Warren Buffett Taking Berkshire Hathaway on the Hunt for Takeover Targets

Companies / Mergers & Acquisitions Mar 03, 2011 - 09:05 AM GMTBy: Money_Morning

Kerri Shannon writes:

Iconic investor and Chairman and Chief Executive Officer of Berkshire Hathaway Inc. (NYSE: BRK.A, BRK.B) Warren Buffett announced on Feb. 26 in his annual shareholder letter that his company was eyeing acquisition targets in 2011, sending many "follow the guru" investors on a search for the next big takeover.

Kerri Shannon writes:

Iconic investor and Chairman and Chief Executive Officer of Berkshire Hathaway Inc. (NYSE: BRK.A, BRK.B) Warren Buffett announced on Feb. 26 in his annual shareholder letter that his company was eyeing acquisition targets in 2011, sending many "follow the guru" investors on a search for the next big takeover.

Berkshire's cash rose to a three-year high of $38.2 billion and Buffett said the firm was on the prowl for new buyouts.

"We will need more good performance from our current businesses and more major acquisitions," wrote Buffett. "We're prepared. Our elephant gun has been reloaded, and my trigger finger is itchy."

Berkshire Hathaway generated almost $1 billion a month in free cashflow last year. It also completed its biggest purchase, spending $26.5 billion for rail company Burlington Northern Santa Fe Corp.

Many analysts view the defense industry and agriculture sectors as the most appealing sectors.

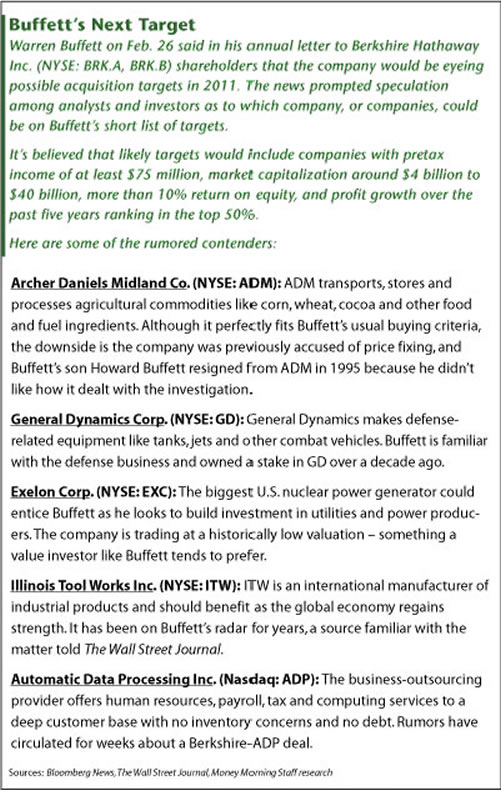

Two names rumored to be contenders are Archer Daniels Midland Co. (NYSE: ADM), the world's biggest grain processor, and General Dynamics Corp (NYSE: GD), a defense equipment maker.

"He's probably looking for something along those lines," Barry James, president of James Investment Research Inc., told Bloomberg News. "All these are great fits for any value investor. Obviously, we're going to need defense, energy and agriculture. Those are just good, solid companies."

Berkshire's usual targets include companies with market value of $5 billion to around $20 billion, little or no debt, pretax profit of more than $75 million and consistent earnings.

ADM fits the technical parameters Buffett lays out. It has a market value of $23.3 billion, is trading at 12.1 times earnings, and analysts expect profits to hit record levels this year and next.

"ADM, as a food processor and middleman, is more plausibly up his alley," Brian Barish, president of Cambiar Investors LLC, told Bloomberg. "The jewel of the company is that they have a huge business, which is called agricultural services. This is transporting food, storing food and grains. That's a very difficult business to replicate. That one seems potentially very interesting."

But ADM isn't a sure bet as the next addition to the Berkshire family. In 1996 ADM agreed to pay a $100 million antitrust fine after the U.S. government accused the company of price fixing. Buffett's son Howard Buffett had worked for ADM, but quit in 1995 because he disliked the way the company handled the investigation, according to The Wall Street Journal.

General Dynamics, another rumored target, has a market value of $28 billion and has traded at an average of 13.2 times earnings over the past five years. Buffett owned a stake in GD about 10 years ago.

General Dynamics "does have a business that he's familiar with," Thomas A. Russo of Gardner Russo & Gardner, told Bloomberg. "That's one that's possible."

Some analysts think Buffett could target insurers because of their cheap valuations, while others are pegging energy businesses like natural gas companies Energy Transfer Partners L.P. (NYSE: ETP) and Linn Energy LLC (Nasdaq: LINE).

Opportunity Knocks

Buffett in his letter to investors indicated that Berkshire is confident in the U.S. economy, which is why his company is on the hunt for new opportunities.

"Money will always flow toward opportunity, and there is an abundance of that in America," Buffet wrote.

Berkshire invested $5 billion, or 90% of its total expenditure, in U.S. property and equipment last year. He also said a U.S. housing recovery will begin in the next year, giving a boost to those Berkshire subsidiaries tied to that sector.

Buffett also shared Berkshire's plans to add to its position in The Marmon Group, a manufacturing business in which it holds a majority stake. Berkshire first snagged a 64% stake in Marmon three years ago, and is now buying an additional 16.6% for $1.5 billion.

Buffett last year completed his last big purchase, Burlington Northern, after building a stake in 2008 and 2009. Buffett already owned a 22.6% stake in Burlington when he bought the remaining 77.4% in February 2010.

Rising commodity prices have helped boost revenue at Marmon and Burlington. About 40% of Marmon's revenue increase, or $360 million, was due to last year's jump in copper prices.

Meanwhile, Burlington's performance last year contributed $2.2 billion to Berkshire's 2010 profit.

Buffett and partner Charles T. Munger, vice president of Berkshire, previously had an unfavorable view of railroads.

"Warren and I have hated railroads our entire life," Munger said in 2007, the year Berkshire first started investing in Burlington. "They're capital-intensive, heavily unionized, with some make-work rules, heavily regulated, and long competed with a comparative disadvantage versus the trucking industry, which has a very efficient method of propulsion (diesel engines) and uses free public roads. Railroads have long been a terrible business and have been lousy for investors."

However, rising oil prices and highway congestion have made trucking a much more expensive industry than railroads, increasing available business for Burlington.

Buffett called the Burlington acquisition "an all-in wager on the economic future of the United States," and reduced Berkshire's holdings in riskier picks like newspapers and healthcare companies to compensate for the investment.

Since the Burlington takeover, rumors have put the railroad's CEO Matt Rose on the list of Buffett's possible Berkshire CEO successors. Berkshire said this week it had identified four contenders to lead in Buffett's absence but did not release names.

Buffett in his annual letter praised Rose, along with NetJets CEO David Sokol, MidAmerican Energy Holdings CEO Greg Abel, Berkshire's reinsurance group leader Ajit Jain, and Government Employees Insurance Company (GEICO) CEO Tony Nicely. All are on the list of possible successors.

Buffett surprised investors in October by adding little-known hedge fund manager Todd Combs to his investment management team, sparking talk that Combs is another CEO candidate.

"He is a 100% fit for our culture," said Buffett. "I can define the culture while I am here, but we want a culture that is so embedded that it doesn't get tested when the founder of it isn't around. Todd is perfect in that respect."

Buffett has repeatedly stressed the importance of preserving company culture, both for the business and investors, and someone who can do that will be a lead contender to take over the reins.

"He wants me to make sure that the culture's not disrupted," Howard Buffett said Feb. 25 in an interview with Bloomberg Television. "Maintaining it with the right CEO in place will not be that hard to do."

Source : http://moneymorning.com/2011/03/03/...

Money Morning/The Money Map Report

©2011 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.