Stock Energy, Materials, and Industrial Sectors Are Well Positioned

Stock-Markets / Sector Analysis Mar 21, 2011 - 01:05 PM GMTBy: Chris_Ciovacco

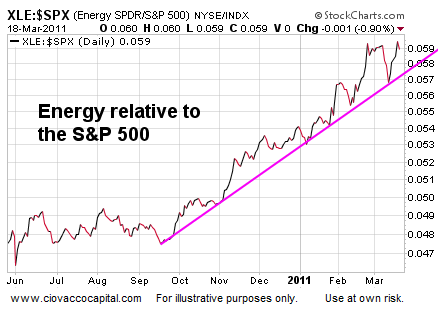

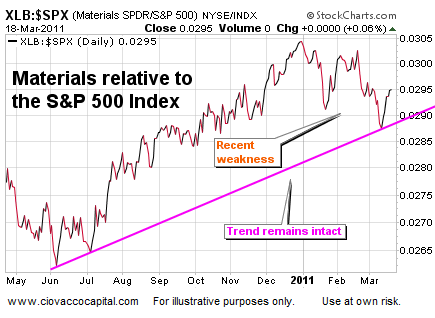

Since the markets have pulled back significantly from their recent highs, it is a good time to revisit our big picture investment strategy. Attractive sectors, based on fundamental and technical data, include energy (XLE) and industrial stocks (XLI). While a good case for stocks in the materials sector (XLB) also exists, we prefer the materials themselves (commodities) relative to stocks.

The fallout from the devastation in Japan may hamper the growth of nuclear power in the United States, which in turn could increase the demand for more traditional sources of energy including oil and coal (KOL). According to CBS News:

Right now, the South Texas Project, as this nuclear power plant southwest of Houston is called, produces nearly 8% of the electricity used in Texas. Until ten days ago, it looked as if NRG, the New Jersey company that owns it, was on track to start building two new reactors here, creating 8,000 jobs and enough power to light two million homes. “It’s not necessarily a fatal setback, but it’s a substantial setback,” said David Crane, the CEO of NRG. “If you ask me, can I give you assurance that this plant will be built, it very much depends on what’s going to happen [in Japan], what’s the reaction going to be once this event is over and people are assessing the implications.”

Energy stocks have maintained their leadership even through the market’s recent pullback, which is a good sign in terms of them remaining attractive in the coming weeks and months.

Barron’s looked at the need for Japan to increase energy imports to replace lost capacity:

S&P analysts are bullish on U.S. refiners with operations on the West Coast. Those refiners could be called on to supply refined products to Japan, whose refining capacity has diminished considerably. Among the refiners that could benefit are Tesoro (TSO), Valero (VLO) and Alon USA Energy (ALJ), says equity analyst Tanjila Shafi.

One of the top holdings in the industrials exchange-traded fund is Catepillar (CAT), which was also mentioned by Barron’s:

Of the stocks S&P equity research covers, Jaffe says Caterpillar (CAT) has the largest footprint in the Asia-Pacific region.

With the heavy damage to buildings, homes, and infrastructure in Japan, demand could increase for products, equipment, and services related to the rebuilding effort that will take years to complete. According to the Wall Street Journal:

The major rebuilding effort that will need to take place should eventually benefit companies that make building materials and construction equipment, Standard & Poor’s Equity Research Services analyst Michael Jaffe said in the strategy report. Construction giant Caterpillar Inc. (CAT, $105.09, +$1.97, +1.91%) in particular has a sizeable presence in Asia, Jaffe pointed out. Caterpillar said its facilities in Tokyo, Akashi and Sagami were not damaged by the earthquake and are on the outside of the current Japan-mandated evacuation zone. Separately, Caterpillar said in a filing with the Securities and Exchange Commission that its global dealer sales are up 59% for the three months ended February.. During the same period the company’s North American sales grew 55%.

Until the markets regain their footing, the nuclear situation in Japan becomes less dire, and the ongoing unrest in the Middle East subsides, we prefer physical commodities to the stocks of material producers. If the equity markets weaken further and/or the economic outlook deteriorates, the odds of the Fed moving toward QE3 increase. Under those circumstances, commodities become attractive as an alternative to paper currencies.

Dow Jones summed up the possible investment implications of recent events in Japan as follows:

The tragedy in Japan is still unfolding, and the extent of the devastation is uncertain, but there will come a time when the country will rebuild. When that happens, the reconstruction effort will be massive and lengthy, and will involve both Japanese and international companies. With that in mind, Standard & Poor’s highlighted some of the companies and industries that could see greater demand for their products and services as Japan recovers. The S&P selections aren’t so surprising — concentrated on building materials, engineering and construction firms that will be called to repair and rebuild Japan’s housing and infrastructure, and oil refiners that could meet the country’s energy needs now that its nuclear power industry is crippled.

We are open to adding to our positions in energy, including oil-related equipment makers (IEZ), industrials (XLI), and commodities (DBC, SLV). However, we still want to see some improvement in the markets as we outlined in Strategy and Outlook for a “Prove It to Me” Market.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.