the uptrend. We haven’t yet arrived at that point and investors are advised to avoid the urge to short this market just yet.

There are other considerations for the year ahead that deserve our attention beyond the equity market outlook. On the economic front, as David Knox Barker writes in the January 2011 Long Wave Dynamics Letter, the inflation versus deflation debate should be resolved in 2011. As Barker put it, “The economy needs deflation in order to get inflation.” He points out that the Fed’s loose money policy and low interest rates for marginal buyers is keeping inefficient producers in business. The Fed is doing its utmost to stave off the effects of long wave deflation but in doing so it’s only guaranteeing that liquidation will be prolonged.

Heading into 2011 the emerging markets are battling inflationary pressures while the developed economies aren’t seeing inflation, except for fuel prices and a few other consumer goods. Capacity utilization for U.S. manufacturers has just barely poked above 75% for the first time since before the credit crisis began. Only when capacity utilization is well above 75% does it reflect inflationary pressures. For the last two years capacity utilization has reflected a deflationary undertow.

By contrast, the inflation rate in many of the Asian economies is on the rise. India’s inflation rate for agricultural products is up 14%. China’s economy is battling inflation pressures and China’s central bank has raised interest rates in an effort to contain inflation and cool off the overheated real estate market. The danger inherent in such a move is that in trying to contain inflation, China’s interest rate hikes could end up backfiring and do harm to its real estate market and create an economic recession. Needless to say this would have negative repercussions for the global economy. It would be no small miracle if China’s government succeeded in containing inflation while simultaneously avoiding doing harm to the Chinese economy through its rate hikes. Such a feat has never been managed by the U.S. central bank and the norm is for banks to go too far in tightening money and credit, thereby creating recession.

China’s stock market has been conspicuously lagging the developed markets including the U.S. The stock market is a barometer of business conditions and the relative weakness displayed by China stocks suggests China’s economy could be in for a negative surprise at some point in 2011. It would not be at all surprising if China led the global markets lower after the 6-year cycle peaks later this year.

Returning to the stock market outlook, another possibility for 2011 is that instead of another double-digit gain for stocks, which many analysts are predicting, the equities market could ultimate disappoint expectations and post either a low single-digit gain or possibly a mild loss at year end. After September the important 6-year cycle will no longer be supportive of stock prices and the Kress 120-year cycle series (which includes the 30-year, 40-year and 60-year cycles) will be in its final “hard down” phase. In other words, these bigger cycles will be leaning heavily against the stock market as we head closer to the fateful year 2014 when the 120-year cycle is due to bottom.

This is where the notable increase in bullish sentiment may actually begin to work against the stock market later in the year. As more of the public become convinced that stocks are headed higher in the foreseeable future, there will likely be an even bigger move out of cash and into stocks. “Smart money” investors meanwhile will sense the danger approaching as we head closer to 2012 and will likely begin withdrawing from the stock market, which will set up the next major top.

Meanwhile the gold price continues to struggle with its intermediate-term 60-day moving average (blue line in the daily chart). In order to get a renewed short-term buy signal the gold price should establish support above the 60-day MA and close at least two days above the 30-day moving average. Gold remains under selling pressure while an important short-term cycle bottoms this week.

Gold & Gold Stock Trading Simplified

With the long-term bull market in gold and mining stocks in full swing, there exist several fantastic opportunities for capturing profits and maximizing gains in the precious metals arena. Yet a common complaint is that small-to-medium sized traders have a hard time knowing when to buy and when to take profits. It doesn’t matter when so many pundits dispense conflicting advice in the financial media. This amounts to “analysis into paralysis” and results in the typical investor being unable to “pull the trigger” on a trade when the right time comes to buy.

Not surprisingly, many traders and investors are looking for a reliable and easy-to-follow system for participating in the precious metals bull market. They want a system that allows them to enter without guesswork and one that gets them out at the appropriate time and without any undue risks. They also want a system that automatically takes profits at precise points along the way while adjusting the stop loss continuously so as to lock in gains and minimize potential losses from whipsaws.

In my latest book, “Gold & Gold Stock Trading Simplified,” I remove the mystique behind gold and gold stock trading and reveal a completely simple and reliable system that allows the small-to-mid-size trader to profit from both up and down moves in the mining stock market. It’s the same system that I use each day in the Gold & Silver Stock Report – the same system which has consistently generated profits for my subscribers and has kept them on the correct side of the gold and mining stock market for years. You won’t find a more straight forward and easy-to-follow system that actually works than the one explained in “Gold & Gold Stock Trading Simplified.”

The technical trading system revealed in “Gold & Gold Stock Trading Simplified” by itself is worth its weight in gold. Additionally, the book reveals several useful indicators that will increase your chances of scoring big profits in the mining stock sector. You’ll learn when to use reliable leading indicators for predicting when the mining stocks are about o break out. After all, nothing beats being on the right side of a market move before the move gets underway.

The methods revealed in “Gold & Gold Stock Trading Simplified” are the product of several year’s worth of writing, research and real time market trading/testing. It also contains the benefit of my 14 years worth of experience as a professional in the precious metals and PM mining share sector. The trading techniques discussed in the book have been carefully calibrated to match today’s fast moving and volatile market environment. You won’t find a more timely and useful book than this for capturing profits in today’s gold and gold stock market.

The book is now available for sale at: http://www.clifdroke.com/books/trading_simplified.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold Strategies Review newsletter. Published each week, the newsletter uses the method described in this book for making profitable trades among the actively traded gold mining shares.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.