Gold Price More Than 50% Below Real Record High Of 32 Years Ago

Commodities / Gold and Silver 2012 Jun 19, 2012 - 07:52 AM GMTBy: GoldCore

Today's AM fix was USD 1,628.50, EUR 1,291.74, and GBP 1,040.31 per ounce. Yesterday’s AM fix was USD 1,623.50, EUR 1,284.52, and GBP 1,035.20 per ounce.

Today's AM fix was USD 1,628.50, EUR 1,291.74, and GBP 1,040.31 per ounce. Yesterday’s AM fix was USD 1,623.50, EUR 1,284.52, and GBP 1,035.20 per ounce.

Silver is trading at $28.87/oz, €22.96/oz and £18.49/oz. Platinum is trading at $1,492.00/oz, palladium at $628.70/oz and rhodium at $1,215/oz.

Gold edged up $1.20 or 0.07% yesterday in New York and closed at $1,627.40/oz. Gold remained steady in Asia seeing gradual gains which continued in European trading.

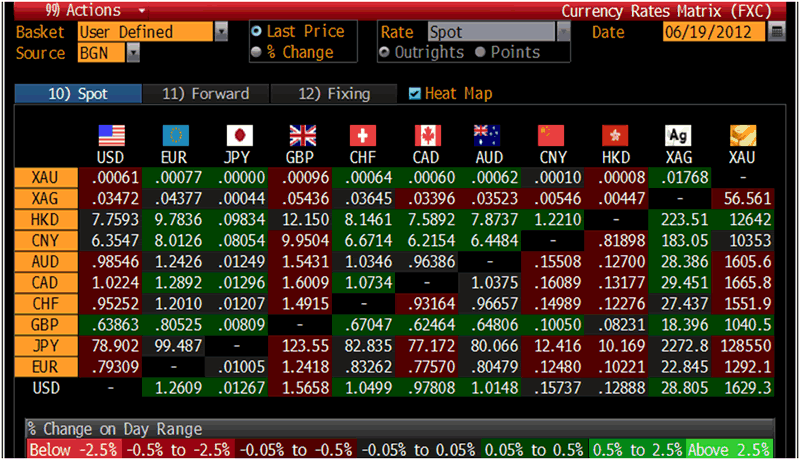

Cross Currency Table – (Bloomberg)

Gold rose for an eighth consecutive session today, its longest winning streak in almost a year. The gains may be due to concerns that the U.S. Federal Reserve may launch further non conventional monetary measures, such as QE, in increasingly desperate attempts to prevent the world's largest economy falling into recession or Depression.

Gold has gradually rose 3% in the last eight sessions and is also supported by the debt crisis in Europe with initial euphoria over a victory for pro-bailout parties in Greece giving way to persistent concerns over Spain and Italy and their banking sectors.

Today's Spanish debt sale saw Madrid's borrowing costs rise even more. The average yield on the 12-month bill was 5.074%, against 2.985% previously.

The Federal Open Market Committee (FOMC) releases a policy statement at the end of its two-day meeting on Wednesday. The Fed's current "Operation Twist" programme, which involves buying long-term debt and funding the purchase by selling short-term notes, is scheduled to expire at the end of June.

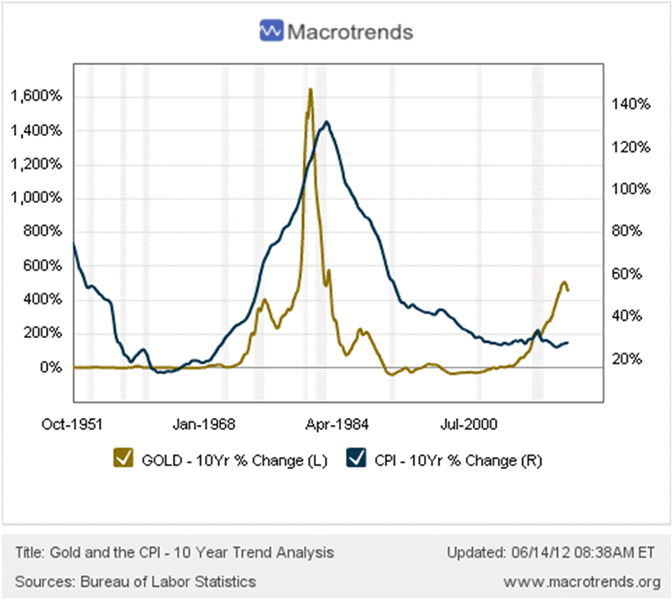

The Fed appears increasingly likely to offer even more monetary stimulus despite political opposition, concerns about whether it will be effective and the still underestimated risk of inflation.

The Group of 20 summit said that leading and emerging economies will "take the necessary actions" to strengthen the global economy and if growth weakens substantially, countries without heavy debt loads stand ready to “stimulate their economies.”

Physical buying was reported as "lacklustre" in bullion markets in Asia however it is worth noting that similar reports of limited demand have been seen in much of the last 12 months and yet demand from China in particular has increased significantly and remained very robust.

Western institutional demand for gold and silver remains robust as seen in the ETF holding figures.

Holdings of the largest gold-backed exchange-traded-fund (ETF), New York's SPDR Gold Trust climbed by 0.33 percent on Monday from Friday, while that of the largest silver-backed ETF, New York's iShares Silver Trust rose by 0.62 percent for the same period.

Gold is less than 18% below the record nominal high of $1,915/oz seen in late August 2011, nearly 10 months ago.

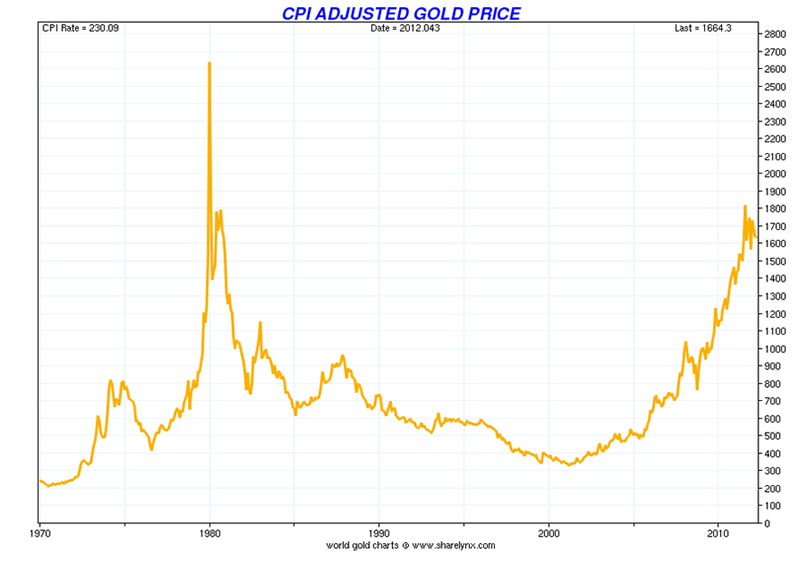

In January 1980, gold traded at $2,600/oz in real terms - adjusted for the significant inflation of the last 32 years. See chart above courtesy of Nick Laird in Sharelynx.

Importantly, today gold at $1,630/oz is still 50% below the real high from more than 32 years ago.

There are very few assets in the world that are trading at well below their real price in 1980.

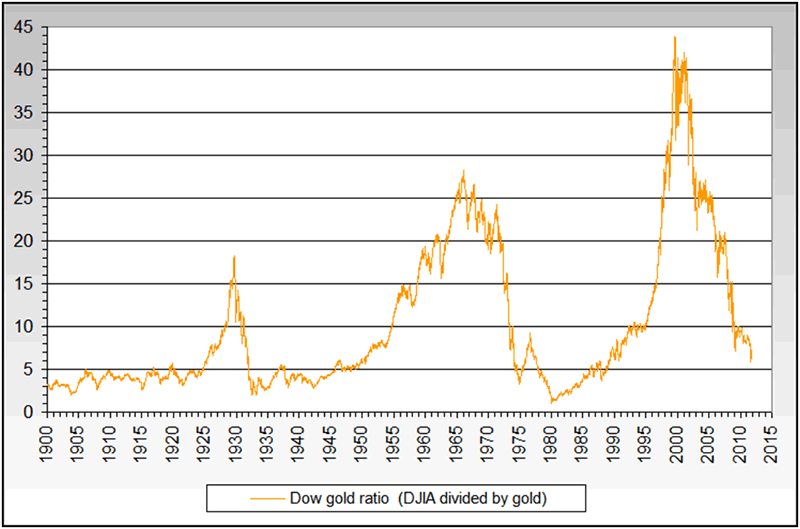

An example of this is the Dow Jones Industrial Average which was trading at 1,000 in 1980 and is today trading at 12,700. Therefore it is nearly 13 times higher than its nominal high in 1980.

Gold's nominal high in 1980 was $850/oz. Today gold at $1,630/oz is less than 2 times its nominal high in 1980.

There are very few goods, services or assets that are only twice their cost in 1980.

This shows how gold is far from overvalued from a historical perspective. While this may seem hard for some to believe due to gold's gains since 1999 which has seen gold rise 6 fold in 13 years.

However, these gains came about after a massive 20 year bear market that saw gold go from being overvalued to being massively undervalued.

The anti gold and ‘gold bubble’ brigade will say that the 1980 high price was a massive bubble as seen in the parabolic price move and subsequent collapse.

They are correct in this. However, they fail to realise that nearly all assets move in cycles from undervalued to fairly valued to overvalued and then to the mania phase of significant over valuation.

The gold market has yet to see that mania phase with gains being gradual in recent years, last year and so far in 2012.

Mania is nowhere near the gold market with the majority of the public having no allocation to gold whatsoever and the non specialist financial media covering gold very occasionally and covering it very sceptically when it does.

There continues to be a complete failure to understand gold’s importance as a store of value, an important diversification and as a crucial safe haven asset.

Another important consideration today is that gold may not have a parabolic price move up and then price collapse a la 1980 as today there is the real possibility that there is a return to some form of gold standard.

Gold may be revalued to a much higher price and that price may be fixed at this higher level.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.