UK House Prices Fall 3.2% in December - On Target for 2008 Crash

Housing-Market / UK Housing Dec 17, 2007 - 01:41 AM GMTBy: Nadeem_Walayat

Rightmove survey announced a 3.2% drop in UK House price asking prices in the month from Mid November to mid December. This was the sharpest decline since rightmove's records began in 2002. The sharpest drop of 6.8% was in London with average house prices falling by a whopping £28,000 in one month.

Rightmove sited the implementation of the home information packs (HIPs) for the sharp drop. The impact of the HIPs was inline with the Market Oracle warning of 23rd November 07 - UK Housing Market to be Hit by the Big HIPs Freeze During December.

Despite the sharp drop, rightmove who have a vested interest as an estate agency are still forecasting a stagnating market during 2008 and call for the Bank of England to cut UK interest rates by a further 0.5% early 2008 to support the UK housing market. The Market Oracle forecast as of 22nd August 07 , is for UK interest rates to fall to 5% by September 2008, with the first cut scheduled to occur in January 2008 having come a month early.

The UK housing market continues deteriorate and is expected to result in annualised UK House price inflation going negative for the first time since the early 1990's by April 2008. The buy to let sector rush for the exit to take advantage of the change in UK capital gains tax rules effective 1st April 2008 as well as buy to lets no longer remaining a viable investment in the face of falling house prices.

An additional sign of the housing slump accelerating was illustrated in my recent analysis of the sharp deterioration in the ability of houses to sell at auction, with the number of sales falling from 97% in January 2007 to 71% by November 2007, typical auction house.

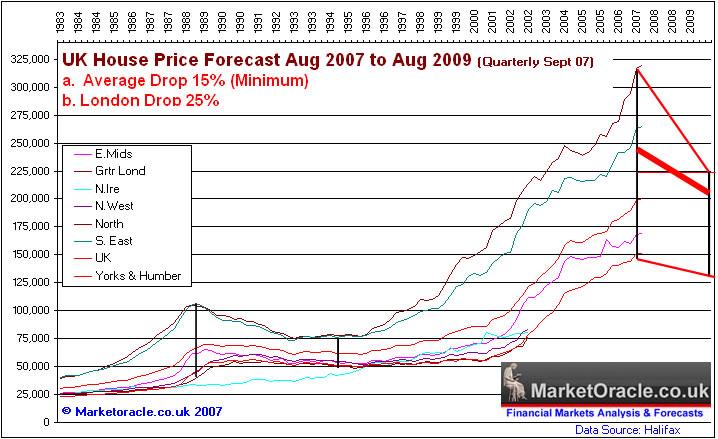

The Market Oracle forecast is for a 15% drop in UK House over the next 2 years with London expected to drop by as much as 25%, as of 22nd August 07.

The UK property market remains at historically high unaffordability levels as illustrated by the Market Oracle UK House Price Affordability Index.

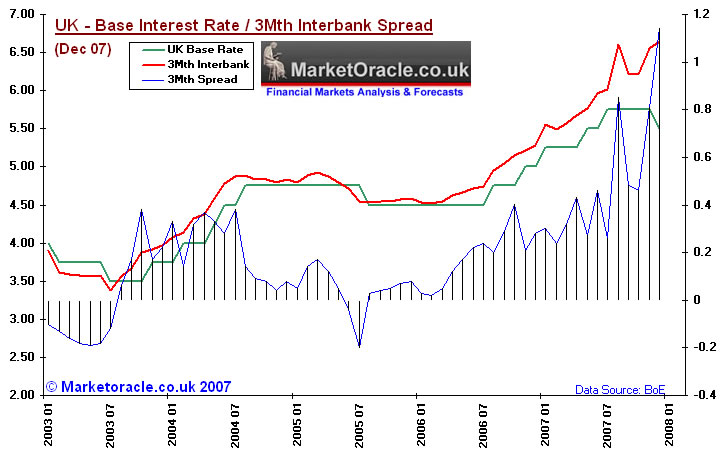

Affordability is expected to worsen as credit market conditions for home buyers continue to worsen with no sign that the recent cut in UK interest rates and the concerted central banks intervention has any significant impact on the interbank money markets. With the 3 month LIBOR rate still a full 1% above the base rate of 5.5%, when during the start of a rate cutting cycle the rate should be discounting anticipated future cuts by trading at below the base rate. Analysis of Interbank and Base Interest Rate Spread

The resulting impact on the UK economy of the credit crisis will lead to sharply lower growth with the Market Oracle forecast of 1.5% increasingly looking optimistic as the UK economy heads towards stagnation.

Current Market Oracle Housing Market / Interest Rate and Inflation Forecasts:

UK Housing Market Forecast for 2008-09 - As of 22nd August 2007 |

||||

UK House Prices to fall by 15% over two years, falling prices to be accompanied by cuts in UK interest rates. (22nd Aug 07), |

||||

|

UK Interest Rate Forecast for 2008 - As of 22nd August 2007 |

UK Interest Rates to Fall to 5% by September 2008, First Cut in UK Interest Rates to Occur in January 2008 (22nd Aug 07) |

18th Sept 07 - UK Interest Rates Forecast to Fall to 5% by September 2008 |

UK Interest Rate Forecast for 2007 - As of 26th December 2006 |

UK Interest Rates to Peak at 5.75% between Aug and Oct 07(26th Dec 06) |

7th Nov 06 - UK Interest Rates could rise to 5.75% in 2007 |

UK Inflation Forecast for 2008 - As of 26th Nov 2007 |

Despite the current upward trend continuing into the immediate future, UK Inflation as measured by the RPI is expected to fall sharply to or below 3% by November 2008 (current 4.2%). The CPI is expected to fall to 1.8% by November 2008 (current 2.1%). (26th Nov 07) |

By Nadeem Walayat

Copyright (c) 2005-07 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading, analysing and forecasting the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 100 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.