Gold Transition to the D-Wave

Commodities / Gold and Silver 2011 May 09, 2011 - 03:32 AM GMTBy: Toby_Connor

Don't let the title fool you, for reasons I've outlined in this weekend's report I think gold likely has one more move to new highs before the D-wave begins.

Don't let the title fool you, for reasons I've outlined in this weekend's report I think gold likely has one more move to new highs before the D-wave begins.

However the action in the dollar and silver this week has probably taken the parabolic phase of this C-wave off the table. Rather than the normal sharp spike up it appears that this C-wave is going to end with a more modest move than prior C-waves. That being said it did last much longer and gain just as much above the prior C-wave top as any other C-wave. So in terms of duration and magnitude this C-wave has fulfilled every expectation.

I've noted in the past that a D-wave is a regression to the mean, profit taking event. That regression tends to be most severe when the C-wave ends with a parabolic move. Action and reaction.

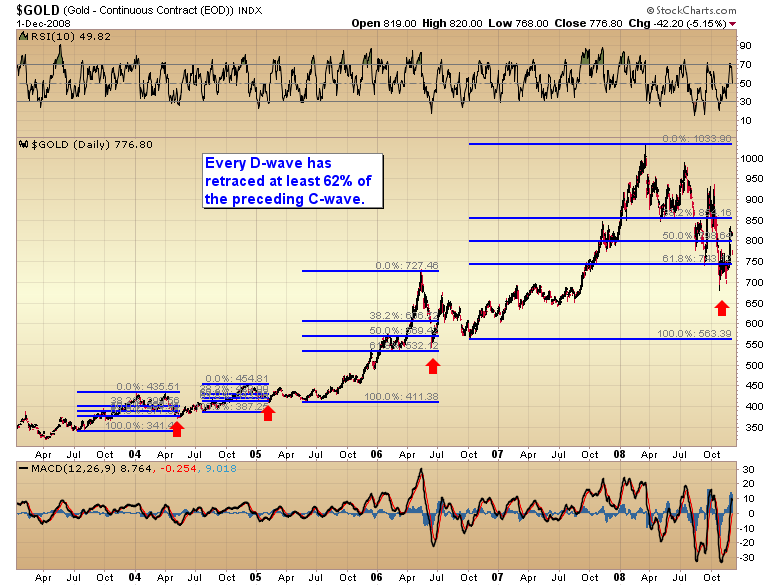

However this time it appears there will likely be no parabolic rally to top the C-wave. In that case the D-wave will probably be milder than prior D-waves. As a point of reference every D-wave so far has retraced at least 62% of the prior C-wave advance.

Without the parabolic stretch I think it's likely that the impending D-wave will only retrace roughly 50% of this C-wave. If gold pushes up to a marginal new high slightly above $1600 (in the weekend report), then it will probably only drop to around $1250 which just happens to mark the upper boundary of last summer’s consolidation zone.

What should follow after that is a fairly strong A-wave surge. A-waves usually test but don't break to new highs. At that point gold will enter a long sideways period to consolidate the massive gains made during this last C-wave. During this period it will get very tough to make money in the precious metals market.

However there is still some upside potential once gold puts in the daily cycle low that is trying to form now. Great potential during the D-wave if you know how to use puts and excellent upside potential during the A-wave next fall, before the metals sink into the consolidation doldrums.

This year still has great opportunities left and of course we still have the next C-wave to look forward to in 2013. That one should make this C-wave look puny in comparison.

To read the rest of the report click here to access the premium website, then click on the Apr. 16 link.

Toby ConnorGold Scents

GoldScents is a financial blog focused on the analysis of the stock market and the secular gold bull market. Subscriptions to the premium service includes a daily and weekend market update emailed to subscribers. If you would like to be added to the email list that receives notice of new posts to GoldScents, or have questions,email Toby.

© 2011 Copyright Toby Connor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Pemba

01 Sep 11, 03:38 |

Smart Money Tracker

Did Toby Connor copy this Article from SMT? http://smartmoneytracker.blogspot.com/2011/05/transition-to-d-wave.html |