Ben Graham’s Curse on Gold

Commodities / Gold and Silver 2012 Feb 21, 2012 - 11:43 AM GMTBy: John_Mauldin

This week we have a shorter Outside the Box, from my friend David Galland at Casey Research, with an interesting insight into why gold can be considered as a poor investment by some rather influential investors (like Warren Buffett) while others may see it as the core of a diversified portfolio. As usual when I use someone's material for an OTB, I include a link at the end, if you want to look deeper. The rather large team at Casey Research specializes in gold, natural resources, and energy-related investments, for those with such an investing bent.

This week we have a shorter Outside the Box, from my friend David Galland at Casey Research, with an interesting insight into why gold can be considered as a poor investment by some rather influential investors (like Warren Buffett) while others may see it as the core of a diversified portfolio. As usual when I use someone's material for an OTB, I include a link at the end, if you want to look deeper. The rather large team at Casey Research specializes in gold, natural resources, and energy-related investments, for those with such an investing bent.

As a quick note, the feedback on this weekend's letter on taxes has been substantial, and a great deal of it is quite good and worth thinking about. Many bring up real problems with the position I took in my letter, and I may surprise you by agreeing with some of them. My intention right now (barring something happening between now and Friday night) is to take some of the better statements and questions, and answer them. I am not married to any specific plan. I just want to solve the problem and am open to anything that is politically feasible and makes sense, as long as we solve the basic problem of the deficit. I think it will make for a very interesting letter. I do read your feedback, by the way. So if you wanted to respond and wondered if I might actually read it, the answer is yes I do, and this week will answer as many as I can.

And to answer a question I get a lot, I buy a little physical gold every month. I don't even look at the price. The check is written the same day each month, for the same amount. I take delivery. I hope the price of gold goes down so I can get more gold per dollar. I also hope it ends up being worthless, as that will mean everything else has worked out just fine. But my gold is there just in case my crazy gold bug friends are right and we can't actually trust the government to find a reasonable solution to our dilemma. And maybe because deep down I really don't trust the (insert your favorite expletive). Just a little insurance, you understand.

So, until we connect this weekend, have a great week!

Your I am not a gold bug analyst,

John Mauldin, Editor

Outside the Box

JohnMauldin@2000wave.com

Ben Graham’s Curse on Gold

By David Galland, Casey Research

It seems that the mainstream investment community only takes a break from ignoring gold to berate it: one of gold's most outspoken critics, uber-investor Warren Buffett, did so recently in his latest shareholder letter. The indictments were familiar; gold is an inanimate object "incapable of producing anything," so any investor holding it instead of stocks is acting out of irrational fear.

How can it be that Buffett, perhaps the most successful (and definitely the most well-known) investor of our time, believes that gold has no place in an intelligently allocated investment portfolio?

Perhaps it has something to do with his mentor, Benjamin Graham.

Graham, author of Security Analysis (1934) and The Intelligent Investor (1949), is correctly respected as one of history's most knowledgeable investors. Over a career spanning 1915 to 1956, he refined his investment theories, in time becoming known as the father of value investing. Much of modern portfolio theory is based upon Graham's work.

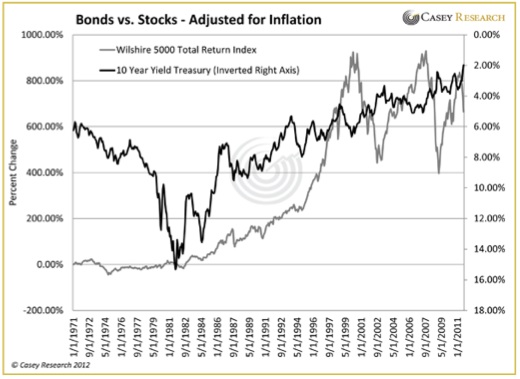

According to Graham, while no one can tell the future, there are periods when the valuations of stocks and bonds would deviate from fair value by becoming excessively over- or undervalued. To enhance returns and reduce risk, investors should alter their portfolio allocations accordingly. A quick look at a long-term chart supports Graham's theory clearly shows periods when one asset class offered a better value than the other:

But what of the periods when both stocks and bonds stagnated or fell together? For much of the 1970s and again from 2001 through today, any portfolio allocated solely between stocks and bonds would have at best treaded water and at worst drowned in a sea of stagflation. To earn any real return, an investor would have needed to seek alternatives.

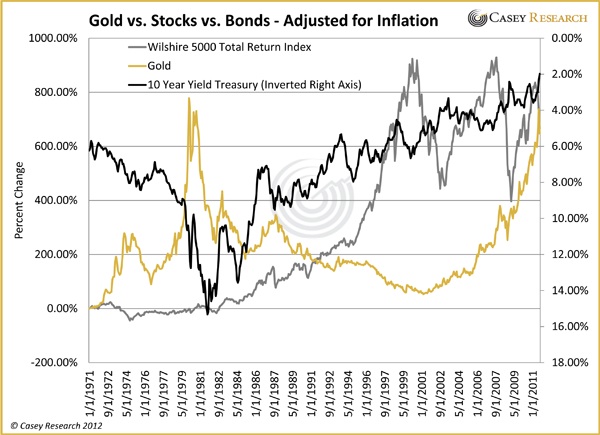

It's clear from this next chart that gold was exactly that alternative, a powerful counter-trend investment for periods when both stocks and bonds were overvalued. Yet gold is conspicuously absent from Graham's allocation model.

But this missing asset class is entirely understandable: for most of Graham's adult life and the most important years of his career, ownership of more than a small amount of gold was outlawed. Banned for private ownership by FDR in 1933, it wasn't re-legalized until late 1974. Graham passed away in 1976; he thus never lived through a period in which gold was unmistakably a better investment than either stocks or bonds.

All of which makes us wonder: if Graham had lived to witness the two great bull markets in precious metals during the last 40 years, would he have updated his allocation models to include gold?

We can never know.

We can know, however, that given Graham's outsized influence on investment theory, there is little question that his lack of experience with gold, and therefore its absence from his observations, has had a profound effect on how most investment professionals view the yellow metal. This, in our opinion, goes a long way toward explaining the persistently low esteem in which gold is held by the mainstream investment community. And, as a consequence, its widespread failure to even be considered as an asset class.

A couple of takeaways: first, perhaps now you can stop wondering why your broker, the talking heads in the financial media, and Warren Buffett continue to misunderstand gold as a portfolio holding. More importantly, however, is that in order to have sustained, long-term investment success, one must accept that an intelligent portfolio allocation needs to include not two but three broad categories of investment – stocks, bonds and gold, with the amounts allocated to each guided by relative valuation.

[JFM here: I would suggest additional broad categories of investments depending on your personal situation. Alternative investments like commodity trading funds. Low leveraged income oriented real estate consistent with your ability to handle the ups and down of the rental/leasing market and shorter term carry costs. I for one am not psychology capable of dealing with renters, of whom I am one. I want service and you to pay for major maintenance, and the ability to move at the end of my lease. My choice, not dependent upon your cash needs. But I know of plenty of people who can do that and have amassed considerable portfolios over time. Perhaps your own small business that has the potential to grow. Investments outside of your country of residence. Etc.]

Investors who understand this tenet have an almost unfair advantage over other investors as it allows them to get positioned in gold ahead of the crowd and enjoy the bulk of the ride, while others sit on their hands.

So when you hear commentators ridiculing gold as a barbarous relic, lamenting that they cannot eat it or smugly asserting that it produces nothing, rest contently in knowing that they're operating with a severe handicap in their own portfolio. Meanwhile, we'll prosper, armed with the understanding that gold fulfills a very important and specific purpose in a portfolio, namely as real money that protects net worth during periods marked by excessive government debt and currency debasement such as we are currently experiencing.

Given the powerful influence of Ben Graham and his disciples, his curse on gold will not go quietly into the night. But it should.

David Galland is managing director of Casey Research, which provides independent investment analysis on a subscription basis to a global network of over 180,000 self-directed investors and money managers. Recognizing the emerging bull market in gold early on, in the late 1990s, Casey Research formed a metals and mining division that has grown into a leading provider of actionable gold and resource intelligence. For investors looking to become familiar with the asset category, Casey Research offers a monthly newsletter, BIG GOLD ( try it risk-free for 90 days), focusing on undervalued opportunities in mid- to large-cap producers, as well as best practices in buying, holding and selling precious metals. Learn now why it's more important than ever to invest in gold and gold-related equities.

By John F. Mauldin

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2012 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.