Uranium Stocks Continue to Drift Lower

Commodities / Uranium Nov 15, 2007 - 12:53 AM GMTBy: Merv_Burak

Another dull uranium trading day but it just might get more interesting. For the day the Merv's Daily Uranium Index closed up 0.44 points or 0.96%. There were 30 stocks on the up side, 15 stocks on the down side and 5 on no side. As for the performance of the top five stocks by market value, Cameco gained 1.0%, Denison lost 1.7%, Paladin lost 3.8%, UEX gained 7.2% and Uranium One gained 0.5%. Another mixed day. The best performer today was Max Res. with a gain of 13.9% while the worst performer was Consolidated Abaddon with a loss of 6.5%.

Another dull uranium trading day but it just might get more interesting. For the day the Merv's Daily Uranium Index closed up 0.44 points or 0.96%. There were 30 stocks on the up side, 15 stocks on the down side and 5 on no side. As for the performance of the top five stocks by market value, Cameco gained 1.0%, Denison lost 1.7%, Paladin lost 3.8%, UEX gained 7.2% and Uranium One gained 0.5%. Another mixed day. The best performer today was Max Res. with a gain of 13.9% while the worst performer was Consolidated Abaddon with a loss of 6.5%.

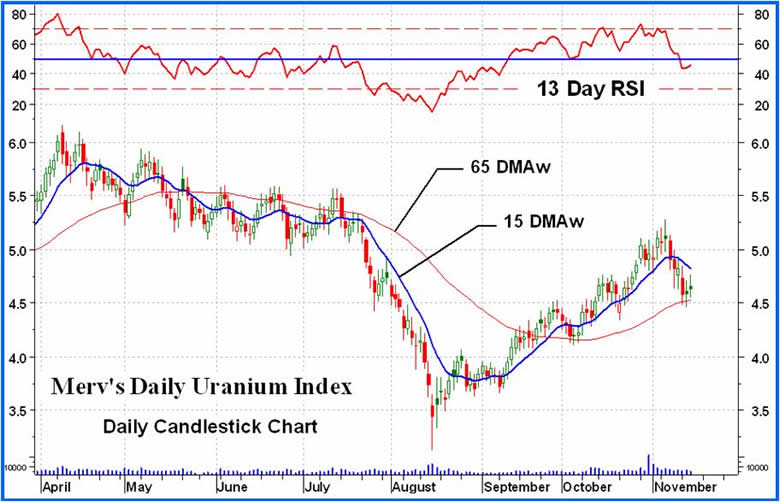

The daily action is getting interesting. The last two days were dull but that's what we often get prior to a trend reversal. On the short term these last two days look very much like those in early October. One might then be expecting some upside activity pretty darn soon. However, there is a slight difference with that October activity. Again, looking at the two candlesticks for the past two days one observes that on both days the closing price was lower than the opening price, unlike the October days where the close was higher than the open.

Whether this is significant or not, I'm not too sure. Only time will tell. This is all in trying to predict the next day's action. As for where the Index (and uranium stocks) stand at the present, from a short term perspective, that's easy. The Index is still below its short term moving average line and the line is pointing lower. The short term momentum (shown) is still below its neutral line although starting to turn up towards the line. For now the short term can only be rated as BEARISH but with the early hints of a reversal ahead.

The intermediate term is also easy. The Index remains above its intermediate term moving average line and the line continues to point upward. The momentum indicator which had been very slightly negative has now moved into the very slightly positive position. Although the daily volume is unimpressive the cumulative effect as viewed on the volume indicator is more on the positive side. With all that I can upgrade the intermediate term rating to + NEUTRAL with another upgrade tomorrow if we have another plus day in the Index.

By Merv Burak, CMT

Hudson Aero/Systems Inc.

Technical Information Group

for Technically Uranium with Merv

Web: http://techuranium.blogspot.com/

e-mail: merv@themarkettraders.com

During the day Merv practices his engineering profession as a Consulting Aerospace Engineer. Once the sun goes down and night descends upon the earth Merv dons his other hat as a Chartered Market Technician ( CMT ) and tries to decipher what's going on in the securities markets. As an underground surveyor in the gold mines of Canada 's Northwest Territories in his youth, Merv has a soft spot for the gold industry and has developed several Gold Indices reflecting different aspects of the industry. As a basically lazy individual Merv's driving focus is to KEEP IT SIMPLE .

This Blog is - A periodic review of the daily or weekly market action in uranium stocks. The review is strictly from the technical perspective. Merv is a pure market technician. Weekly, one will find a table of technical information and ratings of the 50 component stocks of the Merv's Uranium Index as well as a weekly summary of the uranium stock activity. Daily (most days), one will find a daily review of the market action of the Merv's Daily Uranium Index as well as technical analysis of one or more uranium stocks of interest.

Disclaimer - Technical analysis is not perfect. Should you expect perfection this is not the site for you.

Technical analysis IS a very sound technique to assess the daily or weekly trading activities in securities and to assess appropriate timing of investment activities. This blog provides such technical analysis of the trading activity in uranium stocks for your information. Any use made of this information is strictly at the users risk. No guarantees are made for the accuracy or potential for the information provided herein. Use at your own risk. You are strongly advised to check with your broker or investment adviser before activating any investment desisions.

Merv Burak Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.