Public Sector Pay to Cripple the UK Economy During 2008

Economics / UK Economy Dec 28, 2007 - 03:40 AM GMTBy: Nadeem_Walayat

The unproductive public sector renowned for demanding unrealistic pay hikes whilst at the same time failing to deliver competitiveness and anticipated output, looks set to go to war against Gordon Browns government during 2008. Which is already expected to be the worst year for jobs in a decade.

The unproductive public sector renowned for demanding unrealistic pay hikes whilst at the same time failing to deliver competitiveness and anticipated output, looks set to go to war against Gordon Browns government during 2008. Which is already expected to be the worst year for jobs in a decade.

Prime sectors of the public sector to assault on government finances amidst a weakening economy are likely to be local government and the NHS. As an example GP's are already targeting pay hikes of as much as 10% for 2008 against government offers of 1.5%. This is after several years of self delivered pay rises of 33% per annum or more whilst at the same time cutting back on time spent on patient care. The consequence being an increasing loss of confidence in GP surgeries and the wider NHS with more and more patients seeking to opt for private diagnoses and treatment, where in many cases patients go abroad to the continent for both more competent and competitively priced medical care or even wider a field to asia.

The union leaders response has been to suggest that the attempted pay freeze during 2007 and for the next 3 years at 2% will result in a cut in living standards for public sector workers. However, the public sector pay should be linked to productivity, which it has never been. Whilst the current state of affairs continues, the public sector will be a continuing drain on the UK economy. Rather than pay rises during 2008 the public sector should be subject to pay cuts which is inline with the failure to increase productivity during the last 10 years.

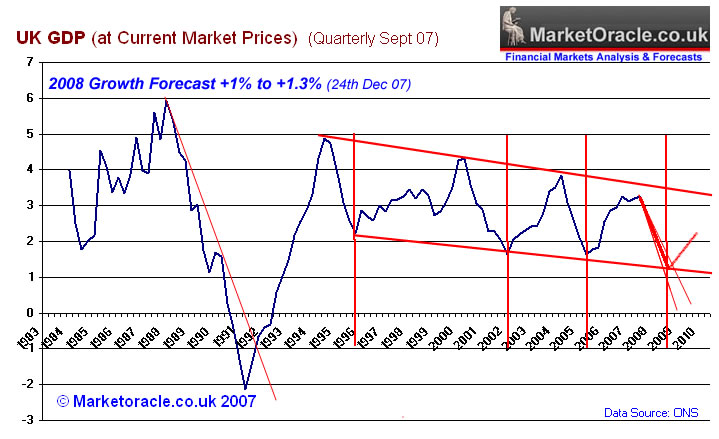

Over the last 7 years public sector debt has grown from 29% of GDP to 37% of GDP, with the budget deficit at £9 billion for November 2007 alone to be added to the burden on the UK economy in the form of servicing interest payments on total debt of £520 billions. This drain on the economy is evident in the increasingly down sloping trend channel as the public sector diminishes the UK economies ability and prospects for future growth.

Analysis of UK GDP Growth for 2008

The Market Oracle forecast for UK GDP growth by the end of 2008 is for an annualised rate of between 1% and 1.3%.

By Nadeem Walayat

Copyright (c) 2005-07 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading, analysing and forecasting the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 100 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.