A Few Chinese Bad News Bears To Spoil A Happy New Year

Economics / China Economy Dec 26, 2011 - 12:47 PM GMTBy: EconMatters

Goldman's Jim O'Neill noted in a recent interview that the world's future prosperity depends on China's growth. While we don't totally agree with that assessment as we see China as one of the many contributory factors towards world's future, there are some recent bad news bears coming out of China that could spell troubles for markets, at least in 2012.

Goldman's Jim O'Neill noted in a recent interview that the world's future prosperity depends on China's growth. While we don't totally agree with that assessment as we see China as one of the many contributory factors towards world's future, there are some recent bad news bears coming out of China that could spell troubles for markets, at least in 2012.

Export Growth Could Drop to Zero in 2012

The General Administration of Customs released November trade figures showing export growth continued to decelerate and was at their most sluggish in two years. At a news conference, China's Commerce Ministry spokesperson warned,

"The overall trade environment next year for China will be complicated, partly due to the economic uncertainties in the European countries, and I should say that the export situation in the first quarter of next year will be very severe."

Wang Tao, an economist at UBS Securities noted China's export growth is expected to "drop to zero in 2012," which will have a "sizable negative impact on the economy," and that the export figures underline "shifts in the export structure - some traditional lower-end and labor-intensive sectors may be losing market share to cheaper producers." (See Chart Below)

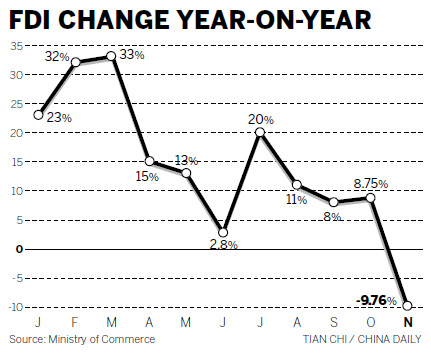

FDI Sees Its First YoY Drop in 28 Months

Part of China's recent explosive growth has to do with foreign investments pouring into the country to capitalize on the expected burgeoning middle class income growth. But in November, China experienced its first year-on-year dip of 9.76% in Foreign Direct Investment (FDI) in 28 months primarily from a sharp drop in inflows from the United States, while investments from the European Union -- China's single largest trading partner -- were essentially flat. (See Chart Below).

Moreover, this drop came on top of the first net capital outflow from China in four years in October, as investors fled emerging markets due to Europe's festering debt crisis.

|

| Chart Source: ChinaDaily.com, 16 Dec. 2011 |

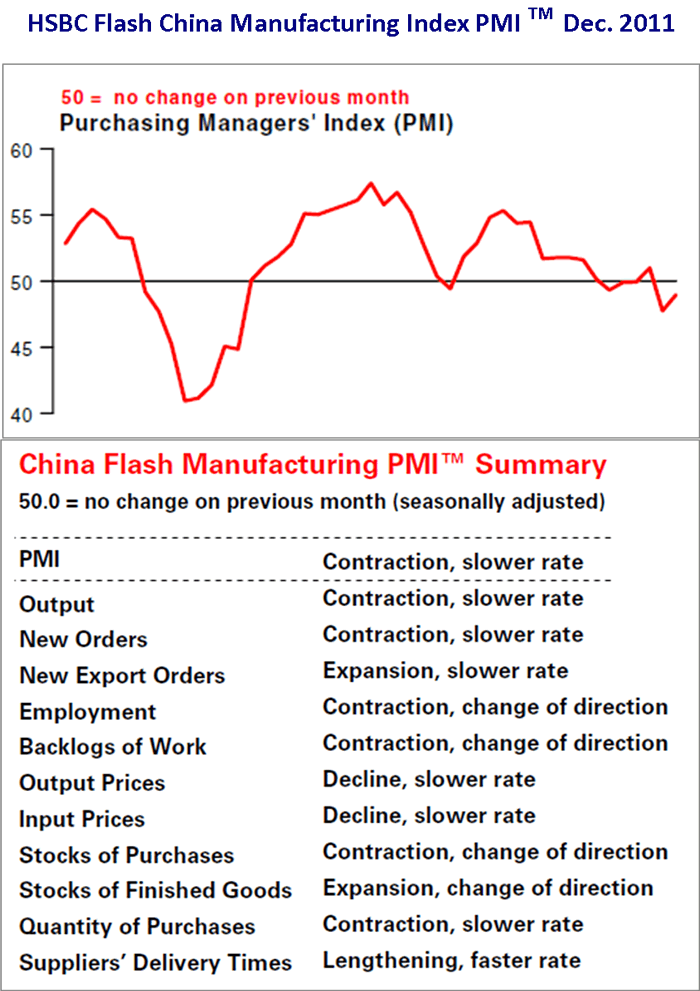

Manufacturing Tanks To Near Three-Year Low

China’s manufacturing contracted for the first time since February 2009 with the Purchasing Managers’ Index (PMI) fell to 49.0 in November from 50.4 in October. (Read: China Manufacturing Tanks To Near 3-year Low)

The December number did not bode well either as the HSBC flash manufacturing PMI, an early indicator of China's industrial activity, showed China's factory output shrank again in December after new orders fell. (See Chart Below)

|

| Chart Source: HSBC, 15 Dec. 2011 |

PBOC Reversing Course - How Bad Is The Economy?

In early December, PBOC (The People's Bank of China), China's central bank, announced the first cut in banks’ reserve requirements since 2008, just two hours before the U.S. Federal Reserve led a global dollar liquidity injection to ease Europe’s sovereign debt crisis. And there could be more easing on the way, as Reuters reported that data showed Chinese banks made 562 billion yuan of new loans in November, a shade more than forecast as Beijing gently eases tight credit conditions.

China has made controlling prices a top priority this year and implemented a series of tightening measures. Inflation fell from a three-year high of 6.5% in July to 4.2% in November, which is still above Beijing's current inflation target of 4%. And China's inflation battle is far from over as rising labor costs and higher input prices are among the factors that will continue to push up consumer price levels.

So the more interesting question is:

How bad is the real economy for China to reverse course taking on the risk of re-surging inflation pressures?Escalating Social Unrest

Inflation and social unrest goes hand-in-hand and has toppled quite a few governments in the history book. Judging from the recent Wukan Siege, the social unrest in China (due to disputes in wages, land grab, etc.) seems to have escalated in both scale and duration. This could suggest a more serious mid-to-long-term undercurrent that would be challenging and delicate to handle for the central government.

Conclusion

From what we discussed so far, it is evident a pronounced China slowdown in the next year or so is inevitable with the nation's export-centric economy struggling with waning global demand, while undergoing domestic structural economic and demographic shifts. Moreover, there could be some hidden debt bombs as a recent Bloomberg finding suggests that China's banks may be understating their exposure to runaway local borrowing by possibly billions of dollars that is raising fears of a government bailout.

How Beijing steers its economic and monetary policies in the next 2-3 years will be key to balance the country's inflation, growth and stability. While we see a very low probability of a hard landing case for China, but based on the rationale of Jim O'Neill about how much the world depends on China's growth, then don't count on that much world prosperity, at least in 2012.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2011 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.