Explaining the Heisenberg Omen(s) of Human Action in Market

Stock-Markets / Stock Markets 2011 Jan 16, 2011 - 12:08 AM GMT In a recent article, I introduced the possibility that the Heisenberg uncertainty principle provides far more insight for stock market cycle analysis than the infamous Hindenburg Omen. Feedback from readers suggests many appreciated this new line of thinking, while others challenged the proposed application of hard science principles to the softer social science of the study of economic and stock market cycles. In this article, I will further explain precisely what I am proposing about human action, including yours.

In a recent article, I introduced the possibility that the Heisenberg uncertainty principle provides far more insight for stock market cycle analysis than the infamous Hindenburg Omen. Feedback from readers suggests many appreciated this new line of thinking, while others challenged the proposed application of hard science principles to the softer social science of the study of economic and stock market cycles. In this article, I will further explain precisely what I am proposing about human action, including yours.

Granted, quantum field theory applied to social cycles is a rather radical notion and big challenge. The Austrian school believes business cycles are the product of monetary policy. Keynesians think they can control business cycles with monetary and fiscal policy, in spite of the mounting evidence, including piles of festering debt, to the contrary. The carnage in the wake of bad monetary policy throughout history suggests the Austrian’s are far closer to the truth, but quantum field theory provides an explanation of why business cycles are there in the first place. It explains why bad monetary and fiscal policy promotes extreme cycles. Instead of being the background noise of human achievement and progress, they become full-blown, edge of the abyss, global crises.

Field theory offers a truly new horizon in global stock market and technical analysis. If the basic approach is correct, and the evidence is mounting every day with the evidence for fields of human action in global markets, the implications are rather far reaching for the future of your nest egg, or that multi-billion dollar hedge fund you are managing, and that heretofore-unpredictable black swan event.

First things first, the implications of the work of James Clerk Maxwell (1831-1879) require a brief introduction. Maxwell was a Scottish theoretical physicist and mathematician that discovered the electromagnetic field. His contributions to science are considered to be on par with Albert Einstein and Isaac Newton. Maxwell’s work in field theory is the basis of much of the work of Einstein, and helped inspire Einstein to formulate the theory of special relativity. The following are quotes regarding Maxwell’s work in theoretical physics:

" ... he conceived and developed the nature of the field and established the reality of the field as the underlying reality of all spatio-temporal (space-time) phenomena." T.F. Torrance

"Maxwell's equations are laws representing the structure of the field .... All space is the scene of these laws and not, as for mechanical laws, only points in which matter or charges are present." Albert Einstein

If you take these quotes at face value, you have to accept that there is the distinct possibility that anything occurring in space-time, including you reading this article, is occurring in some sort of field. Whether we can track social fields is the real question. Anyone that has ever studied a stock, bond, gold or commodity chart cannot help but recognize that they manifest field like characteristics. From fear induced pessimistic troughs they rise to delusional heights of unfounded hope for future returns, driven by unreasonable bouts of optimism, or call it the madness of crowds. Then the recognition of reality and gravity kicks in and the cycle tops and tumbles to a low, starting this human action driven market cycle process all over again. This occurs on large scales and small scales, sometimes during intraday trading. Undoubtedly, all these different scale market cycles of boom and bust exhibit field like characteristics.

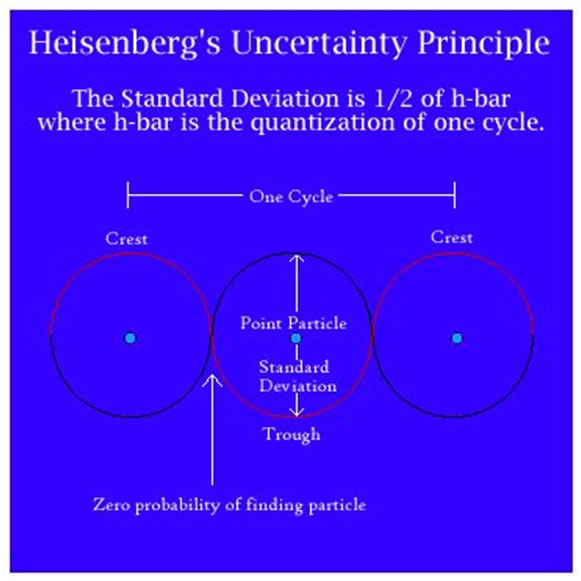

Here is where Heisenberg comes in. The Heisenberg uncertainty principle states that certain pairs of physical properties, position and momentum being some of the favorites of physicists, cannot be simultaneously known to a high degree of precision. The more accurately you measure one property, the less accurately you can measure the other. Heisenberg’s microscope thought experiment is used to explain the uncertainty principle and illustrates that the instrument that measures the properties of a field interferes with and affects the measurement. The instrument affects the field and can change it.

Now we all know that investors and traders are keenly interested in the two properties of price and time. These two properties determine your entry and exit from investment or trading positions. Fortunately, both of these properties can be measured simultaneously with an acceptable degree of precision for a specific asset, otherwise trading and investing would be a rather confusing proposition. However, if you add millions of such transactions together in a market index, they reflect a sum of human action that reflects field like characteristics.

When you make a decision to buy a house, sell a car, buy a stock, or short the municipal bond market, brown bag it, go out to lunch, or go to the gym, a special scientific instrument is at work. The instrument at work is your God given mind and your reason, your human will. Your decisions are based on objective as well as subjective inputs from an untold number of sources at work in the field of human action. Your individual decisions are a part of the economic field in space-time generated by human action. You are affecting the field of the business cycle and related market cycles, directly or indirectly. Your human action produces real results and affects the field.

When millions buy houses with excessive amounts of debt at historically high prices, it sends ripples through the field of global economic and financial activity. When Chairman Bernanke of the Federal Reserve embarks on a $600 plus billion dollar QE policy, or lower interest rates, it has an impact on the economic field and stock market cycles. In fact, that is specifically why he is taking action, in an attempt to alter the field and its outcome.

Granted, the proposed cross-discipline application of fields has more than a few hurtles. The field theory approach to economics and market cycles suggests that all financial and economic activity is occurring in fields of human action. When Chairman Bernanke, and his staff, measure prices and pursue policies to insure “maximum” employment, the human mind is the instrument that is doing the measuring and then taking policy action, and affecting the reaction of millions in various fields of human action affecting markets. Are these measurements or the policy action accurate? Whether they are or not, they are being absorbed into the field of human action that you can observe unfolding on a stock chart.

Pursing answers to the questions generated by the application of fields to human action to the economy and market cycles, I read Aharonov and Petersen’s Quantum Theory and Beyond, who suggested:

"…to measure the momentum of a field according to the canonical method one would need an interaction proportional to the momentum and to some external degree of freedom belonging to the apparatus."

For students of stock market cycles this notion an external degree of freedom immediately brings to mind Fibonacci ratios, which appear to represent degrees of freedom at work in all manner of markets and nature. There is a long history of application of Fibonacci to financial markets and stock market cycles in price and time.

This idea of degrees of freedom began many years of testing new approaches of Fibonacci in price and time against the long wave family of stock market cycles. It has created an entirely new approach to stock market cycles, as well as cycles in bonds, gold and any assets that print a record of price and time on a chart. Cycles have ideal lengths, but they fluctuate in Fibonacci degrees of freedom.

The Fibonacci drill-down grid method in price has discovered what appear to be the degrees of freedom in fields of human action from the big cycles down to intraday cycles, all connected. Fibonacci applied to the notion of degrees of freedom in ideal cycles in time has created an entirely new approach to tracking cycles in time, from the long wave to the 20-Week cycle and the smaller cycles.

Fibonacci in price and time appears to be produced by the instrument of the human action in global markets, from stocks to bonds to gold. When you see a market turn intraday on a Fibonacci Dynamic Web target in a Level 4 grid right down to one-one hundredth of a point, you have to wonder at the nature of these degrees of freedom that are produced by humans taking action in global markets. Fibonacci ratios represent degrees of freedom in stock market cycles. The are regular Heisenberg omens, reflecting the instrument of the human mind and human action at work in the global marketplace.

It was the late great PQ Wall who first suggested, to my knowledge, that there is a real and tangible corollary between quantum field theory and the fields of human action in global stock markets. The global long wave cycle of boom and bust, discovered by Kondratieff, is just such a field of human action. However, it was also the brilliant mind of PQ Wall that proposed that a long wave divided by 144 is the 20-Week trader’s cycle, and a miniature long wave, what I rechristened as the Wall cycle in my book The K Wave (1995) McGraw-Hill. Every business cycle has nine Wall cycles.

Global markets are currently at an important inflection point in the fields of human action in the Wall cycle. The human action of Chairman Bernanke is attempting to override the human action of most of the developed world, which is in the process of going into hibernation during the great deleveraging. It is his job.

The current Wall cycle appears to have bottomed in many emerging markets in November/December, ahead of the developed economies of the world. This is what occurred with the last Wall cycle last summer. However, in developed markets, the Wall cycle appears to have expanded close to the maximum that its Fibonacci degrees of freedom will allow. The May 2010 flash crash was a release of pent up energy from artificial stimulus in the fields of human action on the way to a Wall cycle bottom. The central banks and governments of the developed world have now doubled down, attempting to prevent the fields of human action from turning south, even for just a healthy and always temporary reset human sentiment. Should we be trying to eliminate the fields? Would it be wise to eliminate the natural winter if we could? It would destroy the world if we did. What is it we fear so much?

In stock market charts that reflect the fields of human action, it appears as if the human sentiment of fear and its associated human action that brings regular bouts of selling to markets is suspended in space, but time is still ticking. An extreme in the human action driving sentiment of optimism is unfolding.

It is worth pondering whether the human action that has injected hundreds of billions in stimulus has overridden the naturally occurring field, and launched a new one. Alternatively, has it merely postponed the day of reckoning? All fields of human action ends and the baton is passed to the next field in the space-time continuum. We will the answers to these shortly, since we are riding the fields of human action together.

Human action, yours included, like Chairman Bernanke’s, is a powerful instrument that can alter the outcome of the fields of human action, but not eliminate them. Nature has imposed degrees of freedom. Human action has built and destroyed civilizations over the millennia. Maybe during this long wave winter we will have an opportunity to get human action right, and deliver a new golden age of peace and prosperity. I like to call that possibility The Great Republic. It is closer than you think. It only needs the right human action.

David Knox Barker is a long wave analyst, technical market analyst, world-systems analyst and author of Jubilee on Wall Street; An Optimistic Look at the Global Financial Crash, Updated and Expanded Edition (2009). He is the founder of LongWaveDynamics.com, and the publisher and editor of The Long Wave Dynamics Letter and the LWD Weekly Update Blog. Barker has studied and researched the Kondratieff long wave “Jubilee” cycle for over 25 years. He is one of the world’s foremost experts on the economic long wave. Barker was also founder and CEO for ten years from 1997 to 2007 of a successful life sciences research and marketing services company, serving a majority of the top 20 global life science companies. Barker holds a bachelor’s degree in finance and a master’s degree in political science. He enjoys reading, running and discussing big ideas with family and friends.

© 2011 Copyright David Knox Barker - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.