What a Major Banking Crisis Would Do To the Gold Price

Commodities / Gold and Silver 2011 Sep 16, 2011 - 11:59 AM GMT Loss of Faith and the Decay of Trust in Measured Terms

Loss of Faith and the Decay of Trust in Measured Terms

With the downgrade of Societe General and Credit Agricole, two of the largest French banks, because of their Greek debt holdings, it is certain that any default by Greece (which still looks more than likely) will trigger major banking crises. Moody's lowered Credit Agricole to Aa2 from Aa1 because of its Greek holdings, and will continue to review the impact of funding markets on the rating. Societe Generale was reduced to Aa3 from Aa2, with a negative outlook, as Moody's re-evaluated its level of state support. BNP Paribas (BNP) SA, the largest French bank, had its Aa2 long-term rating kept on review for a possible cut. French lenders top the list of Greek creditors with $56.7 billion in exposure to private and public debt. BNP Paribas has declined 41% in Paris trading this year, Credit Agricole has fallen 46% and Societe Generale has dropped 55% on escalating concern that the European sovereign debt crisis is turning into a banking crisis.

Deposits by financial institutions in Greek banks, which make up 21% of the total, have fallen by one-third since the beginning of 2010, while those by non-financial firms and residents dropped 9%, according to Bank of Greece data. In Germany, deposits by financial institutions, which account for one-third the total, declined 12% over the same period and 24% since the September 2008 collapse of Lehman Brothers Holdings Inc. In France, where the erosion started last year, the same type of deposits, which make up half the total, are down 6% since June 2010. They have fallen 14% since May 2010 at Spanish banks, where they account for one-fifth of the total. Deposits include money kept in banks by individuals and companies. Most of the short-term funding supplied by financial institutions and money funds is counted as deposits by the E.C.B. and other central banks in Europe. While retail deposits at Italian banks have fallen only 1% in the past year, the outflow of money from financial institutions has exceeded $100 billion, a 13% decline, according to Bank of Italy and E.C.B. data. In Portugal, where banks raised the interest rates they pay savers, non-residents have reduced deposits by 19% since March 2010.

The eight largest U.S. money-market funds halved their lending to German, French and U.K. banks over the past 12 months and stopped financing Italian and Spanish financial firms. A survey by Fitch Ratings showed that U.S. money-market funds reduced their lending to European banks by 20% from the end of May through July. The funds cut investments in Spanish and Italian lenders by 97%, to German firms by 42% and to French ones by 18%. The Aug. 22 survey covers almost half the $1.53 trillion assets held by money funds in the U.S.

The trouble is that the interwoven nature of banks holding all sovereign debt is as complex as a spider's web. So if a major bank, or banks, sag beneath such burdens, so will a host of as yet unnamed other banks. This will give new meaning to the word 'contagion'. As it is, the smell of a 'run' on banks is in the air.

Retail and institutional deposits at Greek banks fell 19% in the past year and almost 40% at Irish lenders in 18 months. Meanwhile, European Union financial firms are lending less to one another and U.S. money-market funds have reduced their investments in German, French and Spanish banks. While the European Central Bank has picked up some of the slack, providing about €500 billion ($685 billion) of temporary financing, banks are cutting lending, which could slow growth in their home countries. They're also paying more to keep and attract deposits or, in the case of Italy, selling bonds to retail customers for five times the interest they offer on savings accounts, which will erode profitability. It shows that even European banks don't trust each other anymore, so they're taking their money out of the E.U. system. It's similar to the distrust that happened worldwide in 2008.

In essence, what faith that remains Eurozone is centered in the European Central Bank. To make up their deficits, firms are leaning on the E.C.B. for short-term funding. Borrowing by Italian lenders from the central bank more than doubled to €85 billion between June and August. Greek and Irish banks each took about €100 billion from the E.C.B. in August. Irish lenders also got €56 billion from their domestic central bank. Portuguese banks borrowed about €46 billion from the E.C.B., while Spanish banks took €52 billion in July. What was the collateral that gave the E.C.B. cause to lend? It was government bonds that were not able to raise funds at reasonable rates in the market place. Could the E.C.B. cash in these bonds? It's possible but with the E.C.B. the seller, they would not even fetch a small percentage of their face value.

Will it Get Worse?

With Greece finding it more and more difficult to find the money to manage their awful debt situation as the country is forecast to suffer a 5% recession now the cash flow from government receipts is dropping quickly. The sale of government owned assets is telling a similar story with assets priced at €1.2 billion fetching around €400 million. Let's face it, avoiding bankruptcy is all about an adequate cash flow and that's looking unreachable.

Market talk is that Greece could leave the Eurozone and its debts behind it, despite Merkel and Sarkozy being convinced it won't. If they do they will have to return to the Drachma! To prevent massive exits of Capital, we have no doubt that they will have to make it a two-tier currency -one for financial transactions at a deep discount to the other [30+%?] and the other at a reasonable level for trade and tourism transactions. Greece will have some of the nicest and low-priced holidays on offer. Remember, runaway inflation starts with stringent liquidity problems!

European and Worldwide Banking System Will There Be a Role for Gold?

The ripple effect of a Greek exit from the Eurozone in a bankrupt state will not only savage their balance sheet but trigger fears in the remaining depositors that their banks could be next. The structure of the banking system is so interwoven that it is possible that it will seize up, if only for a while. Trust in government's finances in the developed world is already at a low. It will take governments to act 'in concert' to save the banking industry, such as we have seen in the U.S.A. but internationally.

This is happening right now!

Failure to do so will result in some spectacular bank collapses. With the monetary system going into shock the need for a reference point for value becomes critical. The head of the World Bank, Mr. Zoellick, called for gold to be used in that role last year. His warnings this week of the dangers facing the world reiterate the depth of the crisis and validate last year's call. We wonder if the global monetary authorities will now listen.

This crisis will change the role of gold in the future

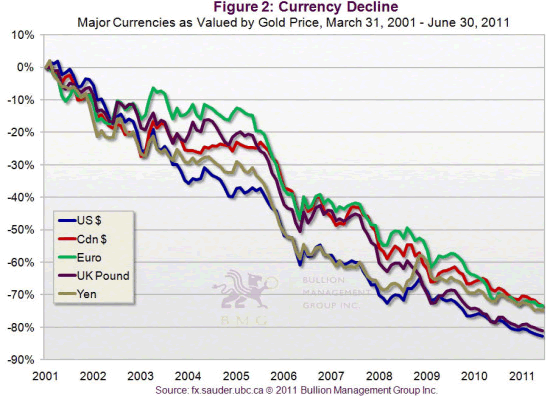

- Question of Currency Value

- Gold Price in These Currencies

Gold Forecaster regularly covers all fundamental and Technical aspects of the gold price in the weekly newsletter. To subscribe, please visit www.GoldForecaster.com

By Julian D. W. Phillips

Gold-Authentic Money

Copyright 2011 Authentic Money. All Rights Reserved.

Julian Phillips - was receiving his qualifications to join the London Stock Exchange. He was already deeply immersed in the currency turmoil engulfing world in 1970 and the Institutional Gold Markets, and writing for magazin![]() es such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

es such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

What is Gold-Authentic Money all about ? Our business is GOLD! Whether it be trends, charts, reports or other factors that have bearing on the price of gold, our aim is to enable you to understand and profit from the Gold Market.

Disclaimer - This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold-Authentic Money / Julian D. W. Phillips, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold-Authentic Money / Julian D. W. Phillips make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold-Authentic Money / Julian D. W. Phillips only and are subject to change without notice.

Julian DW Phillips Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.