Gold in Yen Consolidates Near 120,000 as Japanese Economy Contracts Sharply

Commodities / Gold and Silver 2011 May 19, 2011 - 06:35 AM GMTBy: GoldCore

Gold is lower while silver is higher this morning after yesterday’s 1% and nearly 5% gains respectively. The yen has fallen as markets digest the news that the world’s third largest economy has again fallen into recession after a very sharp contraction in GDP growth in the first quarter.

Gold is lower while silver is higher this morning after yesterday’s 1% and nearly 5% gains respectively. The yen has fallen as markets digest the news that the world’s third largest economy has again fallen into recession after a very sharp contraction in GDP growth in the first quarter.

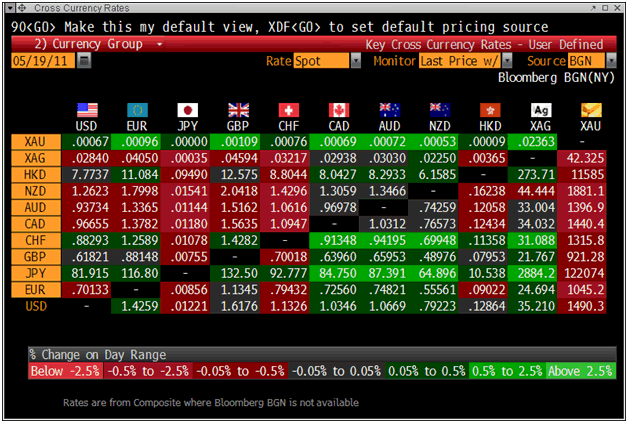

Cross Currency Rates

Japan's economy shrank at an annualized rate of 3.7% in the January to March quarter, almost double the margin economists had ‘forecast’.

The risk is that the effects of Japan’s disaster are likely to be felt more in the 2nd quarter from April to June meaning that Japan’s economy will likely contract even more sharply in the coming months.

The world’s third largest economy falling into recession has obvious ramifications for the global economy. Japan’s crisis is already affecting the U.S. and global economy. In the U.S., production of auto and related parts in April fell nearly 9 percent from the previous month.

A major factor in the decline was the impact of the Japanese disaster which disrupted parts supplies.

Japan is the primary source of machined parts used to make automobiles and other machines globally. Japan is also a major supplier for computer chips and electronic components.

The disaster has greatly affected Japans ability to continue to supply these critical parts. Because the global economy relies on a “just-in-time” supply system, there is little or no inventory of many of these critical parts which are made in Japan.

This has significant ramifications for industrial production and manufacturers globally and may lead to a decline in profits and a further increase in unemployment.

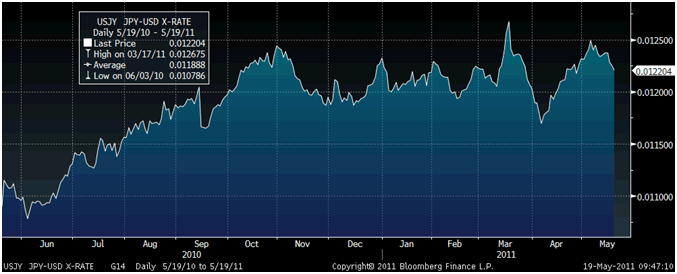

Gold in Japanese Yen – 1 Year (Daily)

Most Wall Street and City of London analysts have completely underestimated the risk posed by the Japanese natural disasters and deepening nuclear crisis. Thus, the risk of a return to recession and even depression in Japan is completely underestimated.

Japan, like most of the western world, is massively indebted with Japan's government debt-to-GDP ratio projected to top 200 percent this year, the heaviest in the industrialised world. Greek’s debt load is set to rise to 160% of GDP growth next year which is close to the levels seen in Zimbabwe which recently experienced hyperinflation.

Complacent analysts reassure that unlike Greece and Zimbabwe, much of Japan’s debt is held by domestic savers and the belief is that they are unlikely to sell their yen paper assets.

This assumption is highly questionable as in the event of inflation deepening and the yen continuing to fall on international markets, Japanese savers are likely to diversify out of yen denominated bonds and cash.

Ireland too had a large domestic savings base denominated in euros but this did not protect it from a sovereign debt crisis.

Massive public debt in Japan, in conjunction with very poor demographics and a shrinking population mean that Japan is increasingly vulnerable to a sovereign debt and or currency crisis.

The “past performance” of Japan’s deflation of recent years may not be indicative of future performance.

The current and continuing response of the Japanese authorities is the printing of trillions and trillions of more yen and further fiscal and monetary profligacy.

Thus, Japan looks likely to be entering a period of much higher inflation. This creates the real risk of virulent stagflation and even of hyperinflation in the coming years.

Gold in Japanese Yen – 40 Year (Weekly)

Gold in Yen Consolidates Near 120,00 and Record Nominal High of 200,000 Yen Likely

Gold’s rise in yen (see charts above) has been very gradual in recent years due to the yen’s relative strength versus other fiat currencies.

Gold in yen has had a period of massive consolidation in recent months and this base will likely be the spring board for much higher prices in the coming weeks and months.

For some 9 months, since September 2010, yen gold has consolidated over 115,000 yen per ounce (see chart above).

Yen gold is likely to rise above its nominal high of 200,000 yen seen over 31 years ago on January 18th, 1980. In the longer term, the inflation adjusted high of over ¥500,000/oz is quite possible given Japan’s dreadful fiscal and monetary position.

News and Commentary can be found on our home page

Gold

Gold is trading at $1,494.58/oz, €1,047.06/oz and £923.09oz.

Silver

Silver is trading at $35.57/oz, €24.92/oz and £21.96/oz.

Platinum Group Metals

Platinum is trading at $1,772.50oz, palladium at $733/oz and rhodium at $2,025/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.