The Foolish Policy of Exporting Natural Gas

Politics / Natural Gas Apr 18, 2012 - 08:20 AM GMTBy: BATR

The lack of a government policy that promotes domestic energy independence in the United States is a tragic consequence of playing politics for decades. The current rage is the natural gas boom that offers the alternative of producing a plentiful and inexpensive source of fuel. Economic prosperity rests upon cheap and reliable power and natural gas offers the best option.

The lack of a government policy that promotes domestic energy independence in the United States is a tragic consequence of playing politics for decades. The current rage is the natural gas boom that offers the alternative of producing a plentiful and inexpensive source of fuel. Economic prosperity rests upon cheap and reliable power and natural gas offers the best option.

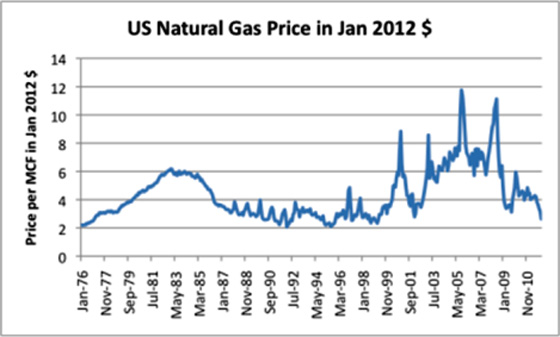

The pricing of natural gas is regional and quite different from trading crude oil. Loren Steffy reports in the Houston Chronicle, "A surge in drilling for gas from shale formations around the U.S. has generated a glut of natural gas, pushing prices below $2 per million British thermal units."Forbes set out the basic dilemma that conflict with the true long-term internal energy benefit, from the use of our own resources, for the national interest.

"The U.S. government may soon decide on the request from Cheniere Energy to build an LNG export terminal that allows the company to liquefy natural gas and export to international markets, where prices are much higher than in America.

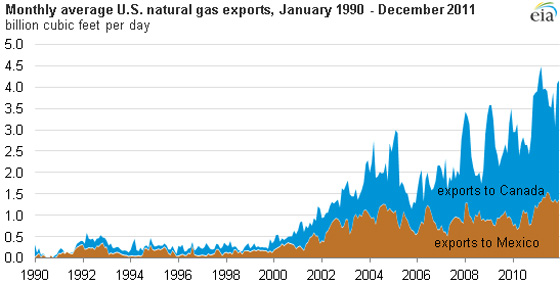

Natural gas exports could allow companies to take advantage of higher gas prices in Asian and European markets and ease the supply glut in the U.S."

Hello, just think about this corporatist lunacy that wants to grab up our own natural gas supplies at rock bottom price, so that companies can export a crucial national resource, to foreign markets that are willing to pay $10.00 and above, merely for the enrichment of some business enterprise. An American government policy that allows for this legalized theft is absurd.

The true underlying basis for establishing a supply and demand floor for a national gas source is to transition gasoline and diesel vehicles to burn natural gas. This obvious assessment received major push back because it disrupts the oil monopoly for fueling cars, buses and trucks.

Since the cost of natural gas has averaged above $6.00 per BTU for the last decade, the cost for conversion should anticipate a much higher price when the gas fracking rage comes down to reality. The idea that insufficient regulated policing of a dangerous process of chemical and water contamination is justified in order to export natural gas is shameful.

As long as shortsighted politicians and insatiable companies seek to misuse our internal resources for international greed, the country will suffer another round of energy dependency.

Note the significance from the Executive Order: Feds To Take Control of Domestic Natural Gas Production.

"The President’s order establishes an "Interagency Working Group" to be composed of deputy level or higher representatives from federal agencies that include the Defense Department, Transportation, Agriculture, Health and Human Services, Energy, Homeland Security, and the Environmental Protection Agency.

Moreover, because a key stated purpose of the Executive Order is to ensure long-term supplies, the President’s decree gives the federal government the ability to shut down gas production operations as they see fit, potentially leading to government price fixing and centralized control of an essential natural energy resource."

Wrapped in the guise of ensuing domestic natural gas supplies is the actual drive behind the fracking rage. Exporting Natural Gas Would Be Very Profitable For North American E&P Companies admits the unmistakable motivation that confirms the previous report.

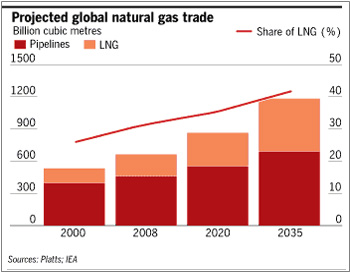

"The best way to alleviate the problem of natural gas oversupply in North America is to increase its export. The most economical way to export natural gas is to liquefy it; this type of natural gas is called LNG. In its liquid state natural gas takes up 1/600 of its normal volume, making it ideal for export. There are currently over 100 production, export and storage facilities in the U.S. Many companies have submitted applications with the U.S. Department of Energy for LNG export terminals, such as BG and Sempra (SRE). The nation's largest exporter of LNG is Cheniere Energy (CQP). Last year, Cheniere's Sabine Pass terminal was the first export terminal project in more than 40 years to get authorization from the U.S. Department of Energy to export natural gas to major importing countries."

An executive order does not make a sound energy policy. The Energy Department continues its pattern of stripping domestic independence production. The fact that our natural resources are squandered for export will never develop a marketplace where inexpensive domestic usage becomes the driving fuel behind a viable national transportation system.

How can anyone reasonably expect that an agency established by President Jimmy Carter will do any better? What came from the shale oil or coal conversion initiatives of the late 1970’s? Continuous government incompetence and misguided export direction will never restore economic affluence on the home front.

Natural gas is a superior fuel resource that needs to benefit our own consumers. As long as national policy ignores this goal, our interests will continually be shipped overseas.

The growth trend for using natural gas worldwide is clearly advancing. The Obama administration wants to eliminate electric generation from coal. Natural gas will become the energy of choice for utilities. Is it not time to establish a long-term market ceiling on electric costs?

Pursuing and encouraging a LNG sell abroad strategy just rewards the gas drillers and exporters. The very real risks and environmental fallout from unsafe fracking methods are a bad trade off when the natural gas ultimately goes for foreign use.

As gas exploration advances and production increases, the opportunity is historic to lower our domestic fuel costs. This is no time for allowing the exporters to exploit the natural gas resource of America.

James Hall – April 18, 2012

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2012 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.