Gold, DAX Stocks Index and US. Dollar Still Pointing to Sharply Lower Prices

Stock-Markets / Financial Markets 2011 Oct 06, 2011 - 12:06 PM GMTBy: Chris_Vermeulen

The past month has been a wild ride for both equity and commodity traders around the globe. Novice traders have had their heads handed to them and their investment accounts drained. When fear, uncertainty and volatility are running high, some of the best opportunities become available to those who know what to look for. These market conditions force you to focus and strive for perfection in finding low risk entry setups and to also actively managing positions with laser focus because within hours a winning trade can turn into a losing trade.

The past month has been a wild ride for both equity and commodity traders around the globe. Novice traders have had their heads handed to them and their investment accounts drained. When fear, uncertainty and volatility are running high, some of the best opportunities become available to those who know what to look for. These market conditions force you to focus and strive for perfection in finding low risk entry setups and to also actively managing positions with laser focus because within hours a winning trade can turn into a losing trade.

Looking back on the daily charts of the dollar, SP500, gold, and also the overseas markets it looks as though we are nearing a market bottom. I say NEARING because I think investments need more time for the current selling pressure and bearish sentiment to run its course, which could take another few weeks and possibly a few month before truly bottoming.

Let’s take a quick look at some charts...

SPY 30 Minute Chart Looking Back 2 Months

As you can see below price action has been wild. But for subscribers to my newsletter it has been a fun and exciting time having pocketed over 40% return from August 1st – up until today.

The point of this chart is to show you the basic market phases (Impulse, Uncertainty, and Corrective). Understanding how to identify each phase using momentum, price action, volume analysis and market sentiment is crucial for success in today’s volatile market. Once mastered you can trade virtually any investment with a high level of confidence, though I recommend mastering 3-4 investments at most and just trading those full time with pinpoint accuracy. Through my newsletter members learn exactly how to read the market and manage positions from my daily video market analysis, intraday updates, trade alerts and trading tips.

As you can see below I am anticipating weakness in the market over the next few days. Once those levels are reached or if the charts start hinting that a reversal back down is imminent I will be ready to take action using an inverse leveraged ETF.

Gold 30 Minutes Chart Looking Back 2 Months

This chart will piss some people off for sure... but the chart to me is still pointing to lower prices at this time. Until we get a breakout above the upper resistance level I am not bullish on gold. Keep in mind that during strong selloffs in the stock market almost all investment drop together (gold, silver, oil, stocks).

German DAX Daily Chart Looking Back 3 years

This chart shows the long term chart of the DAX which I think is giving us some insight to a global market bottom in the coming months. You will notice I painted the phases over the chart and where I feel the market is trading and where it is headed looking forward.

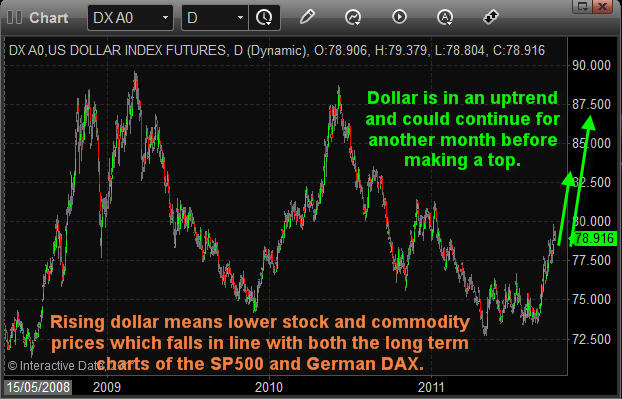

Dollar Index Daily Chart Looking Back 3 Years

The dollar also shows us three years for price action. If this strong rally continues in the dollar we will see lower stock and commodity prices for a few more months.

Trend Trading Idea Conclusion:

In short, I feel we have some very exciting times ahead along with huge potential trades starting to unfold. While I don’t want the market to collapse I will admit I prefer trading the short side of the market because fear is easier to trade than greed, not to mention prices drop much quicker than they rise... I’m sure you like making money fast also... J

If you would like to receive my daily pre-market trading videos so you know exactly what to expect each session along with my ETF trades be sure to join my free newsletter and get my free book here: http://www.thegoldandoilguy.com/trade-money-emotions.php

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.