Bill Gross, Master of Monetary Psy-Ops

Interest-Rates / US Bonds Apr 12, 2011 - 12:57 PM GMT Every so often, and more often than not, a rumor emerges in the blogosphere about a significant development, seemingly adverse to the interests of the U.S. federal government, being manufactured by the government to further solidify their control over the masses. Sometimes these rumors are plainly absurd on their surface, and sometimes they are just too perfect to be true. The nature of these "psy-ops" is that they are nearly impossible to verify with any direct evidence until well after the fact, so we must rely on indirect logical analysis and a bit of intuition.

Every so often, and more often than not, a rumor emerges in the blogosphere about a significant development, seemingly adverse to the interests of the U.S. federal government, being manufactured by the government to further solidify their control over the masses. Sometimes these rumors are plainly absurd on their surface, and sometimes they are just too perfect to be true. The nature of these "psy-ops" is that they are nearly impossible to verify with any direct evidence until well after the fact, so we must rely on indirect logical analysis and a bit of intuition.

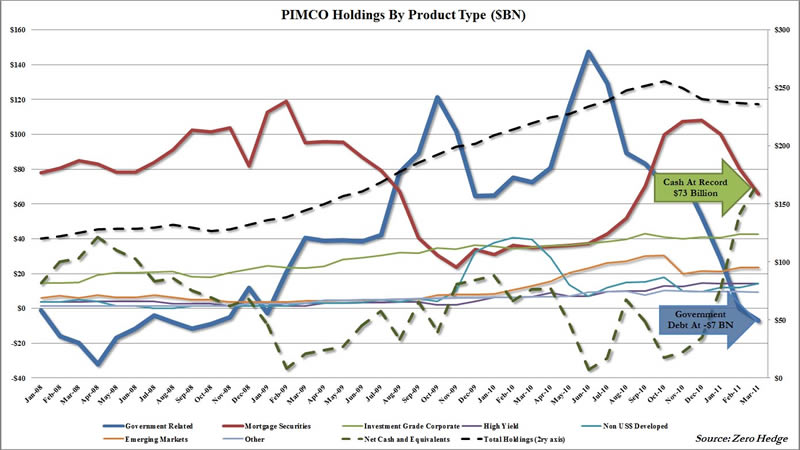

Personally, I always find it curious when a piece of news that pops up into the public domain just doesn't seem to fit in with the systemic realities that I otherwise perceive. It could be that I am simply taking these realities for granted and it is time to re-evaluate them, but it could be that they don't fit because they were never intended to. A report last month from Zero Hedge showed that PIMCO had reduced the Treasury exposure of its Total Return Fund (TRF) from 18% to 0%, and a more recent report has shown that it actually has a net short position on Treasuries. [1].

Pimco is the world's largest bond fund, and its manager Bill Gross has been quite vocal over the last two years about the U.S. Treasury's massive and unsustainable deficits. He was so vocal about it that he decided to load up on Treasuries and make a killing from February of 2009 until July of last year, with only a few brief respites in between. That's just the type of person Bill Gross is - he's a shark wading in the deep blue waters of Wall Street, and, like most other ones, he's an "insider trader".

He went on a Treasury-buying binge in February 2009, just in time to fully ride the coat tails of the Fed's QE operations that commenced in March and monetized $300B in long-term Treasury debt. [2]. No one in the public domain knew about the existence of this program in February, or the extent to which it would be carried out. It's not about economic fundamentals and it's certainly not about principles or "what's right", it's only about money and, specifically, lots and lots of money.

Now, the TRF is net short Treasuries and many people are convinced that its short position is, in fact, nothing short of a prediction by Gross that the Treasury market will soon collapse. Indeed, he seems to be at least betting that rates will increase significantly in the short-term. Perhaps that is true or perhaps he is making a bad bet, but perhaps we should also be wary of such plainly advertised convictions. After all, the insider "beltway" encompassing Wall Street and Washington has two lanes running in both directions.

If the Fed has a hidden agenda, then it would not hesitate to use Gross and his bond fund to pursue it, and if there's any institution with a hidden agenda, it's the Fed. At the beginning of 2009, the prospect of the Fed launching operations to monetize the federal debt was a radical one, unexpected by all but the most well-connected money managers.

By this time, QE has been going on for so long and with such force that it has become a standard routine. It has even gotten to the point where mainstream publications, such as the Wall Street Journal [3], are accusing the Fed of directly influencing the eruption of bloody revolutions in foreign countries. The Fed needs to maintain integrity in the U.S. Treasury market above all else [4], but it is also needs to maintain a semblance of integrity in its own house.

It's in the process of walking a delicate tightrope, and the rope it struggles to walk has increasing amounts of slack. With additional QE to supplement the MBS prepayment re-investments and QE2 operations, both of which are currently winding down, the Fed risks stoking the fires of social and political chaos which constantly threaten to consume it. This dynamic is the result of primary dealer banks selling newly issued Treasury coupons to the Fed at scheduled times and walking the profits down the beltway into equity and commodity markets. The Fed must now fear that further hot money speculation in commodities will make gas and certain foods unaffordable for not only the poor Tunisian people, but for the average American energy guzzler as well.

Without additional QE, however, the Fed loses all control of U.S. asset markets, and, by proxy, asset markets the world over. So what it really needs is a sort of timeout, in which it can engage in an immature display of wild-eyed frustration, erratically flailing its hands up in the air, shouting, "We're Done!". Then, it can sit back and watch fear set in the eyes of investors worldwide, as they realize that no more QE means no more over-valued equity and commodity markets. And no more of those means no more towers of leveraged capital producing unspeakable returns 24/7, day in and day out. Instead, all of that imaginary capital will be squashed down into a dime-sized pancake and will return nothing but the foul odor of putridly stale losses.

It is at that point when senior editors at the Wall Street Journal will abandon their offices and go running to the Fed with their guts in hand, furiously apologizing in one breath and then begging for more QE in the next.

"You see, Mr. Bernanke, our subscribers have been calling en masse to cancel over-priced yearly subscriptions as their investment capital continues to get wiped out in the stock, commodity and real estate markets. For Christ's sake, man, we need your help!"

The systemic fear generated from crumbling markets worldwide will first serve to attract scared capital into the Treasury market, as it still remains the only place to go for people with sums of money that won't fit under any mattress. Besides, the only real difference between the U.S. dollar and short-term Treasury bills or notes is that the latter could potentially give you a fixed income over their duration. The fear will then serve to further justify Treasury asset purchase operations by the Fed, the ongoing sociopolitical destruction in the Middle East be damned. So how does Pimco and Bill Gross fit into all of these deceptive monetary tactics? Well, the fact that TRF currently holds a record 38% of its assets in dollar-denominated cash is a telling one. [5].

Every investor knows that the best and quickest way to make money is to own something that virtually no one else does, right before it gets hot and takes off towards the moon and the stars. An unexpected end to QE operations will send the dollar soaring, and as mentioned before, all asset markets plunging except for the U.S. Treasury market. Bill Gross may have dumped all of his Treasury exposure for now, but has any other major financial institution or money manager followed his suit? Has the Fed announced any plans to sell its Treasury holdings back into the primary or secondary markets?

Of course not. These institutions are not worried about rates surging outside of their control anytime soon, and will be glad to make a few extra bucks from higher interest payments (paid by taxpayers) before the "rush to safety" really gets underway. I suspect that, by that time, there would have been a significant reversal in the Treasury holdings of TRF and the superficial justifications for the investment decisions of the omniscient Bill Gross. Perhaps he will continue to have minimal exposure to U.S. Treasuries throughout the year, as a partial hedge to his fund's enormous cash holdings, but that certainly should not be taken as an absolute bet against the Treasury market.

Gross is merely a beltway insider with a purpose, which happens to coincide with the purpose of every other insider and elite - to preserve the dollar-based financial system. He is the magician's assistant, distracting the audience in the front with a short-con while the magician sets up the long-con behind him. The bad cop who beats the suspect over the head and tells him he has one last minute to confess before the entire case is blown wide open, followed by the good cop who enters the room and promises they will go easy on the suspect and recommend leniency to the judge, as long as he just tells them where all the money is hidden. Once again, it is not about enforcing the law or finding justice, it's only about using deception to drive all of that money out of its hole and into their hands.

Besides, did anyone really think that the world's biggest bond fund was about to unconditionally give up on the world's biggest bond market (which just so happens to support every other U.S. bond market, and foreign ones as well)? Personally, I think Bill Gross is going to continue doing what he does best - speaking in half-truths and pretending like he cares about day-to-day developments in the U.S. fiscal situation, while carting his millions in compensation to undisclosed personal bank accounts around the world. That is one financial shark who cannot survive outside of the deep waters, and his next feast of flesh will be no less filling than the last.

Ashvin Pandurangi, third year law student at George Mason University

Website: "Simple Planet" - peakcomplexity.blogspot.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2011 Copyright Ashvin Pandurangi to - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.