Emerging Market Central Banks Continue to Tighten Interest Rates

Interest-Rates / Central Banks Jun 18, 2011 - 10:16 AM GMTBy: CentralBankNews

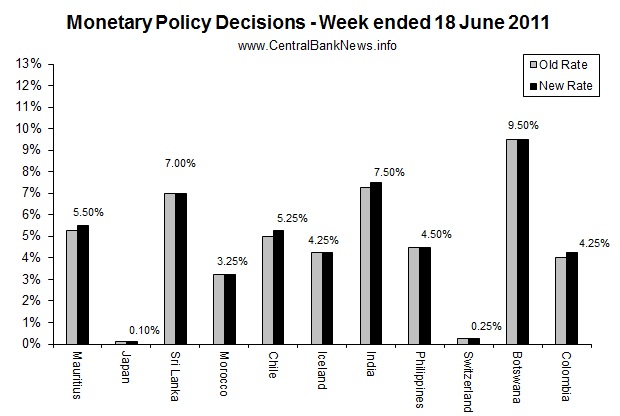

The past week in monetary policy saw a range of tightening measures announce by emerging market central banks. Of those that increased interest rates were: Mauritius +25bps to 5.50%, Chile +25bps to 5.25%, India +25bps to 7.50%, and Colombia +25bps to 4.25%. Meanwhile those that reviewed policy but held rates unchanged were: Japan 0.10%, Sri Lanka 7.00%, Morocco 3.25%, Iceland 4.25%, Philippines 4.50%, Switzerland 0.25%, and Botswana 9.50%. Aside from interest rates the People's Bank of China raised its required reserve ratio by another 50 basis points to an average 21.5%, likewise the Philippines central bank raised its reserve requirements by 100 basis points.

So in total the week saw 6 monetary policy tightening measures from emerging market economies (Mauritius, China, Chile, India, Philippines, and Colombia).

The common themes among those that tightened were comments around upside inflation risks, with still high commodity prices, low or no excess capacity (output gaps), and still relatively high levels of economic growth (aggregate demand). But another common theme was the balance between economic growth and inflation, with most of the central banks (emerging markets) viewing inflation as the greater challenge, tempered against almost universally recognized global risks to domestic growth, e.g. Euro Zone debt issues.

Next week the following Central Banks meet to review monetary policy settings: Hungary: Magyar Nemzeti Bank - 20 June (expected to hold at 6.00%), Norway: Norges Bank - 22 June (expected to hold at 2.25%), US Federal Reserve's FOMC - 22 June (expected to hold at 0.25%), Czech National Bank - 23 June (expected to hold at 0.75%), and the Central Bank of the Republic of Turkey - 23 June (expected to hold at 6.25%). Aside from those monetary policy meetings, the Reserve Bank of Australia (21 June) and the Bank of England (22 June) will release the minutes of their most recent monetary policy committee meetings.

Source: www.CentralBankNews.info

Article source: http://www.centralbanknews.info/2011/06/monetary-policy-week-in-review-18-june.html

© 2011 Copyright centralbanknews - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.