Emerging Market Central Banks Continue to Raise Interest Rates

Interest-Rates / Central Banks Jun 04, 2011 - 11:58 AM GMTBy: CentralBankNews

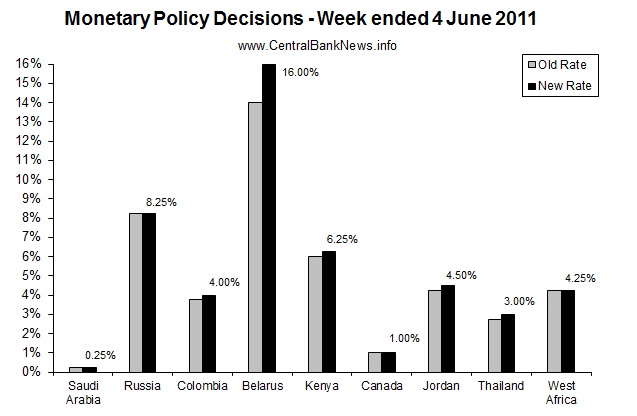

The past week in central banking saw monetary policy announcements from 10 different central banks. Of those announcing interest rate decisions, the following central banks increased their main policy interest rates: Colombia +25bps to 4.00%, Belarus +200bps to 16.00%, Kenya +25bps to 6.25%, Jordan +25bps to 4.50%, and Thailand +3.00%.

Those that held interest rates unchanged were: Saudi Arabia 0.25%, Russia 8.25%, Canada 1.00%, and the West African States 4.25%. Russia did however increase another one of its interest rates, the overnight deposit rate, +25 basis points to 3.50%. Also announcing monetary policy changes was Vietnam, which increased its reserve requirements by 100bps, and lowered interest rate caps on US dollar accounts.

So it was very much a continuation of the theme of emerging market monetary policy tightening as relatively strong growth in emerging markets has continued to spur on inflation. Aside from rising aggregate demand, most emerging markets are seeing rapid expansion in credit, and are also seeing the inflationary effects of higher global food and energy prices.

Indeed, one of the "BRIC" economies, Russia made another tightening adjustment to its monetary policy settings, meanwhile another BRIC economy, the People's Bank of China is rumored to be planning an interest rate increase within the week ahead. The question of when do developed market central banks become more worried about inflation may be made clearer next week when the central banks of Australia, New Zealand, the UK, and EU announce monetary policy decisions.

Indeed, next week is a busy week in monetary policy; in the emerging market space the National Bank of Poland meets on the 8th of June (expected to hold at 4.25%), then there's theBanco Central do Brasil also on the 8th (expected to increase 25bps from current 12.00%), and the Bank of Korea on the 10th of June (expected to hold at 3.00%). In developed markets the Reserve Bank of Australia announces its interest rate decision on the 7th of June (expected to hold at 4.75%), the Reserve Bank of New Zealand is on the 9th (expected to hold at 2.50%), as is the Bank of England (expected to hold at 0.50%), and the European Central Bank (expected to pause its tightening again at 1.25%).

Source: www.CentralBankNews.info

Article source: http://www.centralbanknews.info/2011/06/monetary-policy-week-in-review-4-june.html

© 2011 Copyright centralbanknews - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.