Stock Market Update: The Remedy to Sideways Markets

Stock-Markets / US Stock Markets Dec 09, 2007 - 12:28 AM GMTBy: Dominick

If Friday felt like a real sleeper, then I'm sorry to say we may have a few more days' sideways trading in store for us ahead of the Fed. At TTC we currently have three distinct patterns for this rally off the recent lows, but by Tuesday evening we'll be looking to have one or two of those invalidated. And as alternates are eliminated, we continue to buy and sell every wiggle.

If Friday felt like a real sleeper, then I'm sorry to say we may have a few more days' sideways trading in store for us ahead of the Fed. At TTC we currently have three distinct patterns for this rally off the recent lows, but by Tuesday evening we'll be looking to have one or two of those invalidated. And as alternates are eliminated, we continue to buy and sell every wiggle.

This week's action further demonstrated the degree to which the Street was short this market and that we were fairly on our own two weeks ago calling for the start of some action to the upside. Last week's update left off with TTC looking for a pause in a Santa Claus rally that should ultimately extend well into 2008. Tuesday's gap down confirmed our expectations, but the shallowness of the pullback proved bears were now using to dips to cover.

The explosive gap and go rally on Wednesday further verified the short covering thesis. As price closed in on our target, some thirty points from the support we bought, the following chart was posted to show the completion of a perfect move and the prudence of taking some profits.

About an hour after that posting, the market dropped sharply and the move was captured well by our proprietary RSI indicator, shown below. The target for the decline at that time became 1477.25, which was hit to the tick. After a quick reversal, it was smooth sailing as the market raced up to close at the highs and held them into the weekend.

The indicator above illustrates the nice, juicy moves that can be caught in the major indices during these volatile market periods. But as easy as we may make it look here, it takes a lot of time and patient attention to be on top of these intraday trades at all times. Even worse, you get days like Friday where there's not much tradable action at all no matter how much effort you put into it.

The remedy for this at TTC has always been to trade other clearly trending markets. As much as the newsletter focuses on the ES, there's practically nothing we don't trade, from currencies to commodities to bonds and foreign indices. For example, this past week the multi-week reversal in the EUR/USD we've been expecting finally started getting some media attention and, going forward, we're preparing to make some more trades there.

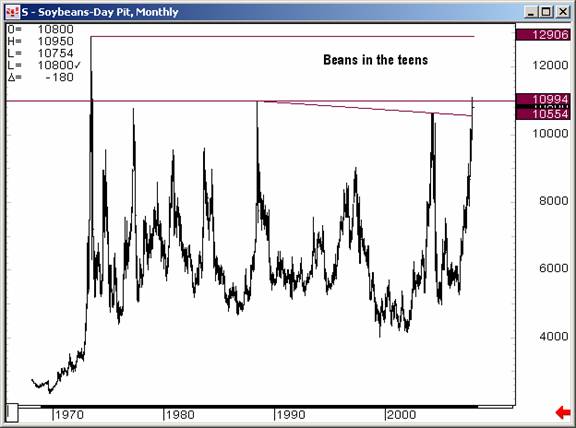

And talk about beans in teens – soybeans have been moving ten to twenty ticks per day lately. While many traders pull out their hair trying to catch a few points in the broader market, TTC turns to the clear trends for the relatively easy money. Of course, moves in beans don't snag the CNBC headlines, so most traders don't know how to trade them, but watch out, beans aren't going to $20 here, and if you do someday soon hear about them on the news, it's probably time to sell.

And of course then there's oil. Remember when $100 looked inevitable? Now you can't sell crude for $90. TTC, however, had a fantastic week in oil, first using a beautiful target at $86.50. When crude dropped about fifty cents below the target Wednesday night, some of our members thought we'd taken out the support level, but Thursday justified our longs with a quick move back to almost to $90. To top it off, we put out a sell on crude Thursday night and after some squiggles, crude went out at about our next target, $88.50, giving us about $5 in 24 hours.

So there shouldn't be much mystery about what TTC is doing next week if we get a sleepy stock market pre-Fed. Oil, soybeans, euro – these trends aren't finished. A single focus on the ES during slow days just won't be as profitable as learning to trade in multiple markets. And, fortunately, TTC is just the place to learn these markets if they're unfamiliar. If you're looking for a place to give and take information, to share charts and become a better trader in multiple market, TTC is for you.

Finally, a reminder that TTC will be raising its monthly membership fee to $129 on February 1, 2008. If you join now you can take advantage of the current $89 fee and be grandfathered in when we close our doors to retail investors sometime next year depending on sentiment amongst the membership. Over the past several months TTC has become a haven for institutional investors and in 2008 we're going to make a concerted effort to make the institutional side our primary focus. Only existing retail members will continue to be admitted after the cutoff, so if you've been holding out, the time to join is now!

Don't forget about TTC's Pick the Tick Constest, taking end of the year predictions until Tuesday! Win a 5-oz fine silver round with our custom design if you call the closing price on the Dow and other indices. Click for more details!

Have a profitable and safe week trading, and remember:

“Unbiased Elliott Wave works!”

By Dominick

www.tradingthecharts.com

If you've enjoyed this article, signup for Market Updates , our monthly newsletter, and, for more immediate analysis and market reaction, view my work and the charts exchanged between our seasoned traders in TradingtheCharts forum . Continued success has inspired expansion of the “open access to non subscribers” forums, and our Market Advisory members and I have agreed to post our work in these forums periodically. Explore services from Wall Street's best, including Jim Curry, Tim Ords, Glen Neely, Richard Rhodes, Andre Gratian, Bob Carver, Eric Hadik, Chartsedge, Elliott today, Stock Barometer, Harry Boxer, Mike Paulenoff and others. Try them all, subscribe to the ones that suit your style, and accelerate your trading profits! These forums are on the top of the homepage at Trading the Charts. Market analysts are always welcome to contribute to the Forum or newsletter. Email me @ Dominick@tradingthecharts.com if you have any interest.

This update is provided as general information and is not an investment recommendation. TTC accepts no liability whatsoever for any losses resulting from action taken based on the contents of its charts, commentaries, or price data. Securities and commodities markets involve inherent risk and not all positions are suitable for each individual. Check with your licensed financial advisor or broker prior to taking any action.

Dominick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.