Always a Bull Market Somewhere - Today it is Solar

Companies / Renewable Energy Mar 14, 2011 - 11:12 AM GMTBy: Trader_Mark

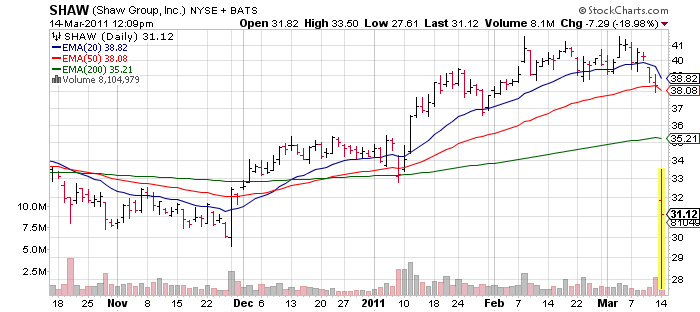

Except for the darkest of days, the speculator class can find a theme and run up stocks in that sector. Today the theme is "away with nucelar, and into solar!" Shaw Group (SHAW) which is the infrastructure company most affiliated with nuclear is being bludgeoned to the tune of a 20% loss (higher earlier today), and Cameco (CCJ) which is a uranium play is down 16%. Meanwhile, hile solars of all stripes are running to the moon as a wave of solar projects surely will begin in earnest in weeks. ;) Boo yah hot money....

Except for the darkest of days, the speculator class can find a theme and run up stocks in that sector. Today the theme is "away with nucelar, and into solar!" Shaw Group (SHAW) which is the infrastructure company most affiliated with nuclear is being bludgeoned to the tune of a 20% loss (higher earlier today), and Cameco (CCJ) which is a uranium play is down 16%. Meanwhile, hile solars of all stripes are running to the moon as a wave of solar projects surely will begin in earnest in weeks. ;) Boo yah hot money....

Trina Solar (TSL) +9.5%

JinkoSolar (JKS) +9.3%

Yingli Green Energy (YGE) +7.1%

LDK Solar (LDK) +6.5%

First Solar (FSLR) +4.6%

Shaw? Not so much....

Via Barron's

- Shares of solar energy technology companies are rallying mightily this morning amid a sense that Japan, the third largest oil consumer in the world, could use a technology a little less risky than the nuclear reactors that succumbed to Friday’s earthquake and the resultant Tsunami.

- In a note to clients this morning, Credit Suisse’s Satya Kumar provides a mixed bag for solars as regards Japan. On the one hand, the country, which already had the potential for 2.5 gigawatts of demand in the next three to five years, up from 1 gigawatt in 2010, may find its desire for solar rise, writes Kumar. At the same time, there are a few company-specific issues, writes Kumar.

- First Solar, for one, may not benefit as greatly because Japan “has focused on crystalline silicon, CIGS and thin film silicon based panels for its roof top markets,” not FSLR’s technology, writes Kumar.

- In addition, Suntech Power Holdings (STP) “had acquired a Japan-based company,” notes Kumar, and “SunPower recently signed a contract with Toshiba (TOSBF).

- The solar sector will experience aftershocks from the earthquake in Japan, including disruptions in polysilicon supplies and near-term impact on demand, Piper Jaffray analyst Ahmar Zaman writes in a research note this morning.

- Zaman notes that Japan accounts for 2 GW of expected 2011 demand, over 19,000 metric tons of polysilicon capacity, 650 MW of wafer capacity, 2.2 GW of cell capacity and 2.5 GW of module capacity. Piper cuts its 2011 solar demand forecast to 1 GW from 2 GW, bringing its global estimate down to 17.5 GW.

- “We believe lowered demand in Japan resulting in Japanese module suppliers looking to place more product in the rest of the world, will pressure ASPs in 2011,” he writes. “Also, the drop-off in poly production in Japan, will tighten global supply further, keeping ASPs north of $70/kg over the near-term. This will challenge downstream margins.”

No position

By Trader Mark

http://www.fundmymutualfund.com

Mark is a self taught private investor who operates the website Fund My Mutual Fund (http://www.fundmymutualfund.com); a daily mix of market, economic, and stock specific commentary.

See our story as told in Barron's Magazine [A New Kind of Fund Manager] (July 28, 2008)

© 2011 Copyright Fund My Mutual Fund - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.