Silver Shorts Feel the Burn

Commodities / Gold and Silver 2011 Apr 23, 2011 - 02:55 AM GMTBy: Clif_Droke

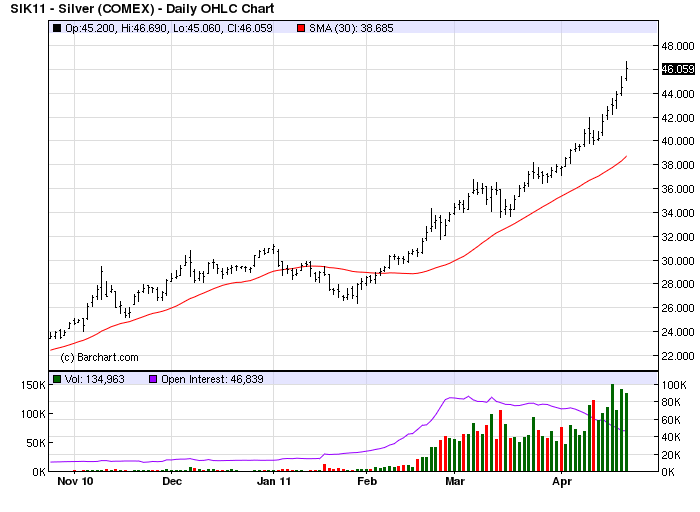

Silver has stolen the spotlight among investors in recent days after surging nearly $50/oz. Lost in all the commotion, however, are the wildly disparate rumors accompanying silver's rally. It's hard to believe that it has been only a week since a widely circulated story concerning a large hedge fund which supposedly made a "gargantuan" bet against silver. This story, which smacked of being planted by speculative interests, was circulated by some otherwise reputable financial publications.

Silver has stolen the spotlight among investors in recent days after surging nearly $50/oz. Lost in all the commotion, however, are the wildly disparate rumors accompanying silver's rally. It's hard to believe that it has been only a week since a widely circulated story concerning a large hedge fund which supposedly made a "gargantuan" bet against silver. This story, which smacked of being planted by speculative interests, was circulated by some otherwise reputable financial publications.

As we've talked about in past commentaries, whenever extremely bearish news stories are circulated in the financial press it carries a contrarian implication in most cases. In an established bull market like the one for silver, it's dangerous to sell short based on a rumor since the major trend is up and a large buildup in short interest can create explosive rallies when everyone decides to short the market at the same time. This is what apparently happened last week.

Here's a quote from the story that appeared in the financial press last week:

"A gargantuan bet against silver values was placed into position [April 11] with the initiation of a one million-share-large put on the iShares Silver Trust (SLV) - at the $25 level by July. The bet constituted the largest single options trade on US exchanges and came as silver was touching the 31-year high watermark near $42 per ounce. The (as yet) unidentified buyer of said puts is in effect counting on a 37% decline in silver prices by that timeframe and is perhaps reinforcing the UBS-originated opinion issued [April 11], that 'it takes a brave investor to buy silver right now.'"

Assuming the above statement contains the truth, the fact that several financial news wires picked up on this and circulated it with a scary headline definitely helped generate a bearish bias in the silver market among inexperienced retail traders. It also undoubtedly resulted in many of them losing their shirts.

Even the normally level-headed market technicians who write for the popular financial blogs apparently fell for the bearish rumor on silver last week. One writer for the popular Seeking Alpha web site called for a 20% correction in the silver price. He based this forecast on the fact that the silver price was dramatically over-extended from the 200-day moving average. The lesson here again is that's extremely dangerous to short an established uptrend based on scanty technical evidence. Unless there is an extremely compelling (and hopefully non-publicized) reason for doing so, the best policy is to refrain from selling short in a bull market.

Now that the evidently false rumors have been discredited by silver's major rally, the shorts have been scrambling to cover and the embarrassed financial press has been desperately searching for "reasons" to explain the latest market action. What's particularly galling is that the very same publication that circulated the tale about the hedge fund manager being a heavy seller of silver has published a new story under the following headline: "Silver Surges Over $46.25/oz as Rumors of a Short Squeeze and Cornering Market Gain Credence." Apparently the publication has gone from publicizing one misleading rumor to another one. The moral of this story is to avoid giving credence to any headline rumor unless the rumor can be conclusively proven.

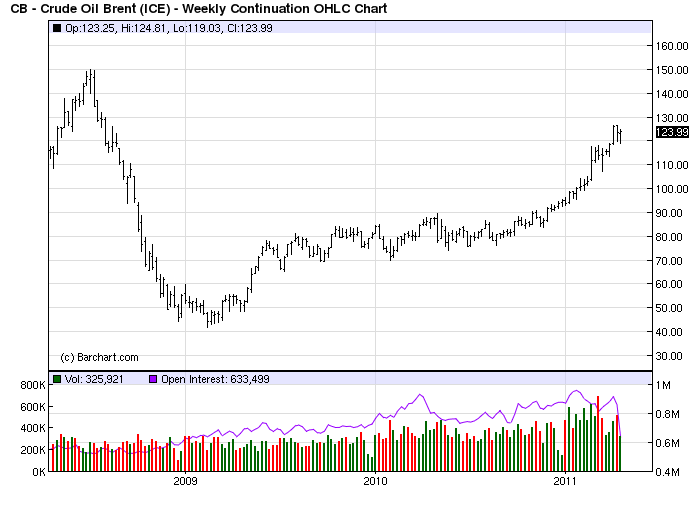

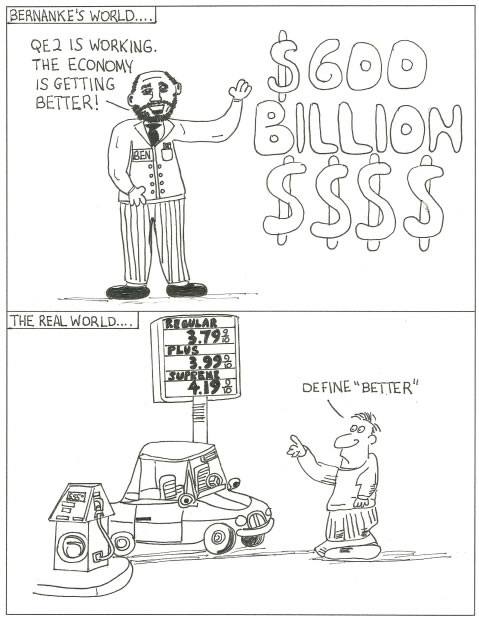

Now let's turn our attention to the energy market. This is something which is going to affect all of us in the weeks and months ahead. As the crude oil price climbs higher and the benchmark price of gasoline inches closer to $4/gallon, the mainstream press continues to shrug it off as being due to "demand from China." As with most major stories, this is only a small piece of the big picture. Much of the rise in the crude oil price can be traced to the Federal Reserve's insistence on keeping the U.S. economy on the equivalent of economic life support via the quantitative easing (QE2) program. Many economic observers believe that this extreme measure isn't as necessary as it was in the early stages of the post-credit crisis recovery.

A growing number of analysts also believe the excessive liquidity, courtesy of the Fed, is finding its way to the commodity markets. Crude oil is a favorite speculative medium of the market-moving hedge fund and institutional traders and the last time speculative funds were funneled into oil it created a massive bubble, the bursting of which coincided with the worst financial crisis since the Great Depression. The oil price rally has been more gradual this time around but it's starting to pick up steam.

The following longer-term graph for Brent crude oil should send shivers down the spine of any serious chart reader. It's currently in the early stages of what can be classified as a potential parabolic blow-off. One can see the crude oil price will soon reach $130/barrel and it doesn't take much imagination to see that a re-test of the previous all-time high of $145/barrel isn't too far off.

It's also evident by now that the retail gasoline price will probably, by summer, reach if not exceed that of the previous all-time high from summer 2008. Of course a rising oil and gasoline price also means rising producer costs, which in turn means higher prices across the board for a wide variety of goods and serves. The economy was much stronger then and it's questionable how much of the rising costs consumers will be able to absorb this time around. Ironically, the Fed may well end up torpedoing the very economic recovery it helped engender through its loose money policy.

The price of gold and silver can initially respond to this in two ways. First, we're likely to see a residual effect from the Fed's loose money policy and indeed we're seeing it now. The current rally in the precious metals is less a measure of fear and uncertainty than of speculative interest from momentum traders.

The second (and more important) way that gold and silver can respond to the emerging oil price crisis is that once it fully dawns on market participants that the oil price increase will undermine the economic recovery they will begin seeking a safe haven. Gold will of course be the first thing that comes to their mind.

While gold is by no means totally immune from panics (as we saw in late 2008), it's relative safety is always recognized once rational thought returns following periods of extreme crises. That's one reason why gold has outperformed stocks and other assets in recent years.

We're entering the final "hard down" phase of the long-wave deflationary cycle. This is where gold should come into its own as the ultimate hedge against the ravages of deflation. And while a runaway oil price may at first glance seem to be inflationary, it's actually deflationary in its longer-term implication since it will lead to lower demand and consumption and, eventually, lower oil prices (price cures price).

Gold & Gold Stock Trading Simplified

With the long-term bull market in gold and mining stocks in full swing, there exist several fantastic opportunities for capturing profits and maximizing gains in the precious metals arena. Yet a common complaint is that small-to-medium sized traders have a hard time knowing when to buy and when to take profits. It doesn't matter when so many pundits dispense conflicting advice in the financial media. This amounts to "analysis into paralysis" and results in the typical investor being unable to "pull the trigger" on a trade when the right time comes to buy.

Not surprisingly, many traders and investors are looking for a reliable and easy-to-follow system for participating in the precious metals bull market. They want a system that allows them to enter without guesswork and one that gets them out at the appropriate time and without any undue risks. They also want a system that automatically takes profits at precise points along the way while adjusting the stop loss continuously so as to lock in gains and minimize potential losses from whipsaws.

In my latest book, "Gold & Gold Stock Trading Simplified," I remove the mystique behind gold and gold stock trading and reveal a completely simple and reliable system that allows the small-to-mid-size trader to profit from both up and down moves in the mining stock market. It's the same system that I use each day in the Gold & Silver Stock Report - the same system which has consistently generated profits for my subscribers and has kept them on the correct side of the gold and mining stock market for years. You won't find a more straight forward and easy-to-follow system that actually works than the one explained in "Gold & Gold Stock Trading Simplified."

The technical trading system revealed in "Gold & Gold Stock Trading Simplified" by itself is worth its weight in gold. Additionally, the book reveals several useful indicators that will increase your chances of scoring big profits in the mining stock sector. You'll learn when to use reliable leading indicators for predicting when the mining stocks are about o break out. After all, nothing beats being on the right side of a market move before the move gets underway.

The methods revealed in "Gold & Gold Stock Trading Simplified" are the product of several year's worth of writing, research and real time market trading/testing. It also contains the benefit of my 14 years worth of experience as a professional in the precious metals and PM mining share sector. The trading techniques discussed in the book have been carefully calibrated to match today's fast moving and volatile market environment. You won't find a more timely and useful book than this for capturing profits in today's gold and gold stock market.

The book is now available for sale at: http://www.clifdroke.com/books/trading_simplified.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter. Published twice each week, the newsletter uses the method described in this book for making profitable trades among the actively traded gold mining shares.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.