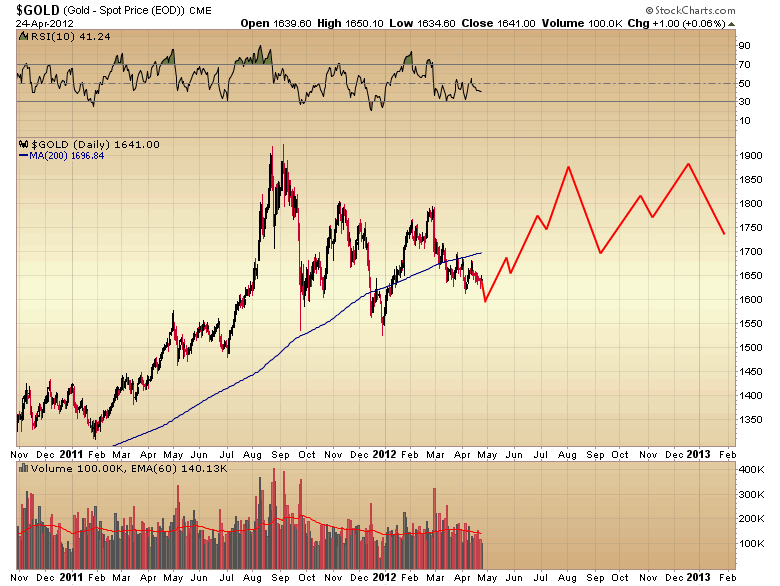

Gold's B-Wave Bottom

Commodities / Gold and Silver 2012 Apr 25, 2012 - 10:27 AM GMTBy: Toby_Connor

Over the last several days volatility in the gold market has collapsed forming what is known as a coil.

Over the last several days volatility in the gold market has collapsed forming what is known as a coil.

I think the Fed announcement tomorrow will probably break gold out of this holding pattern. But contrary to popular belief, about 70% of the time the initial move out of a coil ends up being a false move that is reversed by a more powerful and durable move in the opposite direction.

In this case if gold breaks lower out of the coil it is late enough in the intermediate cycle that the move is unlikely to last more than a few days before forming what would presumably be an intermediate cycle and B-Wave bottom.

I suspect many gold bugs are going to get knocked out of their position if this scenario plays out tomorrow. However, if this does turn out to be a B-Wave bottom, and I think it will, the next couple of days are going to be the single best buying opportunity for the rest of this secular bull market.

This doesn't mean that gold will reverse and head straight up immediately. I expect we will probably see a volatile consolidation with several tests of the all-time highs above $1900 but no breakout for the rest of the summer.

Traders are going to be looking for the next trend once the stock market bottoms. I doubt that tech stocks are going to resume the leading role that they've enjoyed since last October. More likely liquidity will find its way into a beaten up sector.

As I always say, liquidity will eventually flow into the most undervalued assets. There is no sector as undervalued and as unloved as the mining stocks right now.

Sentiment in this sector has reached levels of pessimism capable of generating triple digit returns over the next couple of years, and I wouldn't be surprised to see a 25 - 50% gain during the next intermediate cycle alone.

I think the next momentum move is about to begin in the sector most overlooked and least expected by investors, the mining stocks.

Click here to access the premium newsletter. Click here for the $10 trial subscription.

Toby Connor

Gold Scents

GoldScents is a financial blog focused on the analysis of the stock market and the secular gold bull market. Subscriptions to the premium service includes a daily and weekend market update emailed to subscribers. If you would like to be added to the email list that receives notice of new posts to GoldScents, or have questions,email Toby.

© 2012 Copyright Toby Connor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.