Plunge Protection Team Orchestrating a Stock Market Bottom?

Stock-Markets / Elliott Wave Theory Jan 27, 2008 - 02:00 PM GMTBy: Joseph_Russo

A Work in Progress

A Work in Progress

Well, it is blatantly obvious that the (PPT) plunge protection team, presidents working group – or whatever they call themselves - found it necessary to intervene in the free-market in attempt to orchestrate a bottom.

Where are these guys when markets are a boiling-pot of unsustainable parabolic animal spirit? We suspect during such episodes, they are patting themselves on the back for planting the seeds for such bullish orgies

Massive Undertaking / Will it be Different this Time

Might the inordinately early rescue efforts (which began pre-Dow 14K, in August of '07) be telling of the sheer size and scope that this particular bail-out requires?

This alone, may suggest that any short-term temporary political stimulus (even alongside the redundancy of emergency monetary policy interventions) may do little to mitigate what is quite plausibly a much longer-term systemic malady.

When does Change become Revolution

Given that both Democrats and Republicans are in general agreement (prompting both to mount strong campaign platforms of “change”) that a critical portion of our government is fundamentally broken, we wonder how each candidate would define accomplishing “true-change” without radical consequence? Perhaps this may be why (R) Ron Paul is being ignored like the plague by his opponents and mainstream media alike.

In our view, the century for tweaking status quo paradigms has past. The 21 st century demands a bold new sustainable vision of truth, preservation, prosperity, and security. Anything less equates to re-arranging the deck chairs on the Titanic.

We suspect change-denied, becomes revolution when a failing government's inevitable last band-aid-fix and race-against-time falls terribly short - prompting masses of regional populations toward revolt, and general civil unrest as a result of acute and sustained levels of economic pain and hardship.

Following this week's short-term trading summary, we will provide an update of our big-picture overview to monitor just how well the powers-that-be are executing their efforts to incite and orchestrate a perceived bottom.

Trading amid Intervention

How should traders and prudent speculators deal with massive government interventions in the supposed free-markets? Should they immediately get-long the intervention bandwagon, or should they stand pat on shorts, in attempt to fade the omnipotent fed?

In our view, the answer is none-of-the-above. Despite exerted efforts to manipulate markets, the short-answer is to simply trade the price-action as it is presented – contrived, fraudulent, or otherwise.

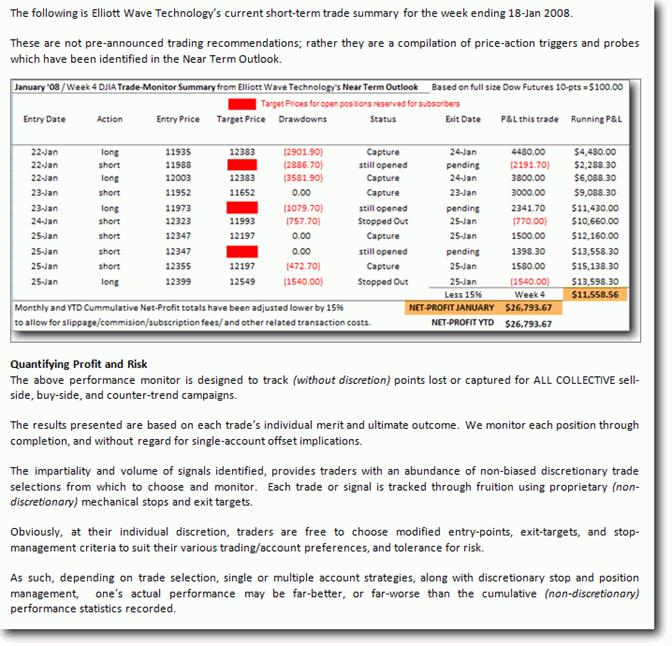

Short-Term Trading Environment: Week ending 25-Jan.

Last week's trade was frantic, excessive, and extremely volatile. The highlight was Wednesday's 600-point daily range-reversal off a retest of Tuesday's lows. We warned traders in advance to anticipate potential for larger drawdowns and the likelihood of larger potential losses amid the ongoing melee.

Re-Capping last week's trading points:

It was apparent on Monday's market Holiday that trade would open the shortened week with a significant decline.

Though markets were likely on path to putting in a near-term bottom on their own, the emergency intervention efforts simply sealed the deal, and set the stage for Wednesday's deep re-test and hyper-reversal to the upside.

The Near Term Outlook already had sell-side positions in place from the previous week, many of which achieved downside price target objectives amid Tuesdays sell-off.

We had also been anticipating and actively probing for a near-term low. Tuesday was no exception, as buy-side probes were quantified per our evening report posted the previous Friday.

Yes indeed, we faded the initial intervention rally on Tuesday to capture 300-pts of intraday profit near Wednesday's lows, while our longer time-frame buy-probes off bottom continued un-stopped.

The mega-reversal rally on Wednesday also triggered at least two additional short-term long-positions, one of which has already reached a rather profitable price objective.

By Thursday, we were back in what appeared to be a business-as-usual “levitation” mode, which often follows major price spikes, especially when fostered and mandated by “the fed.”

Ignoring such political acrobatics, our discipline called for a short-term sell-side position which was indeed stopped for a loss on Friday's marginal new high.

With our usual resolve, the follow-through high on Friday open was also faded with three separate sell-side trade-signals – two of which have already achieved their downside price objectives on sustained weakness through the close of the week's final session.

All said and done, we grabbed well over 1300 points from the Dow by week's end - with one long and two short positions still actively working.

Below is graphic summary of this week's trade-triggers identified via Elliott Wave Technology's Near Term Outlook .

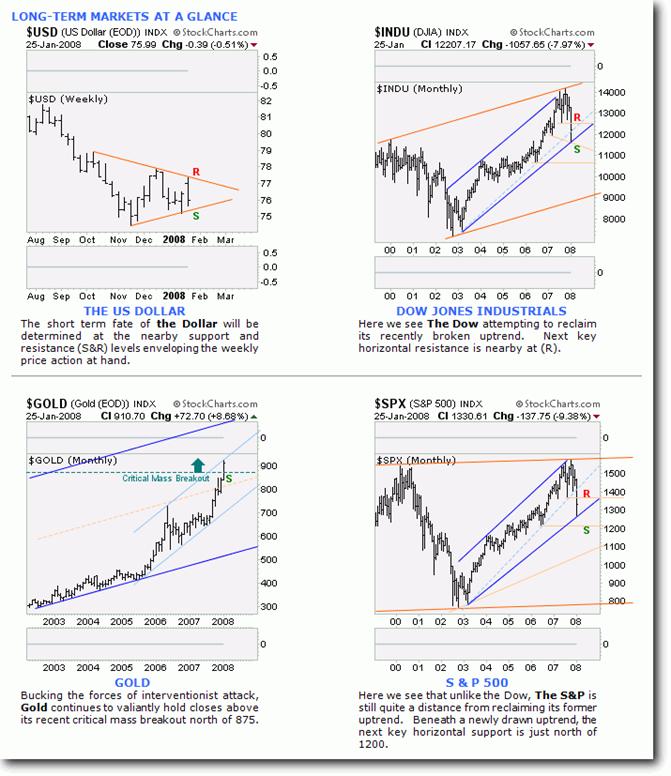

The Broad market update (big-picture)

On a grand-scale, major equity indices (with the assistance of massive interventions) are trying to recover from key-minor support level breaches. They are fast approaching a time frame in which a swift and forceful recovery must be sustained in order to re-claim and salvage investor confidence for the long-haul.

Should one have interest in subscribing to our long-term technical analysis and/or acquiring access to our proprietary short-term market landscapes, we invite you to visit our web-site or blog page for more information.

The Near Term Outlook covers the short-term Dow, S&P, and NDX five-days-per-week, and issues near-term updates for the Dollar, Gold, Crude Oil, and the HUI two times per week.

Trade Better / Invest Smarter...

By Joseph Russo

Chief Editor and Technical Analyst

Elliott Wave Technology

Copyright © 2008 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.