Booming Global Auto Market Good For Many

Stock-Markets / US Auto's Feb 28, 2011 - 03:57 AM GMTBy: Frank_Holmes

Perhaps no industry has experienced a stronger recovery from the depths of the recession than the global automobile industry. Around the world, cars are rolling off the lot at a pace not seen in years. Global car ownership is expected to rise 17 percent over the next five years, according to data from J.D. Power.

Perhaps no industry has experienced a stronger recovery from the depths of the recession than the global automobile industry. Around the world, cars are rolling off the lot at a pace not seen in years. Global car ownership is expected to rise 17 percent over the next five years, according to data from J.D. Power.

In the U.S., an improving job market is giving consumers confidence to purchase big-ticket items such as automobiles. A recent survey from the Conference Board shows a record number of people (13 percent) are looking to purchase a vehicle in the next six months. That’s triple the amount of a year ago and the highest in more than a decade.

In the U.S., an improving job market is giving consumers confidence to purchase big-ticket items such as automobiles. A recent survey from the Conference Board shows a record number of people (13 percent) are looking to purchase a vehicle in the next six months. That’s triple the amount of a year ago and the highest in more than a decade.

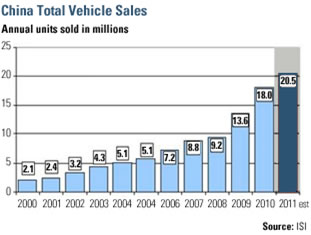

In China, the auto sector is really heating up. January total vehicles sales were up 13.8 percent on a year-over-year basis to 1.89 million vehicles, the highest monthly total on record, according to ISI Group. The firm is forecasting total sales of 20.5 million units this year, up nearly 900 percent since 2000. By 2015, ISI estimates annual sales will total 30 million units.

Two things really stand out from the rise: 1) vehicle sales rose despite a rollback in government subsidies, and 2) passenger vehicles drove sales. ISI says that “persistent double-digit per capita real income growth is creating a ‘car culture’ in China.”

Two things really stand out from the rise: 1) vehicle sales rose despite a rollback in government subsidies, and 2) passenger vehicles drove sales. ISI says that “persistent double-digit per capita real income growth is creating a ‘car culture’ in China.”

While thriving, the car culture is China is still in its infancy. Currently, there are roughly 3.5 vehicles owned for every 100 Chinese citizens. However, that figure is very low compared to other countries with similar levels of GDP per capita.

You can see from this chart from Main First Bank that China and Thailand have relatively similar levels of GDP per capita, but the rate of vehicle ownership in China is significantly lower. If China were to catch up with the trend of other countries, the ratio would roughly be 10 vehicles for every 100 people. The same can be said for other countries where incomes are rising such as Turkey and India.

When you spot such a powerful trend, it’s important to look for the inter-market relationships. The demand for new automobiles is generating increased demand for auto supplies such as batteries, tires, sensors, aluminum and electronics. It is also driving demand for oil through gasoline and diesel consumption.

The infrastructure needed to handle all these vehicles is also in great demand. Roads and bridges need to be built and congested streets and highways need to be expanded and widened, driving demand for cement and steel.

The stage is set for a booming global auto market over the next several years. This could be a driver for the entire supply chain from basic commodities to high-end components.

Frank Holmes is CEO and chief investment officer for U.S. Global Investors. John Derrick serves as director of research for U.S. Global Investors. The world of global investing now comes in a travel size. Download the free U.S. Global Investors iPhone application and stay up to date on investment news in gold, natural resources and emerging markets while you’re on the go. Click here to download or visit the App Store.

Please consider carefully the fund's investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.