Japanese Yen: G7 Intervention vs Laissez-faire

Currencies / Japanese Yen Mar 20, 2011 - 10:27 PM GMTBy: Dian_L_Chu

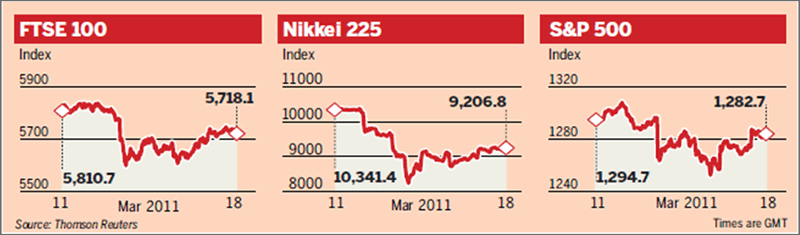

The world's fifth-largest 9.0 magnitude quake and the resulted tsunami not only devastated Japan, but also wreak havoc in the Japanese stock market. The worst two-day rout in 40 years caused a 6.2% drop in Nikkei share index, wiping £90 billion (roughly $145.45 billion) off stocks and shares traded there, reported The Telegraph.

The world's fifth-largest 9.0 magnitude quake and the resulted tsunami not only devastated Japan, but also wreak havoc in the Japanese stock market. The worst two-day rout in 40 years caused a 6.2% drop in Nikkei share index, wiping £90 billion (roughly $145.45 billion) off stocks and shares traded there, reported The Telegraph.

Separately, Financial Times quoted EPFR, a data provider, that Investors pulled $8.2 billion from equity funds, and $4.3 billion from money market funds, in the week to Wednesday, March 16. That in turn dragged share prices to a six-week low in many countries.

Separately, Financial Times quoted EPFR, a data provider, that Investors pulled $8.2 billion from equity funds, and $4.3 billion from money market funds, in the week to Wednesday, March 16. That in turn dragged share prices to a six-week low in many countries.

BOJ Mass QE Post Catastrophe

To stabilize the market, Bank of Japan (BOJ) pumped a record 15 trillion yen ($183 billion) liquidity, which is the biggest amount ever made in a single transaction, and the bank has also announced steps to ease monetary policy, and enlarged its asset-purchase program.

The tsunami and earthquake is expected to be the world's most expensive natural disaster with preliminary predictions that the estimated total economic loss is to be between $200 billion and $300 billion, while costs to the insurance industry could exceed the record $40 billion-plus claims from Hurricane Katrina.

S&P Downgrade & IMF Warning

The big problem is that Japan is already in a lot of fiscal trouble before the quake. In January this year, Standard & Poor's cut Japan's credit rating one notch to "AA-" from "AA", citing high debt and government’s lack of a "coherent strategy" to tackle the debt problem.

Then, just weeks after the S&P downgrade, International Monetary Fund (IMF) warned that Japan's outstanding debt and fiscal deficit "are not sustainable over the medium- and long-term." At the time, the IMF does believe an imminent European debt like crisis, mainly due to Japan's high savings rate.

Debt Trouble Could Deepen

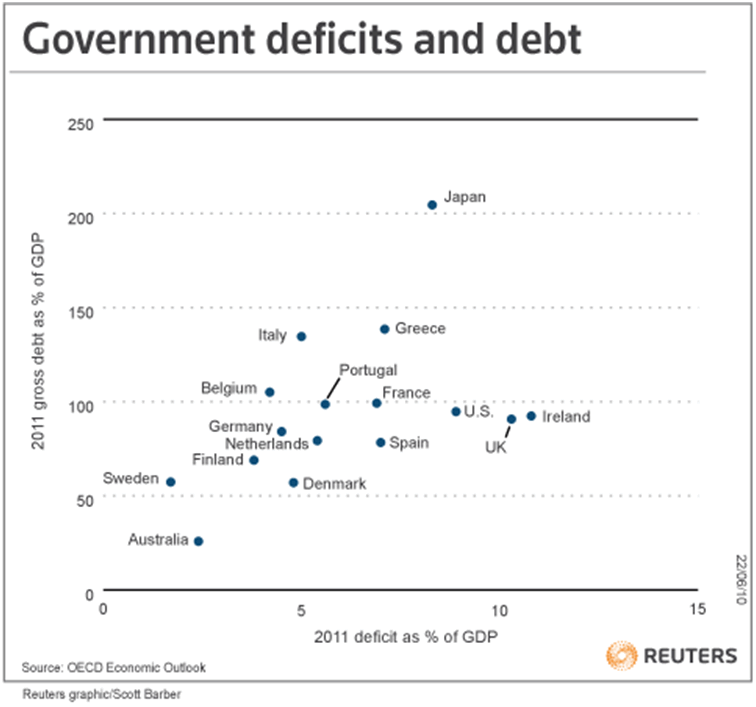

Japan has been plagued by a decade-long deflation, and has the highest debt to GDP ratio of any developed nation (See Chart). Although the majority of Japan’s debt is held internally, this unprecedented disaster in Japan’s history could make the country’s situation that much worse with global implications as Japan is a significant trader partner with many countries around the globe.

Investors worries drove five-year credit-default swaps (CDS) on Japan’s government to a record 130 bps on March 17, but dropped back down to about 105 bps on Friday, March 18 as Japan is working on containing the radiation leak. Nevertheless, it is fair to say there’s a very real fear that the country’s economy could plunge further into a recession, and may even face a near-term sovereign debt crisis situation… in a worst case scenario.

Yen Spiked to Record High

With the unprecedented liquidity injection in aftermath of the quake, tsunami, nuclear crisis, combined with existing high debt levels, you would think the Japanese yen currency should weaken considerably, if not in a complete short-term panic landslide.

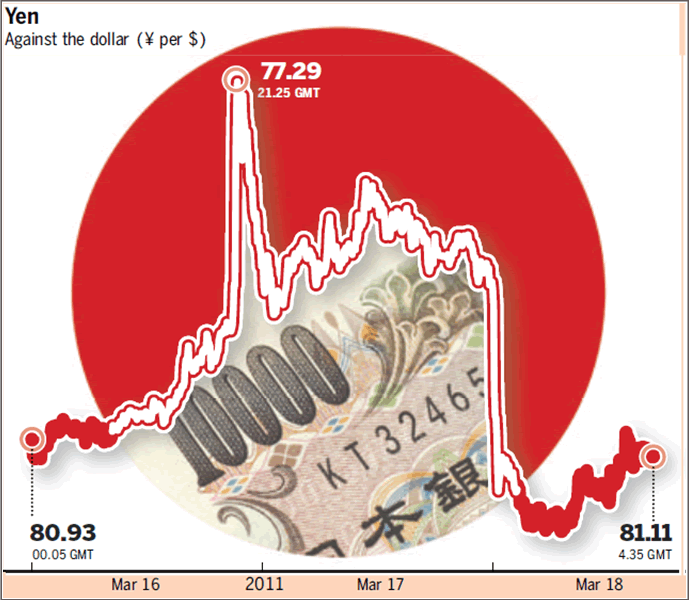

Yet quite the contrary, the yen soared to its highest against the US dollar since the World War II reaching Y76.25 on March 16. Yen’s resilience could be attributed to the following major factors:

- Speculators front running the anticipated repatriation of funds from Japanese investors and firms to fund reconstruction, and damage loss claims

- Some actual repatriation of funds by the Japanese investors and corporations

- Global risk aversion resulting in Yen carry trade unwind

- Stop-run by speculators busting through previous support levels.

A Strong Yen – Bad News Japan

A surging yen currency is certainly the worst news for the country’s export-dependent economy. Even if the loss from quake and tsunami does not drive Japan into another recessionary cycle, the currency strength would be the final nail in the coffin.

G7 Yen Joint Task Force

This dire predicament of the world’s third largest economy is enough to get the central banks of the G7 to step in and initiate a coordinated yen intervention not seen for over a decade.

While the actual amount of the intervention is unknown, Financial Times noted traders estimated the BOJ sold Y2,000bn ($25 billion) against the dollar on Friday, March 18, similar to the record Y2,125 billion it sold to weaken its currency last September, while the Fed and the Bank of Canada confirmed that they had been selling the yen too.

And the two charts (above and below) from Financial Times illustrates that efforts from the ‘G7 joint task force’ sent yen tumbling to around Y81, along with a calmer global equity markets.

Yen Target - Y83 or Volatility?

Fumihiko Igarashi, one of the two senior Japanese vice finance ministers, did not rule out further interventions when he told Dow Jones Newswires Friday his dollar-yen target is around Y83, the levels prior to the massive earthquake and tsunami on March 11. But ministry officials reportedly have privately emphasized that their target is volatility, not a specific dollar-yen level.

Increasing Net Longs on Yen

Meanwhile, WSJ.com said data from the Commodity Futures Trading Commission released on March 18 showed that traders had $4.6 billion in net "long," or bullish, positions in the yen as of Tuesday, up 84% from a week earlier.

So, it seems regardless of volatility or a specific exchange rate as the target, more rounds of intervention could be expected given the increasing net long positions on Yen, the fact that Yen actually bounced back up on fresh buying in the middle of the G7 mass selling, and that Japan is a ‘Whale’ when it comes to currency intervention. In 1995, Japan spend Y5, 000 billion for the whole year, and in September, 2009, it sold Y1, 000 billion in a single day.

G7 Intervention vs. Laissez-faire?

According to Nikkei.com, some traders speculate that Japan might need to handle interventions alone because other G-7 economies just wanted to ease market volatility, and will unlikely step in as the market stability seems to have restored.

Although most central banks, including Japan, have had a dismal record when it comes to currency intervention; however, this time around, there seems to be a few more rounds left before we know who eventually prevails in this grand currency match of Laissez-faire vs. Intervention.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at http://econforecast.blogspot.com/.

© 2011 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.