Are Businesses Quietly Preparing for a Financial Apocalypse?

Stock-Markets / Financial Crash Oct 10, 2012 - 03:15 AM GMTBy: Casey_Research

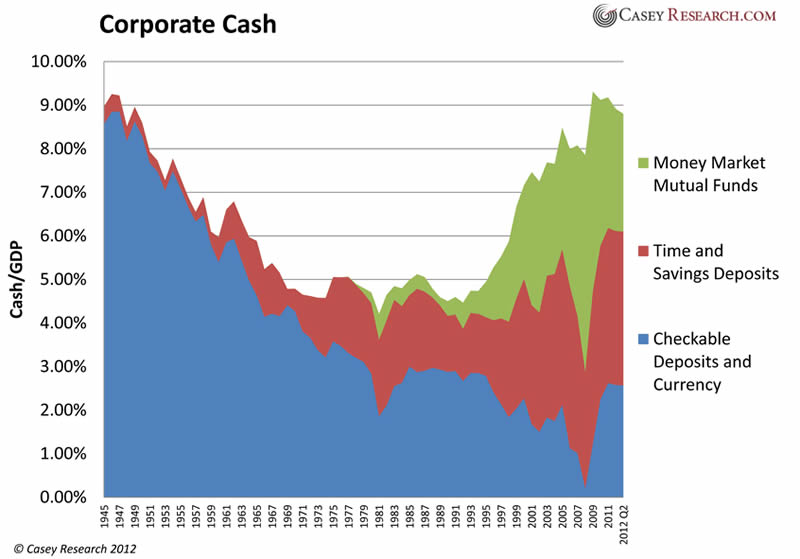

Dan Steinhart, Casey Research writes: US corporations are sitting on more cash than at any point since World War 2.

Dan Steinhart, Casey Research writes: US corporations are sitting on more cash than at any point since World War 2.

That's without including banks. I'm only talking about nonfinancial corporations – the ones that sell goods and services and make the economy go.

Those businesses hold $1.4 trillion. In absolute terms, that's the most ever. In relative terms, it's the most since World War II.

As investors, we can infer quite a bit from corporations' inability (or unwillingness) to deploy their cash.

For one, it indicates that business have assumed a very defensive stance.

Cash, of course, is a buffer against uncertainty - the uncertainty that business slows for any reason. Management wants a healthy cash reserve with which to pay the bills and remain liquid should anything unexpected happen. I think we can all agree that this is prudent, and a good business practice.

But $1.4 trillion? That tells me that businesses are not just a little jittery about the future. They're prepared for an apocalypse.

Think about this, it’s important;

- If these businesses could conjure up even the most marginal of projects to earn a meager 1% return, they would generate $14 billion profit. Instead, they're sitting on the cash and earning near zero for a guaranteed after-inflation loss.

It's a bad omen that corporate management would forego a collective $14b per year. Clearly, by their judgment, the risk of investing in new projects outweighs the reward – the exact opposite of the conditions needed to produce healthy economic growth.

That's the bad news. But here's the good, if paradoxical, news:

Even with all of this corporate slack, earnings and profit margins are very healthy, and stocks have performed quite well. Case in point, the S&P 500 is up 15% YTD.

Why the disconnect?

Well, the rising margins and earnings are easy to explain: corporations have cut costs over the past few years, becoming leaner and more efficient. This also partially explains higher stock prices.

But I think there's another contributing factor to rising stock prices: the downright terrible outlook for bonds. Our analysis of stocks vs. bonds indicates that stocks are by far the better investment today.

“The overriding reason is simple: at near zero interest rates, bonds offer almost no upside and catastrophic downside”

Simply by virtue of not being bonds, stocks have done well.

Back to that pile of corporate cash. There's no question that it's a waste today. But today's waste is tomorrow's potential.

Corporations aren't going to sit on that cash forever. Eventually conditions will be such that they'll either want to or have to invest in new projects.

Perhaps inflation will be the catalyst – corporations can tolerate losing 1.7% per year today. But if the inflation rate heats up to, say, 4%, you can bet that corps will be scrambling to deploy that now idle cash into whatever mediocre projects they can rustle up.

“When that happens, they have $1.4 trillion in cash ready to go. No need to negotiate a loan. No need to issue equity to raise funds. They have all the fuel they need. The gas tank is full.

So while the economy has plenty of problems, and stocks are a far better bet than bonds, lack of cash is not one of them.

Companies are ready to invest and grow. They just need an economic and political environment conducive to doing so.

© 2012 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.