Analysis of Interbank and Base Interest Rate Spread

Interest-Rates / UK Interest Rates Dec 07, 2007 - 12:58 AM GMTBy: Nadeem_Walayat

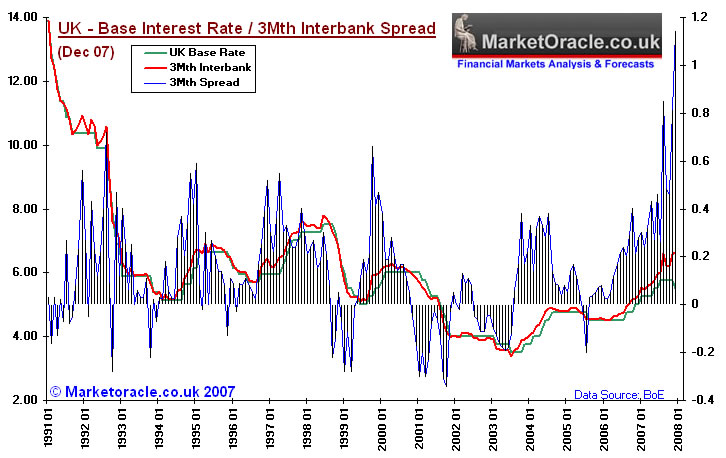

The Bank of England cut UK interest rates on Thursday. One of the primary reasons for the cut was the credit crunch, and specifically its impact on the interbank money markets, which has seen the interbank rates soar since the credit crunch exploded on the scene during August 07, due to the fact there is an increased risk of default and lack of liquidity despite subsequent liberal amounts of liquidity released by the US Fed and the European Central bank. Therefore this article analyses the spread between the base interest rate as set by the Bank of England and the money markets 3 month inter-bank lending rate.

The Bank of England cut UK interest rates on Thursday. One of the primary reasons for the cut was the credit crunch, and specifically its impact on the interbank money markets, which has seen the interbank rates soar since the credit crunch exploded on the scene during August 07, due to the fact there is an increased risk of default and lack of liquidity despite subsequent liberal amounts of liquidity released by the US Fed and the European Central bank. Therefore this article analyses the spread between the base interest rate as set by the Bank of England and the money markets 3 month inter-bank lending rate.

What is the 3 Month Interbank Rate ?

The interbank rate known as the London Interbank Offered Rate (LIBOR) is based on the rates at which banks in London tend to lend one another on the interbank money market. The 3 month rate are basically the rate charged on loans to banks that are due for repayment in 3 months time. This enables banks with large surplus cash to quickly lend money to bank for various terms to other financial institutions. The freeze in the credit markets has occurred due to the collapse in the mortgage backed securities market leaving many banks with illiquid assets that they are not able to price properly and hence the banks are now more reluctant to lend one another and therefore there is less liquidity available and hence higher premium over the base interest rate.

Historic Movements in the Interbank Rate Spread

The Long-term interbank / base rate spread chart suggests the following key patterns of behavior

1. The 3 month interbank rate tends to lead the BoE base interest rate, especially at market junctures.

2. That Peaks in the Spread usually occur some time before both interest rates tend to peak.

Current 3Month Interbank / Base Rate Spread

The spread over the past 4 months has hovered at historic extreme levels of more than 0.8% above the base rate which normally signifies that interest rates are still some way off from a peak. However the Bank of England confirmed the forecast peak in interest rates of 5.75% by yesterdays cut to 5.50%.

So far the cut has failed to have any significant impact on the interbank rate which stands currently at 6.64%, which has resulted in the spread increasing to 1.14%. This illustrates the current extreme impact of the credit crunch liquidity squeeze that is not only impacting the financial sector but now hitting the whole UK economy and is likely sounding alarm bells throughout the financial sector and at the Bank of England.

What this suggests to me is that the trend towards greater liquidity and lax credit financing requirements in terms of risk for the past 17 years has now come to an end for the foreseeable future at least. The spread confirms earlier analysis, that the housing market is now in a bear market whereby the credit markets will continue to retain a large positive spread despite the forecast cuts in UK interest rates to 5% during 2008. This means there is expected to be little relief for the UK consumer and home owner from these cuts, against what one would expect during the past rate cutting cycles that would result in a neutral to negative bias to the spread.

Who are the Winners ?

Its a little early to see who will be the winners, however I do expect after a temporary cut in UK savings rates, savers should again experience higher interest rates due to lack of liquidity amongst the financial intuitions. Also the cuts in interest rates should help to support the corporate sector and stock prices, as the spread between the dividend yield and the base rate makes stock ownership more favorable especially in a climate of falling house prices as potential investors buoyed by the relative strength of the stock market in the face of bad economic news will increasingly be attracted to the stock market as an investment option.

When will the Credit Markets Unfreeze ?

The Market Oracle forecast is for the bear market in UK housing market to continue well into 2009, so I do not expect an unfreezing anytime soon as the UK housing bear market has barely begun. The first signs of the credit markets unfreezing will be seen in the drop of the spread to what one would expect during a rate cutting cycle, i.e. for the spread to dip towards neutral or to below zero, which at this point seems highly unlikely during 2008.

For more on UK Interest Rates see yesterdays article - UK House Prices Slump 1.1% - Interest Rate Cut?

By Nadeem Walayat

Copyright (c) 2005-07 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading, analysing and forecasting the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 100 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.