Gold, Silver Rise On QE4 Currency Debasement Concerns

Commodities / Gold and Silver 2012 Nov 30, 2012 - 12:43 PM GMTBy: GoldCore

Today’s AM fix was USD 1,728.25, EUR 1,329.53, and GBP 1,077.87 per ounce.

Today’s AM fix was USD 1,728.25, EUR 1,329.53, and GBP 1,077.87 per ounce.

Yesterday’s AM fix was USD 1,724.50, EUR 1,327.56, and GBP 1,076.47 per ounce.

Silver is trading at $34.32/oz, €26.53/oz and £21.50/oz. Platinum is trading at $1,621.00/oz, palladium at $683.30/oz and rhodium at $1,050/oz.

Gold rose $6.40 or 0.37% in New York yesterday and closed at $1,725.60/oz. Silver fell to a low of $33.51 in Asia, and ran up to $34.36 in New York and finished with a gain of 1.51%.

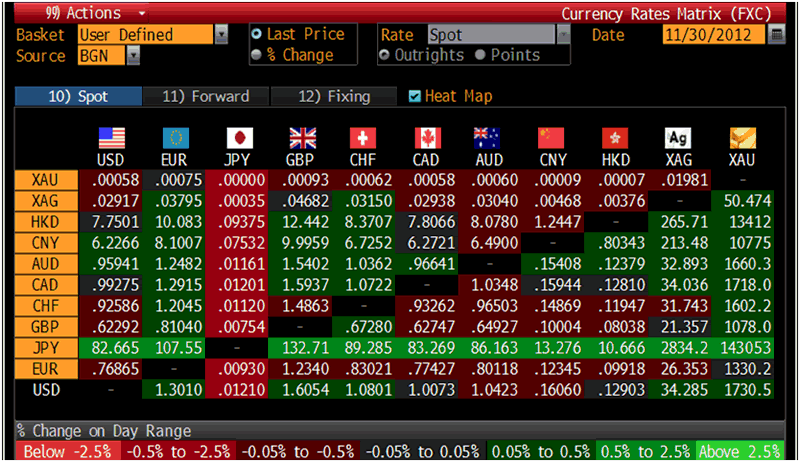

Cross Currency Table – (Bloomberg)

Gold inched up on Friday, but prices saw their largest weekly drop since the beginning of November as the unease of the talks on the US fiscal cliff continue to weigh on sentiment.

Republican Speaker of the House, John Boehner said yesterday that the fiscal cliff talks made little progress, dampening the flame of optimism that he lit on Wednesday.

"Based on where we stand today I would say two things. First, despite the claims that the president supports a balanced approach, the Democrats have yet to get serious about real spending cuts," Boehner said after the private session with Geithner. "And secondly, no substantive progress has been made in the talks between the White House and the House over the last two weeks," Boehner commented.

US Treasury Secretary, Timothy Geithner, is Obama's chief negotiator in talks to avert the US fiscal cliff.

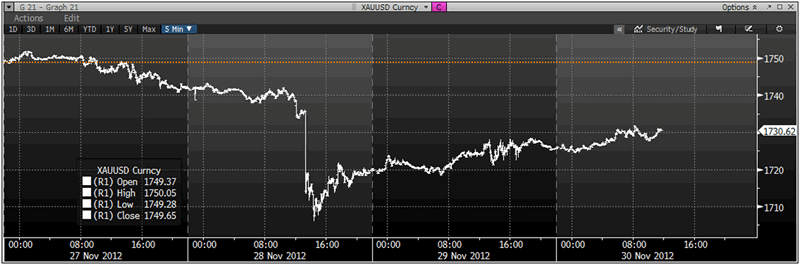

XAU/USD 5 Min – (Bloomberg)

Spot palladium is on course for its 5th weekly gain and a monthly rise of over 14%. Supply shortages contribute to the gain. Norilsk Nickel, the world's largest producer of nickel and palladium, said they expect the palladium market to remain in a deficit in the next few years largely due to a near depletion of Russian state supplies.

XAU/EUR 5 Min – (Bloomberg)

Spot silver is on course for a monthly gain of over 6%.

The Shanghai Gold Exchange said it will begin a trial run of OTC gold trading on the China Foreign Exchange Trading System on December 3rd, allowing interbank trading in large volumes.

The US CFTC (Commodities & Futures Trading Commission) commitment of traders is posted at 1930 GMT.

There is speculation in the markets that the US Federal Reserve will purchase more debt to help the US economy which is boosting gold bullion.

While speaking at Pace University in Manhattan , Federal Reserve Bank of New York President William C. Dudley said, “I will be assessing the employment and inflation outlook in order to determine whether we should continue Treasury purchases into 2013.” Dudley also stated, “The Fed will promote maximum employment and price stability to the greatest extent our tools permit, and we will stay the course.”

Fed officials are considering whether to step up record accommodation to counteract the scheduled expiration next month of Operation Twist, a program swapping short-term Treasuries with longer-term debt. A “number” of Fed officials said at the last policy meeting that they may need to expand its monthly purchases of bonds, according to the minutes of the FOMC ’s Oct. 23-24 meeting.

Gold has returned 10% this year and silver has returned 23% year to date, driven by quantitative easing.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.