Europe's QE3 Will Boost Gold and Silver

Commodities / Gold and Silver 2012 Mar 19, 2012 - 08:49 AM GMTBy: Jeb_Handwerger

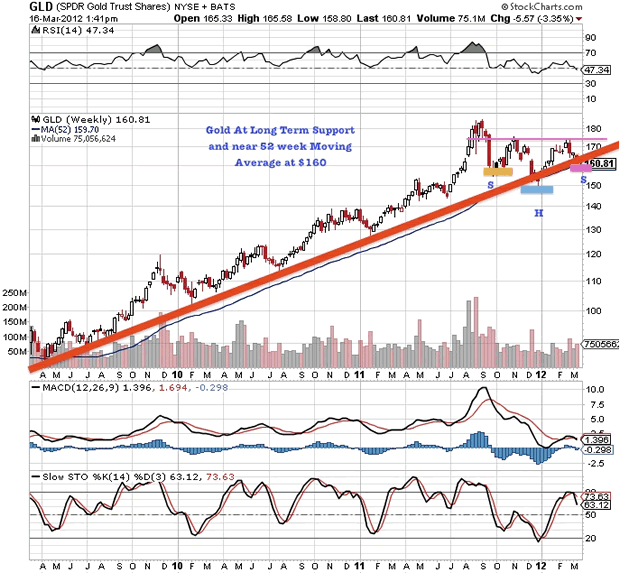

Gold is pulling back to long term support and is able to be purchased at a discount. Investors may be seeking riskier assets due to fears of inflation and higher interest rates. Right now industrial metals such as copper/ nickel, oil and blue chips are outperforming due to their value of being hedges against inflation and represent the riskier assets.

Gold is pulling back to long term support and is able to be purchased at a discount. Investors may be seeking riskier assets due to fears of inflation and higher interest rates. Right now industrial metals such as copper/ nickel, oil and blue chips are outperforming due to their value of being hedges against inflation and represent the riskier assets.

Gold and silver which has in the past represented risk off is still in consolidation mode. Eventually investors will realize that the monetary metals can do well in both a deflationary risk off environment as well as an inflationary risk on environment and the trend will turn significantly higher as it has for the past decade. Gold is actually finding support and presenting a potential discount buying opportunity. It is important to accumulate when the public is disinterested. Right now, Pandora, Facebook and Apple are the current fads, while gold is being overlooked and placed on sale by Mr. Market.

In 2011 the European leaders come up with a deal that may save the day for now. The European leaders have come up with a last minute Greek bondholder rescue and a $1 trillion dollar bank bailout, which apparently has saved the 2011 market crash from being a depression and just a mild recession.

Gold Stock Trades is heaving a sigh of relief in concert with the rest of the financial world. Behind the scenes in this current crisis of capitalism our Chinese colleagues may be playing the role of Victoria's Messenger making a timely entrance on the current stage to play a cameo role in lending validity to the Eurozone QE3.

To paraphrase Ben Franklin, "Gentleman, we must all hang together or else hang separately." Gold Stock Trades has written extensively regarding China's role in the world financial crucible which bears persistent observation. They hold copious amounts of American and European debt and can not divorce their partners.

The point of all this to our subscribers is that the world has a new incarnation of QE3. This means stoking the boilers anew to percolate the Eurozone as America did in 2009-2011 with the TARP, Obama stimulus, two rounds of QE and Operation Twist with the recent $1 trillion Long Term Refinancing Option.

It is indeed fitting that the printing press invented in Germany by Gutenberg in the 15th century be once again called into service in the production of fiat paper.

Remember that Gold Stock Trades on October 4th signaled that a stronger than expected risk on rally was in the cards. We advised that a bottom was being established and that patience and fortitude was our mantra. While others were running for cover, Gold Stock Trades was reiterating maintaining a strong hand in a panic driven market. We also called the top in tissue paper U.S. treasuries in late December and we are now witnessing a breakdown in that marketplace.

Many were the icons purporting to have the inside track on commodities and precious metals who were intoning that commodities, gold and silver, rare earths and uranium had formed a bubble and should be shorted. Moreover, they sounded the death knell of the uranium and rare earth sectors. Paraphrasing P.T. Barnum's admonition, "There is a sucker born every minute...Every second round the clock, like dandelions up they pop." The naysayers were wrong. Gold Stock Trades nailed the bottom in the junior miners.

We are continuing to witness strong upward moves across the board in our natural resource selections vindicating our consistent and resolute stance to keep an eagle's eye on staying the course.

It is increasingly possible that we may have seen the bottom in our chosen sectors and our mantra should be reflected commensurate with a powerful, unexpected upward rally which is the mirror image of the recent downswing. This may be a characteristic "V-Shaped Reversal" which technically is the hardest to forecast but among the most profitable and powerful of all chart patterns. We are encouraged by this upmove, but we must remember there will be volatility and profit taking as resistance levels have to be regained.

Gold is finding support at its uptrend and 52 week moving average.

An important news item surfaced in 2011, in which attention must be paid. Cristina Fernandez flushed with a landslide victory in the Argentinian election, announced plans to repatriate the assets of mining companies in Argentina. At this stage of the game, the definitive scenario is a work in progress. What will be the effect on the proposed merger on Argentinian miners? We have also been concerned about lawlessness down in Mexico due to the drug cartels. How will this affect the gold and silver miners in these two countries? Listen to my recent interview with Rob McEwen where I posed these questions by clicking here...

Subscribe to my free newsletter to get up to the minute updates on rare earths, uranium, gold and silver.

By Jeb Handwerger

© 2012 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.