Rising Interest Rates Could Jolt Stock Markets

Stock-Markets / Stock Markets 2011 Apr 11, 2011 - 06:15 AM GMTBy: Money_Morning

Jon D. Markman writes:

Stocks traded with all the precision of a baseball skipping into the Boston Red Sox outfield over the past week, which is to say it was pretty sloppy. The major equity averages settled near the flat line, but it was a mess getting there after the European Central Bank raised rates for the first time since mid-2008, there was a 7.1 magnitude aftershock in Japan, and Texas Instruments Incorporated (NYSE: TXN) bought a rival chip maker at incredible premium.

Jon D. Markman writes:

Stocks traded with all the precision of a baseball skipping into the Boston Red Sox outfield over the past week, which is to say it was pretty sloppy. The major equity averages settled near the flat line, but it was a mess getting there after the European Central Bank raised rates for the first time since mid-2008, there was a 7.1 magnitude aftershock in Japan, and Texas Instruments Incorporated (NYSE: TXN) bought a rival chip maker at incredible premium.

By far the most important economic news of the past week was the European Central Bank's decision to raise interest rates for the first time in two years. The central bank is run by a Frenchman, Jean-Claude Trichet, but it has aspirations to be considered in the same league as the old Bundesbank, which ran monetary policy in a brilliant, sober fashion for Germany in that country's postwar heyday.

One of the primary aims of the Bundesbank was to avoid the sort of runaway hyperinflation that ravaged the Weimar Republic in the 1920s and ultimately led to the emergence of the Third Reich. It's the aim of every central bank to prevent the debasement of the currency, of course, but Europeans tend to take this a lot more seriously than Americans.

The Bank of England and U.S. Federal Reserve both decided this week not to raise rates as their leaders say that "core inflation'' -- which does not include energy or food prices -- is not a problem. They hand-wave energy and food prices because they believe that pops like NYMEX crude oil at $110 and corn prices at $7.50 a bushel are transitory, and that real inflation pressure comes primarily from higher wages and home prices, both of which are indeed quiet.

Yet the ECB is signaling that inflation may indeed be stirring, and that the Fed, the BOE and the Bank of Japan may soon need to shift their stance.

History tells us periods of rising rates are not really a problem for economic growth, as they indicate an economy strong enough to thrive without monetary crutches. But history also tells us that equity markets tend to freak out anyway when the central banks start raising rates.

Two of the most serious bear markets and crashes of the past 30 years were in fact kicked off by the start of rate-rising regimes. The most vivid came in the summer of 1987, when brand-new Fed chief Alan Greenspan pulled the switch that led to the Black Monday crash in October of that year.

Now before you start worrying, you need to know the initial adjustment periods may be a jolt to the system, but they seldom change the major trend of the market. And there really is no hard-and-fast rule about how equities will perform at such periods. Some rate-rising starts have led to nothing more than a sharp slam on the brakes before a long upswing, while others have led to nothing more than rather dull multi-month soft spots, such as the first ten months of 2004.

The bottom line: The most fearful thing about the transition from quantitative easing to rate raising will be the fear of the transition. Growth may slow a bit, but should pick up again. As long as the credit markets remain open, which I expect, then there could be a broad-market flat spot or slip, but at the same time some groups -- such as energy, health care and precious metals -- should outperform, allowing nimble investors to keep their portfolios on track.

The StrataGem model we run at Strategic Advantage excels at times like these, helping us focus on the stronger sectors and avoid the rest. In 2004, a year when the Dow Industrials were up only 3.1% -- and that was entirely due to a 7% gain in November and December -- StrataGem was up 44%.

Latin American mobile phone giant America Movil SAB de CV (NYSE: AMX) was a typical holding of the model back then, and is back in our model this month. It rose over 200% in 2004-2005 while the S&P 500 was virtually flat, and I would expect a reprise of that kind of action should another transitional, rate-change market emerge.

Stock Scarcity

The Standard & Poor's 500 Index finished the week with a slim loss of 0.3%, but that followed a gain in the prior two weeks of 4.2.%. Most sectors fell in value, with consumer staples leading and industrials lagging.

Another big story of the week was a crash of the dollar and the rise of commodities, as gold jumped 4.8%, silver rose 8.5%, and crude oil rose 5%. The buck hit a new three-year low against a basket of currencies.

Retailers were the only major corporate story of the week, as several major chains announced stronger-than-expected, same-store sales figures for March. The biggest was Bed Bath & Beyond Inc. (Nasdaq: BBBY),which pulled back the sheets to reveal a 10.5% gain. Super-discounter Costco Wholesale Corporation (Nasdaq: COST) announced some of the better numbers, and shot up 3.7% to a new all-time high.

Market internals show that the indexes are rising more due to a lack of sellers than any intensity on the part of buyers. This is how an oversold condition can persist for much longer than bears believe likely. People just don't want to feed their shares into the market because they are increasingly optimistic about the future.

Another factor: All the mergers of large companies lately are taking supply out of the marketplace. Something like $95 billion in big merger deals have been announced in just the past two weeks. That means the shares of several large companies will no longer be available, so people who owned them are being forced to buy something else.

It may be hard to believe we could have an equity scarcity factor, but it's the truth. As an example, if you were a large pension fund and owned both Texas Instruments and National Semiconductor Corporation (NYSE: NSM), what happens after they merge? Do you overweight TXN? No, you don't. Your investment consultant says you can only have a maximum of, say, 1% of your money in a single stock. So you have to go out and buy some other chip manufacturer, feeding the rally.

Another phenomenon improving the tone of the market for techs is that many of the old favorites in technology and emerging markets fell so much in the early part of this year

that they have actually become value plays. And that means an entirely new, and more stable, constituency has turned their attention to these shares.

It's sad to say, but Cisco System Inc. (Nasdaq: CSCO), as an example, has fallen enough to be considered not just a growth "fallen angel" but an outright value as a distressed property. That's why bad news stopped having a negative effect on the shares.

Indeed, techs overall enjoyed a fairly positive vibe on Wednesday after Cisco's chief exec announced he was sorry about screwing up for the past several years by diluting its corporate networking brand into everything from webcams and home audio to cable TV boxes. It was kind of a joke, I think, but he apologized for becoming so bureaucratic, and said he had appointed a committee to look into it.

This modest rotation into tech was not the only thing propping up the market late in the week. There has been a stealth rotation into emerging markets as well.

A note from Goldman Sachs analysts late Wednesday observed that the recent "DM to EM rotation" -- these guys love their abbreviations; this one meant ''developed markets to emerging markets'' -- has come from what they call "real money." Real money is pension fund and mutual fund money, or basically everything that's not a government or a leveraged hedge fund.

My subscribers have certainly seen and benefited from that, as our iShares MSCI Turkey Index Fund (NYSE: TUR), iShares MSCI South Korea Index Fund (ETF) (NYSE: EWY) and Market Vectors Indonesia Index (ETF) (NYSE: IDX) funds have rocketed in the past two weeks, exceeding even our high expectations.

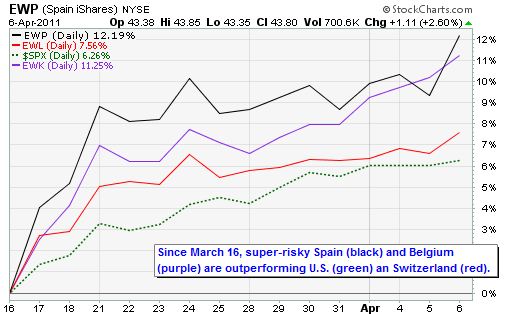

European stocks have also caught an incredible bid of late, despite a renewed understanding in Portugal that its debt situation has gone from bad to worse. Breaking out to new two-year highs lately have been the markets in Spain, Italy, Belgium, Austria, France, the Netherlands and Belgium.

Even more interesting, from the standpoint of risk, is that the markets that were embraced for their low risk three weeks ago are now the laggards! Funny, huh?

That would be, for instance, sober-sided iShares MSCI Switzerland Index Fund (ETF) (NYSE: EWL), whose market has not yet exceeded its February high, while risk-besotted iShares MSCI Spain Index (ETF) (NYSE: EWP) is cruising.

The message of the moment, as interpreted by Mr. Market: Take risks.

Utilities Power Up

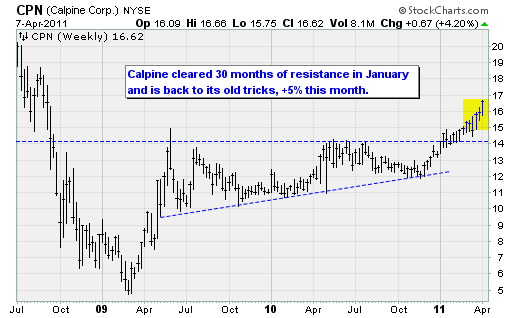

My model has been high on utilities since August of last year, but went heavily into them at the start of April. That's proven a smart move. This week's big hero for us has been Calpine Corporation (NYSE: CPN), unique among its peers for its entrepreneurial approach to wholesale power generation and management.

This approach made the Silicon Valley-based, new-age power producer a darling of investors during the tech bubble, though it subsequently crashed and went bankrupt like many of its neighbors. It came public again at the start of the bear market -- awful timing -- and crashed again, sinking to $4.50 at the March 2009 low from a high of $23 in mid-2008.

Once credit markets recovered, however, the lights came back on at Calpine and shares took off, almost tripling in two months. The stock consolidated for the next two years until breaking out again in January, when it started to go on another tear. Shares were up 3% on 3 million shares traded on Thursday in an otherwise weak market.

CPN was a key reason the StrataGem portfolio knocked out a "mirror" day, when it goes up the same amount that the broad market goes down -- in this case, +0.3% vs. -0.3%. We have not had enough of these in 2011, but keep the faith and you should start to see more of them. They tend to occur most frequently when the portfolio is overweight in a single sector -- such as utilities or energy -- that is in favor in an otherwise soft or negative month.

What's unique about CPN is that it owns 92 natural gas-fired and geothermal power plants in 20 states -- no coal, no nuclear -- and sells the steam, electricity and renewable energy credits to companies and cities on a contract basis. Its profitability is not limited by county or state regulators, and it is a prime beneficiary of the incredibly low and declining price of natural gas.

The bottom line, though, is that investors are showing they want this stock on every dip, as it has been amply supported at its 13-, 30- and 50-day averages over the past four months. Note that in weeks like mid-March, when other stocks were stressed, it toe-tapped the 50 DMA but ended in the middle of its range. And when risk appetites were whetted again later that month, it plowed back into a leadership role.

I'm anxious to see how Calpine turns out in this cycle because it embodies many characteristics that can make a stock successful. It was formerly bankrupt, which means it naturally has a lot of skeptics and disbelievers. And it bombed again in the 2008 bear market, which means even people who gave it a second chance had reason to hate it again.

But now it has cleared a multiyear resistance point, which means CPN has cleared out a lot of selling pressure. It has shown recently it can exhibit relative strength both in weak periods (mid-March) and stronger periods (late March to early April).

Combine that with management that is incentivized by owning a lot of shares, the potential for rising margins due to the declining cost of its primary input, leverage to the improvement of U.S. industry, and a time frame in which it is moving from losses toward positive earnings, and you have the makings of a stock that could have a lot of success this year. Calpine announces earnings April 29. You can buy CPN on dips toward the 30-day average (now $15.50) if you don't own already.

The Week Ahead

Monday, April 11: No economic releases scheduled.

Tuesday, April 12: TheU.S.international trade gap; U.S.Treasury monthly budget report

Wednesday, April 13: Retail salesin March. (Consensus +0.5%). ; Business inventoriesin February. (Consensus: +0.8%).; Beige Bookbeing prepared for the Fed's April 26-27 meeting.

Thursday, April 14: Theproducer price indexfor March. (Consensus, +1%).; initial jobless claimsfor the past week (consensus: 380k).

Friday, April 15: Consumer price indexfor March. (Consensus,+0.5%). EmpireState manufacturing index; Industrial productionin March (consensus, +0.6%); Capacity utilization (consensus: 77.3%); Reuter's/University of Michigan's Consumer sentiment index.

[Editor's Note: Money Morning Contributing Writer Jon D. Markman has a unique view of both the world economy and the global financial markets. With uncertainty the watchword and volatility the norm in today's markets, low-risk/high-profit investments will be tougher than ever to find.

It will take a seasoned guide to uncover those opportunities.

Markman is that guide.

In the face of what's been the toughest market for investors since the Great Depression, it's time to sweep away the uncertainty and eradicate the worry. That's why investors subscribe to Markman's Strategic Advantage newsletter every week: He can see opportunity when other investors are blinded by worry.

Subscribe to Strategic Advantage and hire Markman to be your guide. For more information, please click here.]

Source : http://moneymorning.com/2011/04/11/...

Money Morning/The Money Map Report

©2011 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.