Gold Rallies on Euro-zone Inflation Solution

Commodities / Gold and Silver 2011 Oct 31, 2011 - 02:48 AM GMTBy: Clive_Maund

No politician wants to end up with his head adorning the railings of some public building, and thus - possibly spurred into action by the video of the grisly end of Colonel Gaddafi - European leaders started to display qualities normally totally alien to them last week, in particular unity and resolve and a rare sense of urgency, in dealing with the acute crisis facing Europe. It did not go as far as statesmanship, however, because that would involve actually dealing with the root causes of the crisis, although with the best will in the world it's too late for that, so instead, predictably, they decided to fall in line with the tried and tested US solution to all economic problems, which is to print money and sell more debt - if they can find anyone dumb enough to buy it, that is, and a nice touch later in the week was the sight of a European representative going cap in hand to meet people with real hard cash in their pockets, the Chinese.

No politician wants to end up with his head adorning the railings of some public building, and thus - possibly spurred into action by the video of the grisly end of Colonel Gaddafi - European leaders started to display qualities normally totally alien to them last week, in particular unity and resolve and a rare sense of urgency, in dealing with the acute crisis facing Europe. It did not go as far as statesmanship, however, because that would involve actually dealing with the root causes of the crisis, although with the best will in the world it's too late for that, so instead, predictably, they decided to fall in line with the tried and tested US solution to all economic problems, which is to print money and sell more debt - if they can find anyone dumb enough to buy it, that is, and a nice touch later in the week was the sight of a European representative going cap in hand to meet people with real hard cash in their pockets, the Chinese.

In short, they decided to "kick the can down the road" like everybody else. If they hadn't done this and had instead insisted on continuing with their Dickensian approach of forcing austerity measures on the hapless populace in order to get them to pick up the tab for the bank's mistakes and excesses, the riots in Greece would have spread across Europe and they would have been faced with the end of their Empire. It will all end in a hyperinflationary depression anyway, but who cares about something that far off?

Needless to say, the news that Europe is set to wholeheartedly embrace the economic principles of the likes of Alan Greenspan and Ben Bernanke and refill the punch bowl with a gusto set the markets ablaze. Markets love inflation, hate deflation - they love unlimited liquidity and an expanding money supply - so what if money loses its value? - that's only a problem for the little guy shopping for food and gas. The prospect of a massive new money factory opening in Europe to rival that of the biggest US operations is music to the ears of investors in inflation hedges like gold and silver and explains why practically everything (with the notable exception of the dollar) broke out upside last week, when it become clear that Europe is set to use the "helicopter Ben" approach to its debt problems. While there are many muttering that "the devil is in the details", there is only one point that needs to be understood which dwarfs every other consideration, and that is that they are going to flood the markets with manufactured money, and any rules or regulations that get in the way will in due course be swept aside.

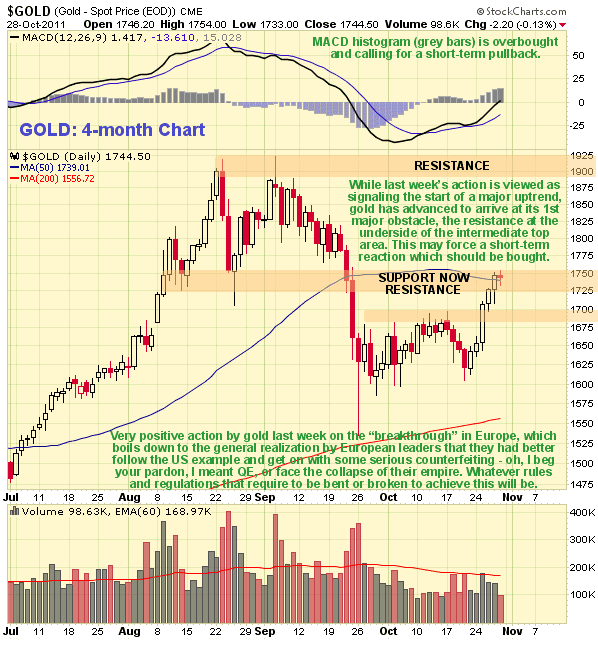

On its 4-month chart we can see that gold broke out upside from what is now clearly an intermediate base pattern that formed above its rising 200-day moving average, with the advance last week looking like the earliest stage of a major uptrend that should take it comfortably to new highs. After 5 days of gains gold arrived at its first serious obstacle on Friday, the resistance at the underside of the earlier intermediate top area, so we should not be surprised to see consolidation or a minor reaction early next week, which is called for by the rather extreme reading of its MACD histogram. It could react back to the $1680 - $1705 area and will be viewed as a buy if it drops to about $1705. The MACD indicator itself shows that gold still has plenty of upside from here, so after some possible consolidation/reaction to digest last week's gains it look set to continue higher.

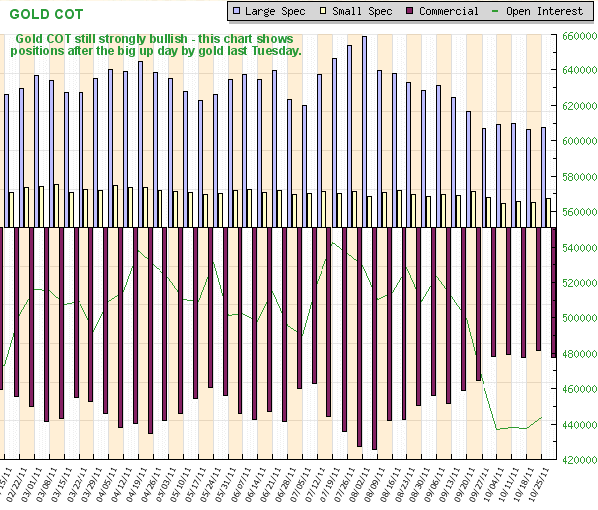

Gold's COT chart continues to look strongly bullish, with a relatively low Commercial short position. This short position rose somewhat this past week, which is to be expected given that this chart is up to date as of last Tuesday's close, and thus includes gold's big up day last Tuesday.

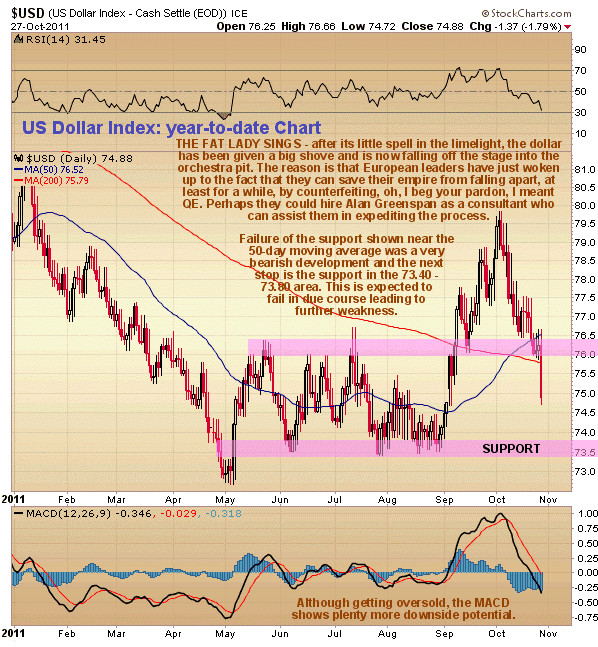

As we had suspected would happen last weekend, the dollar crashed important support on Friday and plunged, despite looking like it was in position for another upleg. The dollar had been "dining out" on the euro's misfortunes and it now looks like the big September rally was its Swan Song - its final upward flurry before a brutal downtrend sets in that takes it to new lows. The dollar's fundamentals are truly awful, which is good news for gold and silver, at least.

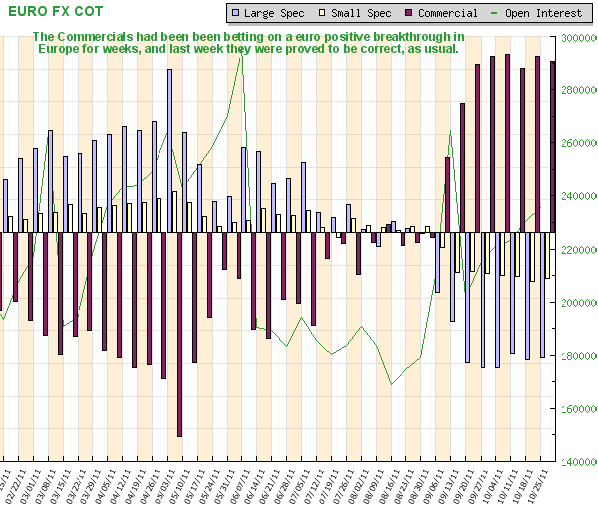

The Commercials have been heavily long the euro for weeks, which means that they were betting on an easing of the crisis in Europe. As usual they have been proved right, and the Large Specs who are short look set to get buried.

By Clive MaundCliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2011 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.