Is the Table Set for a Mania in Gold and Silver?

Commodities / Gold and Silver 2012 Jun 07, 2012 - 06:47 AM GMTBy: Jeff_Clark

It may feel like I'm out of touch with the precious metals markets to broach the subject of a mania today, but I think the table is being set now for a huge move into gold and silver.

It may feel like I'm out of touch with the precious metals markets to broach the subject of a mania today, but I think the table is being set now for a huge move into gold and silver.

There are, however, very valid reasons to reasonably expect a mania in our sector. For one thing, manias have occurred many times before, but the main issue is that a mania in gold and gold stocks is the likely result of the absolute balloon in government debt, deficit spending, and money printing. Saying all that profligacy will go away without inflationary consequences seems naive or foolish. Inflation may not attract investors to gold and silver as much as force them to it.

Now, one could make the argument that any rush into gold and silver will be muted if no one has any savings, especially given that demographers say a quarter of the developed world will soon be retired. But even if individuals are wiped out, the world's money supply isn't getting any smaller, and all that cash has to go somewhere.

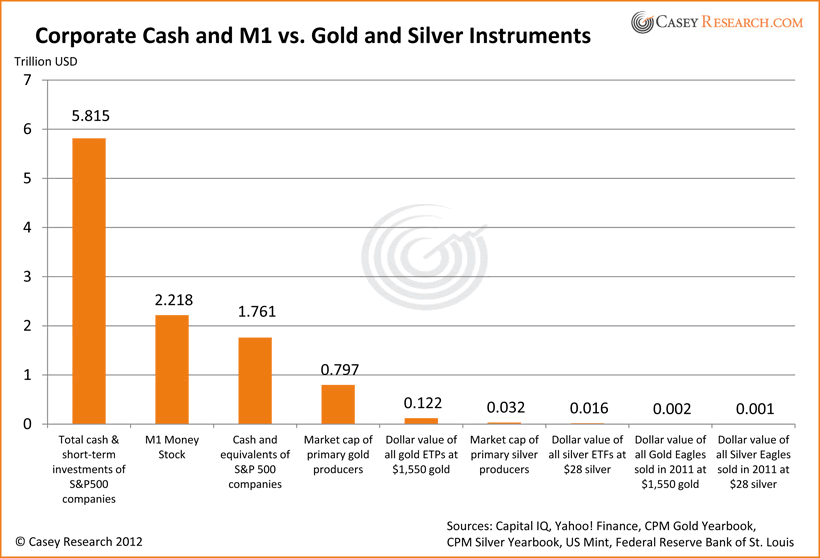

I wanted to look at cash levels among various investor groups to get a feel for what's out there, as well as how money supply compares to our industry. Data from some institutional investors are hard to come by, but below is a sliver of information about available cash levels. I compared the cash and short-term investments of S&P 500 corporations, along with M1, to gold and silver ETFs, coins, and equities. While the picture might be what you'd expect, the contrast is still rather striking.

Naturally, not all this money or even a big chunk of it will be used to buy GLD, Barrick, or American Eagles, but it's clear that if any significant fraction of the cash sloshing around the economy were to be used to buy gold, it would have a major impact on the price of gold - which would trigger the mania I fully expect. Let's take a quick look at what kind of impact our sector could experience if just a small amount of available funds were devoted to various forms of gold and silver.

- The entire worldwide value of all gold exchange-traded products (ETPs) currently represents just 2.1% of the cash and short-term investments held by S&P 500 corporations. If 20% of these companies decided to put a mere 5% of their available holdings into these precious metals vehicles, their value would more than double.

- If just 1% of the physical currency (M1) floating around the system were used to buy gold Eagles, it would be 13 times more than the entire value of all coins purchased last year.

- If corporations chose to invest 1% of their cash in silver ETFs, it would surpass the total current value of all such ETFs.

- If corporations moved 5% of their "short-term investments" evenly into gold stocks, the market cap of every gold company would increase by 20%.

- If they chose silver stocks, they'd each grow by a factor of six.

- Five percent of M1 would increase the market cap of gold producers by 14%. The same fraction would be 3.4 times bigger than the entire current value of all primary silver producers.

This is just S&P 500 corporations - there are many more corporations in the world, as well as pension funds, hedge funds, sovereign wealth funds, mutual funds, private equity funds, private wealth funds, insurance companies, and other ETFs.

It's striking, when you really stop to think about just how big the impact could be if some significant fraction of the larger financial world started chasing the small niche market that is gold. Such cash inflows will send our industry to the moon.

In the meantime, keeping our eye on the big-picture forces that have yet to play out is the plan to follow. Sooner or later, though, I'm convinced the catalysts will kick in that will pull/push/drag/compel/force the mainstream into our sector. I suggest beating them to it.

And when the mania arrives, we'll all wonder why anyone doubted it in the first place.

Jeff Clark has been delving into a variety of data to try to figure out recent precious-metals market moves, in order to spot a shift in trends. That's important because being ahead of the trend gives investors maximal profit opportunities. Another solid analysis Jeff wrote is What Volume Tells Us about Gold Stocks.

© 2012 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.